Raymond James Upgrades Ally Financial: Analysts Project Strong Growth Ahead

Fintel reported on October 21, 2024, that Raymond James has improved its outlook for Ally Financial (DB:GMZ) from Underperform to Market Perform.

Analysts Predict a 30.53% Increase in Share Value

As of July 24, 2024, analysts set the average one-year price target for Ally Financial at 42.19 €/share, with estimates ranging from a low of 21.38 € to a high of 50.78 €. This average price target suggests potential growth of 30.53% from its latest closing price of 32.32 € / share.

Impressive Revenue Projections

Ally Financial’s projected annual revenue stands at 9,377 million euros, reflecting an increase of 38.63%. The anticipated annual non-GAAP earnings per share (EPS) is 5.33.

Fund Sentiment Reflects Growing Confidence

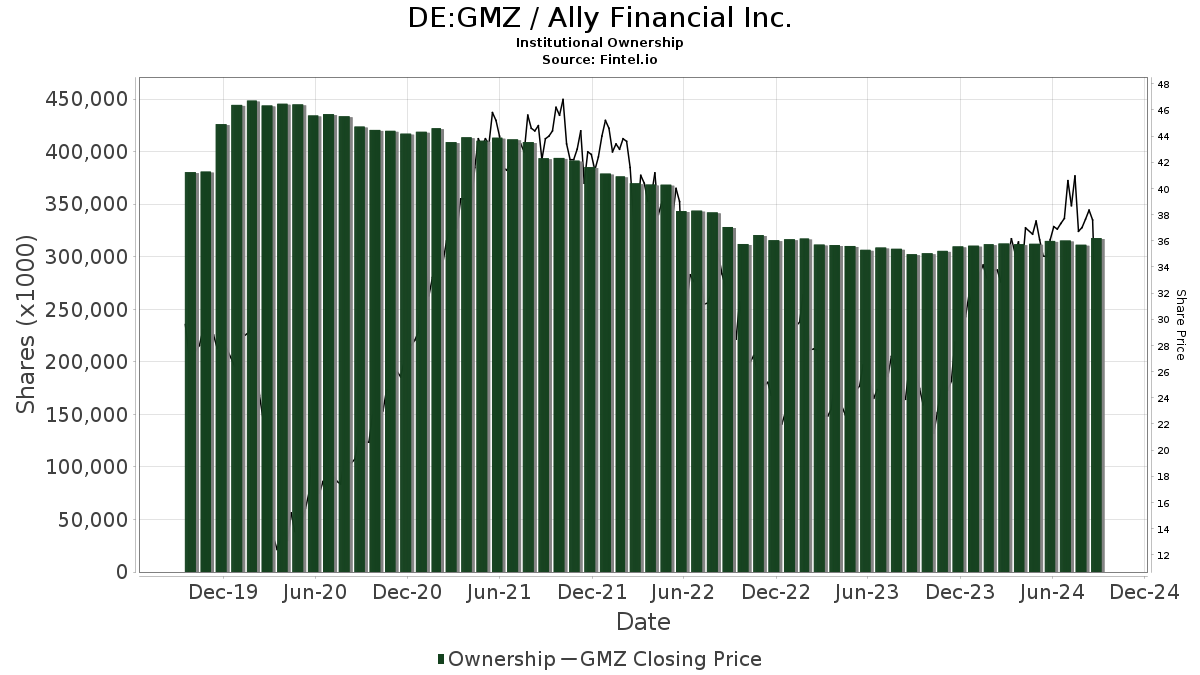

In total, 1,102 funds and institutions hold positions in Ally Financial, marking an increase of 59, or 5.66%, in the last quarter. The average portfolio weight of all funds allocated to GMZ is 0.23%, which is up by 16.55%. Overall, institutional ownership saw a 2.55% rise in the last three months, totaling 318,599K shares.

Institutional Movements in Shareholding

Berkshire Hathaway maintains 29,000K shares, accounting for 9.52% of Ally Financial, with no changes in the last quarter.

Harris Associates L P owns 20,650K shares, equivalent to 6.78% ownership; this represents a decrease from 21,078K shares previously reported, marking a reduction of 2.07%. Their portfolio allocation in GMZ has also decreased by 2.05% over the past quarter.

The Oakmark Fund Investor Class (OAKMX) holds 11,959K shares, maintaining 3.93% ownership without any recent changes.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) has increased its stake from 8,629K to 8,645K shares, now representing 2.84% ownership, albeit with a slight decrease in portfolio allocation in GMZ by 4.77% over the last quarter.

iShares Core S&P Mid-Cap ETF (IJH) has also seen minor growth, raising its shares from 8,452K to 8,510K, which is a 2.79% stake and an increase of 0.68%. The firm’s allocation in GMZ rose by 0.73% in the last quarter.

Fintel offers one of the most comprehensive research platforms available to individual investors, traders, financial advisors, and small hedge funds. Our extensive data includes fundamentals, analyst reports, ownership statistics, and insights into fund sentiment, among other critical information.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.