Gilead Sciences Gets Upgraded Outlook Despite Slight Price Forecast Drop

On October 21, 2024, Leerink Partners raised their rating for Gilead Sciences (BIT:1GILD) from Market Perform to Outperform.

Analyst Forecasts Indicate 6.03% Decline Ahead

The average one-year price target for Gilead Sciences is €75.32 per share, as reported on September 25, 2024. Predictions vary, with a low of €62.05 and a high of €112.07. This average price target represents a 6.03% decline from the company’s latest closing price of €80.15 per share.

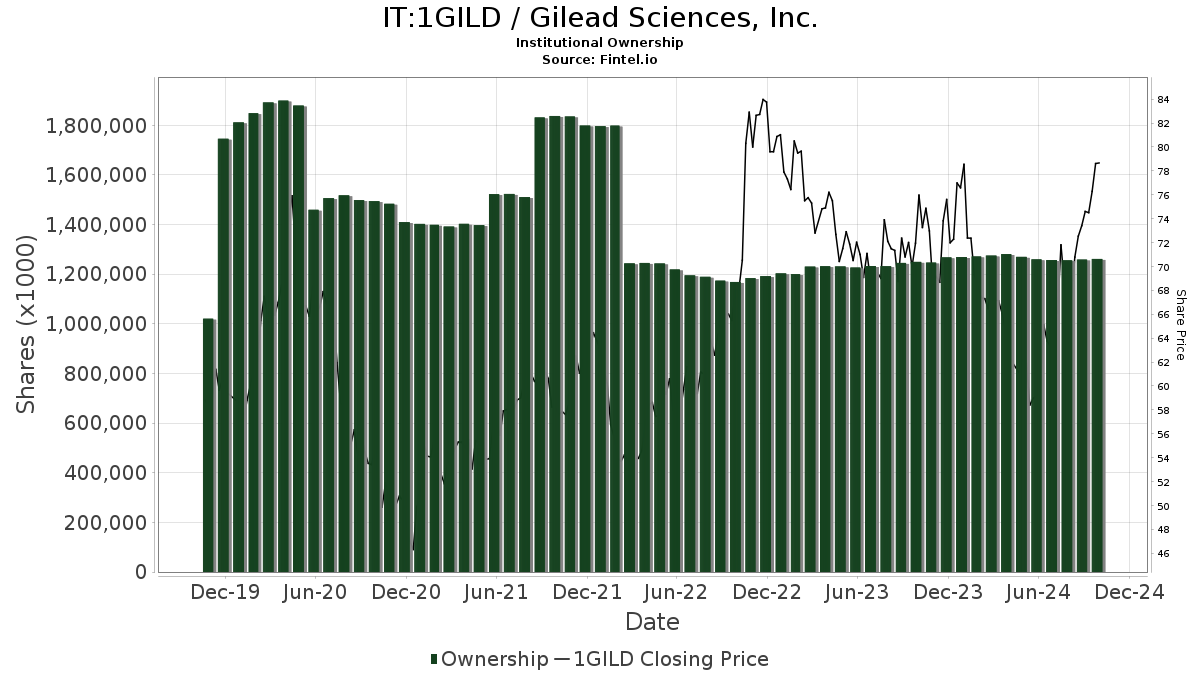

Shifts in Fund Sentiment

Currently, 2,828 funds or institutions have reported positions in Gilead Sciences. This marks a decrease of 67 owners, or 2.31%, from the previous quarter. On average, funds have dedicated 0.39% of their portfolios to 1GILD, reflecting an increase of 0.82%. Over the past three months, total institutional shares owned rose by 2.08% to 1,261,466K shares.

Actions by Other Major Shareholders

Capital World Investors now holds 76,250K shares, which represents 6.12% ownership of Gilead. Previously, they reported 84,497K shares, indicating a decrease of 10.82%, and a 16.72% reduction in their portfolio allocation to 1GILD over the last quarter.

Capital Research Global Investors owns 60,428K shares, translating to 4.85% ownership. This is a slight reduction from the 61,246K shares they held before, a decrease of 1.35%, while their portfolio allocation dropped by 10.38% in the last quarter.

The Vanguard Total Stock Market Index Fund (VTSMX) holds 39,368K shares, representing 3.16% ownership. This shows a modest increase from 39,174K shares, with an 8.46% reduction in their portfolio allocation.

Dodge & Cox has 33,122K shares, or 2.66% ownership, a small decline from 33,167K shares, down 0.14%. Their portfolio allocation also fell by 3.23%.

The Vanguard 500 Index Fund (VFINX) now holds 31,976K shares, equating to 2.57% ownership. This is an increase from 31,400K shares, reflecting a rise of 1.80%, though their portfolio allocation decreased by 9.71% in the last quarter.

Fintel is recognized as a premier investing research platform, catering to individual investors, traders, financial advisors, and small hedge funds.

Fintel’s data encompasses global metrics, including fundamentals, analyst reports, ownership statistics, fund sentiment, options sentiment, insider trading, and much more. Our exclusive stock picks leverage advanced, backtested quantitative models for enhanced profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.