Exploring the First Trust Technology AlphaDEX ETF: A Solid Choice for Tech Sector Investment

If you’re looking to invest in technology, the First Trust Technology AlphaDEX ETF (FXL) could be a smart option. This exchange-traded fund was launched on May 8, 2007, as a way to give investors access to a diverse range of companies within the technology sector.

Understanding Sector ETFs and Their Advantages

ETFs like FXL are gaining popularity among both institutional and retail investors. Their low costs, transparency, flexibility, and tax efficiency make them appealing. By investing in sector ETFs, you can diversify your portfolio and reduce risk while still focusing on specific sectors. The Technology – Broad sector is ranked 4 out of 16 within the Zacks Industry classification, placing it in the top 25% of sectors.

Index and Fund Details

Sponsored by First Trust Advisors, the First Trust Technology AlphaDEX ETF has over $1.38 billion in assets, making it one of the larger ETFs focused on the technology sector. It aims to replicate the performance of the StrataQuant Technology Index, which identifies stocks from the Russell 1000 Index using the AlphaDEX screening method.

Fee Structure

Investing in funds with lower expenses can lead to better long-term returns. FXL charges an annual expense ratio of 0.62%, which is competitive compared to other similar funds.

Moreover, it has a trailing 12-month dividend yield of 0.36%.

Allocation and Key Holdings

While ETFs inherently provide diversification, it’s crucial to examine the holdings within the fund. FXL has a significant allocation to the Information Technology sector, comprising about 81.20% of its portfolio. Industrials and Telecom follow as the next largest sectors.

Among its top individual holdings, Applovin Corp. (Class A) (APP) constitutes approximately 2.62% of the total assets, accompanied by Palantir Technologies Inc. (Class A) (PLTR) and Meta Platforms Inc. (Class A) (META). Together, the top 10 holdings account for roughly 19.65% of the fund’s assets.

Performance Metrics and Risk Profile

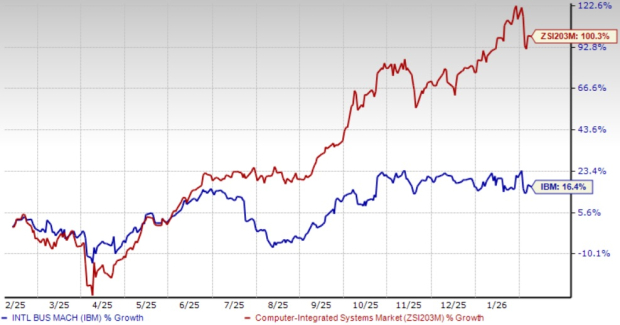

This ETF has shown solid performance, increasing about 11.91% year-to-date and approximately 28.71% over the past year (as of October 21, 2024). Over the last 52 weeks, it traded between $104.07 and $143.43.

With a beta of 1.14 and a standard deviation of 25.27% over the past three years, FXL presents a medium level of risk. It holds around 103 stocks, which helps mitigate the risk associated with individual companies.

Exploring Other Options

FXL holds a Zacks ETF Rank of 1, categorized as a Strong Buy. This ranking takes into account various factors, including expected returns, expense ratios, and momentum, making FXL a compelling choice for those interested in technology ETFs. Other options in this space include the Technology Select Sector SPDR ETF (XLK), which manages $71.95 billion in assets, and the Vanguard Information Technology ETF (VGT), with $79.65 billion. XLK has an expense ratio of 0.09%, while VGT charges 0.10%.

Final Thoughts

To find out more about FXL and other ETFs, consider looking for investments that align with your goals. You can also read about the latest trends in ETF investing at Zacks ETF Center.

Get Key ETF Updates Directly

Subscribe to Zacks’ free Fund Newsletter for weekly updates on top news, analysis, and high-performing ETFs.

Stay informed with Zacks Investment Research. You may also download the report titled “5 Stocks Set to Double” today for more insights.

First Trust Technology AlphaDEX ETF (FXL): ETF Research Reports

Technology Select Sector SPDR ETF (XLK): ETF Research Reports

AppLovin Corporation (APP): Free Stock Analysis Report

Vanguard Information Technology ETF (VGT): ETF Research Reports

Palantir Technologies Inc. (PLTR): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

For more information, visit Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.