Gilead Sciences Prepares to Unveil Key Financial Results Amid Market Challenges

Anticipated Earnings Report Set for November 6

Gilead Sciences, Inc. (GILD), based in Foster City, California, stands out as a leading biopharmaceutical company, particularly noted for its advancements in antiviral therapies. With a market cap of $108 billion, Gilead provides innovative treatments for serious health issues such as HIV, hepatitis, and cancer. Investors are looking forward to the company’s fiscal Q3 earnings report, which is expected to be released after market hours on Wednesday, November 6.

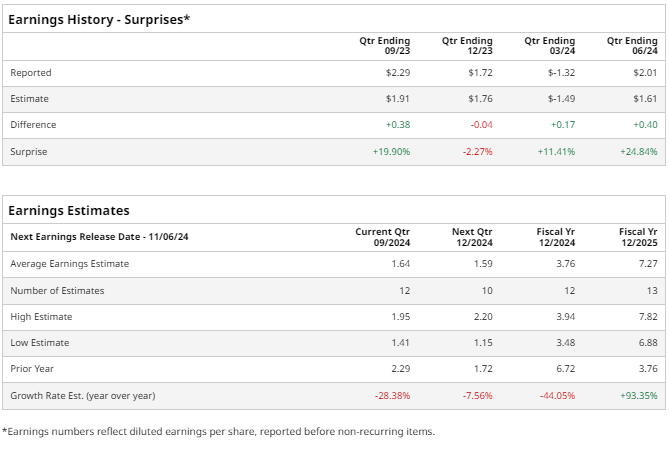

Analysts predict GILD will show a profit of $1.64 per share, marking a 28.4% decline from $2.29 per share recorded in the same quarter last year. Gilead has had a mixed track record over the last four quarters; it exceeded Wall Street’s earnings expectations in three instances but fell short in one.

Quarterly Earnings: A Mixed Bag of Results

For the most recent quarter, Gilead reported an adjusted EPS of $2.01 per share, surpassing the consensus estimate by 24.8%. This result reflects strong demand for therapies treating HIV, oncology, and liver disease.

Looking ahead, analysts forecast GILD’s EPS for fiscal 2024 to be $3.76, a drop of 44.1% from $6.72 in fiscal 2023. However, there’s a projected rebound in fiscal 2025, where EPS is expected to jump by 93.4% to reach $7.27.

Stock Performance Compared to Market Trends

Over the past year, GILD’s stock has increased by 10.9%. However, it has lagged behind broader market averages, such as the S&P 500 Index, which saw a gain of 38.6%, and the S&P 500 Healthcare Sector SPDR, which rose 18.2% during the same timeframe.

Recent Developments and Future Prospects

On September 12, GILD shares climbed 2.7% following positive outcomes from a late-stage trial of its HIV drug, lenacapavir, which demonstrated a significant 96% reduction in new infections. This treatment, administered semi-annually, has been shown to outperform the daily drug Truvada. Gilead is on track to seek regulatory approval for lenacapavir by the end of this year.

Despite an overall positive Q2 earnings report published on August 8, GILD’s stock fell 2.6% in the subsequent trading session. This reaction was largely due to investor concerns regarding revenue growth that appeared reliant on non-core products.

Analysts’ Opinions Remain Optimistic

The consensus on GILD stock is moderately positive, reflected in an overall “Moderate Buy” rating. Among the 27 analysts following the stock, 14 recommend a “Strong Buy,” one suggests a “Moderate Buy,” and 12 advise a “Hold.” This assessment shows a slight improvement from last month when there were only 12 “Strong Buy” ratings.

Currently, the average price target set by analysts for GILD is $84.60, indicating minor potential upsides from present price levels.

More Stock Market News from Barchart

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.