Corcept Therapeutics Sees Share Surge, Eyes Bright Future Ahead

Corcept Therapeutics (CORT) shares jumped 5.5% in the latest trading session, closing at $49.75. This surge was supported by a strong trading volume, indicating significant investor interest. Over the past month, the stock has seen a remarkable gain of 15.3%.

Demand for Korlym Fuels Growth

The driving force behind this increase is the rising demand for Korlym, Corcept’s sole marketed drug approved for treating Cushing’s syndrome. Additionally, the company plans to file a new drug application for relacorilant, another treatment for Cushing’s syndrome, later in the fourth quarter of 2024. These developments may have contributed to the recent jump in share prices.

Upcoming Earnings Report Expected

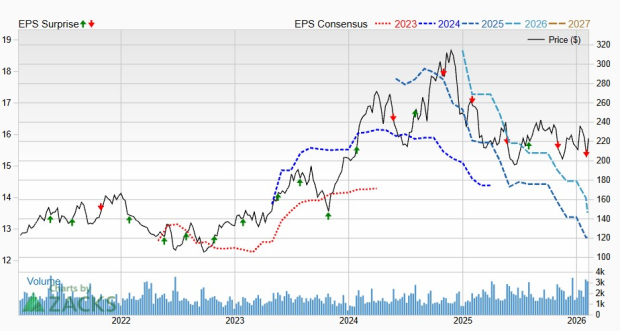

Corcept is set to report quarterly earnings, with analysts expecting it to post $0.27 per share. This marks a slight decline of 3.6% compared to the same quarter last year. Revenue projections stand at $172.11 million, reflecting a 39.3% increase year-over-year.

Keeping an Eye on Earnings Trends

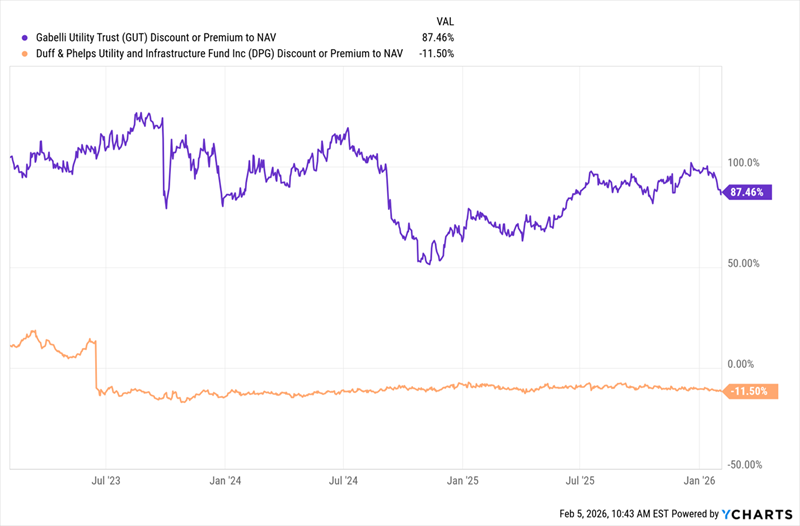

Understanding earnings and revenue growth is crucial to assessing a stock’s potential. Research indicates there is a strong link between shifts in earnings estimates and stock price movements. For Corcept, the consensus forecast for earnings per share (EPS) has not changed in the last month. Without new trends in earnings revisions, it’s unusual for stocks to keep climbing. Investors should monitor CORT closely to see if recent gains sustain momentum.

Zacks Rank Indicates Strong Buy

Currently, Corcept holds a Zacks Rank of #1 (Strong Buy). For comparison, Amneal Pharmaceuticals (AMRX), a competitor in the medical drugs sector, increased by 1.4% to close at $8.58, although it has returned -4% over the last month.

Amneal’s Earnings Expectations

Amneal’s upcoming report estimates an EPS of $0.13, unchanged over the past month, which reflects a drop of 31.6% compared to last year. Like Corcept, Amneal also has a Zacks Rank of #1 (Strong Buy).

Explore Emerging Opportunities

Investors looking for new prospects might be interested in discovering Zacks’ top semiconductor picks. These stocks are situated to benefit from the booming demand for technologies like Artificial Intelligence and the Internet of Things. The global semiconductor manufacturing industry is projected to grow substantially, from $452 billion in 2021 to $803 billion by 2028.

For further insights, feel free to explore Zacks’ latest stock recommendations, including a report titled “5 Stocks Set to Double.” Click to access this valuable information.

For detailed analyses on these companies, refer to: Corcept Therapeutics Incorporated (CORT) : Free Stock Analysis Report and AMNEAL PHARMACEUTICALS, INC. (AMRX) : Free Stock Analysis Report.

To view the original article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.