Duke Energy on Track for Q3 Earnings: What to Expect

Duke Energy Corporation (DUK), based in Charlotte, North Carolina, ranks among the largest energy holding companies in the United States. Its electric utilities serve approximately 8.4 million customers across North Carolina, South Carolina, Florida, Indiana, Ohio, and Kentucky. With a market capitalization of $93.2 billion, Duke Energy’s portfolio includes around 54,800 megawatts of energy capacity. The company is also focusing on upgrading its electric grid and increasing cleaner energy production. Stakeholders can look forward to the fiscal third-quarter earnings announcement for 2024, scheduled for Thursday, Nov. 7, before the market opens.

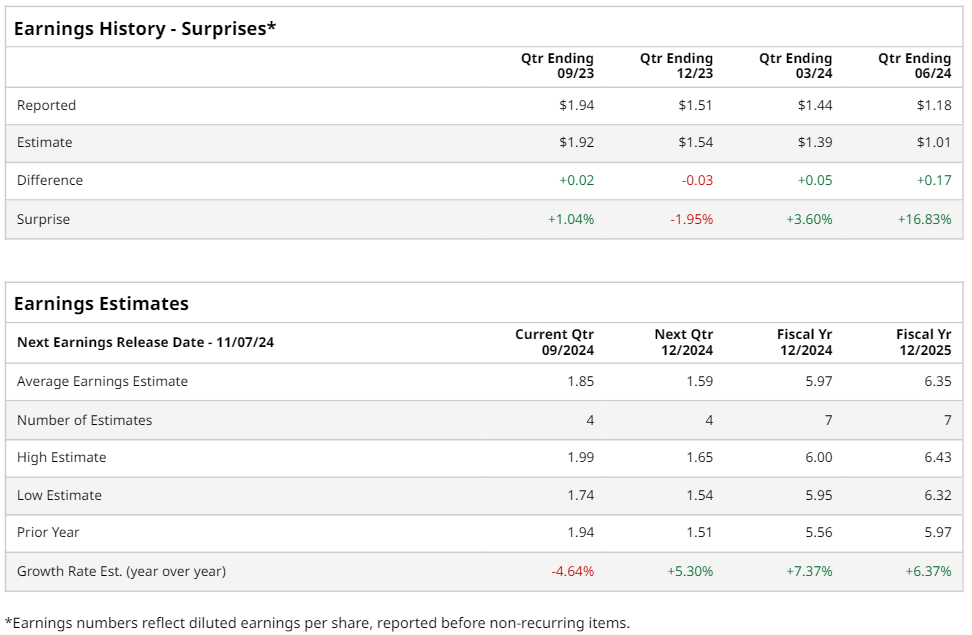

Analysts Predict Earnings Decline

As the announcement approaches, analysts anticipate that DUK will report earnings of $1.85 per share on a diluted basis. This represents a decrease of 4.6% compared to $1.94 per share in the same quarter last year. Over the last four quarters, Duke Energy has managed to exceed consensus estimates in three instances, but it missed the target on one occasion.

Year-End Earnings Projection

For the entire fiscal year, analysts predict DUK will post earnings per share (EPS) of $5.97. This marks an increase of 7.4% from the $5.56 EPS reported in fiscal 2023. Looking ahead, EPS is projected to grow by 6.4% year over year to reach $6.35 in fiscal 2025.

Stock Performance Compared to Market Averages

In the past year, DUK stock has outperformed the S&P 500’s ($SPX) gains of 35.9%, with its shares rising by 36.9% during the same period. However, it has lagged behind the Utilities Select Sector SPDR Fund’s (XLU) increase of 38.4% in the same timeframe.

Factors Contributing to Strong Performance

DUK’s impressive results stem from strategic investments aimed at modernizing its infrastructure and boosting its renewable energy generating capacity. The company is currently focused on expanding its operations, integrating advanced technologies, and enhancing reliability through significant investments in infrastructure. Growth has also been aided by an increasing customer base and favorable weather conditions.

Recent Earnings Beat Expectations

On Aug. 6, DUK shares surged over 1% following the announcement of Q2 results, where the adjusted EPS of $1.18 outperformed Wall Street expectations of $1.01. Revenue reached $7.2 billion, surpassing forecasts of $6.8 billion. Furthermore, Duke Energy has guided for full-year adjusted EPS to be between $5.85 and $6.10.

Analysts Maintain a Positive Outlook

The consensus among analysts regarding DUK stock is largely optimistic, reflecting a “Moderate Buy” rating overall. Among 20 analysts who cover the stock, 11 recommend a “Strong Buy,” one suggests a “Moderate Buy,” and eight rate it as a “Hold.” The average price target for DUK stands at $122, indicating a modest potential upside of 1% from current levels.

More Stock Market News from Barchart

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.