Analyzing Ford Motor: Earnings Ahead and Growing Concerns

If you buy a stock before an earnings event, the risk is elevated, and you need to be confident about the company’s growth trajectory. Ford Motor (F) is about to report its earnings data, and as a cautious investor, I am bearish on Ford stock due to troubling sales data.

Ford Motor, a major player in the automotive industry, produces both conventional and electric vehicles. The company offers a decent dividend, and currently, Ford shares seem to be attractively priced.

However, purchasing a stock solely based on a low price-to-earnings (P/E) ratio and a sizable dividend can be risky. For automakers, demonstrating consistent sales growth is vital, and Ford’s performance raises concerns. The company’s sales figures suggest that its growth may be stagnating.

Is Ford Stock a Value or Yield Trap?

Value traps and yield traps can be problematic for investors. Is Ford caught in both? Let’s explore the details surrounding Ford’s stock and determine if it qualifies as a value-and-yield trap.

Ford’s non-GAAP trailing 12-month P/E ratio is 6.77x, significantly below the sector median of 14.98x. Additionally, the company offers a forward annual dividend yield of 7.05%, outpacing the Consumer Cyclical Sector Average of around 1%.

Yet, a low P/E ratio and high dividend yield might not tell the whole story. Ford’s stock price experienced a decline from $14.50 to $11 recently. Severe drops in stock prices can distort P/E ratios and dividend yields, so careful consideration is necessary before making any trading decisions regarding Ford stock right now.

Mark Your Calendar for Ford’s Earnings Event

Earnings reports can significantly affect stock prices, causing them to surge or drop sharply. The impending release of Ford’s third-quarter 2024 financial results on October 28 adds to the uncertainty surrounding its stock. This timing means investors should tread carefully before making decisions about Ford.

My bearish outlook on Ford stock stems from its recent vehicle sales data. In the third quarter of 2024, Ford sold 504,039 units, a slight increase from 500,504 units during the same time last year, reflecting just a 0.7% growth. In comparison, the company saw a more robust 7.7% growth in vehicle sales during the third quarter of 2023. Concerns about vehicle affordability are impacting sales across the industry, affecting Ford’s competitors like Stellantis (STLA), which reported a 20% decline in U.S. quarterly sales. Given these trends, consider the risks of engaging with Ford stock at this moment.

Challenges for Ford’s Self-Driving Technology

Ford also faces difficulties with its self-driving vehicle service. The company recently announced reductions in subscription prices for its BlueCruise hands-free driving technology, which features lane-keeping assistance and adaptive cruise control.

Ford plans steep cuts to its subscription plans, from $75 to $50 monthly and from $800 to $495 annually. These price decreases suggest that demand for BlueCruise may not be as strong as anticipated, raising questions about Ford’s competitiveness against rivals like Tesla (TSLA) in the burgeoning self-driving market.

Analysts Weigh In on Ford Stock

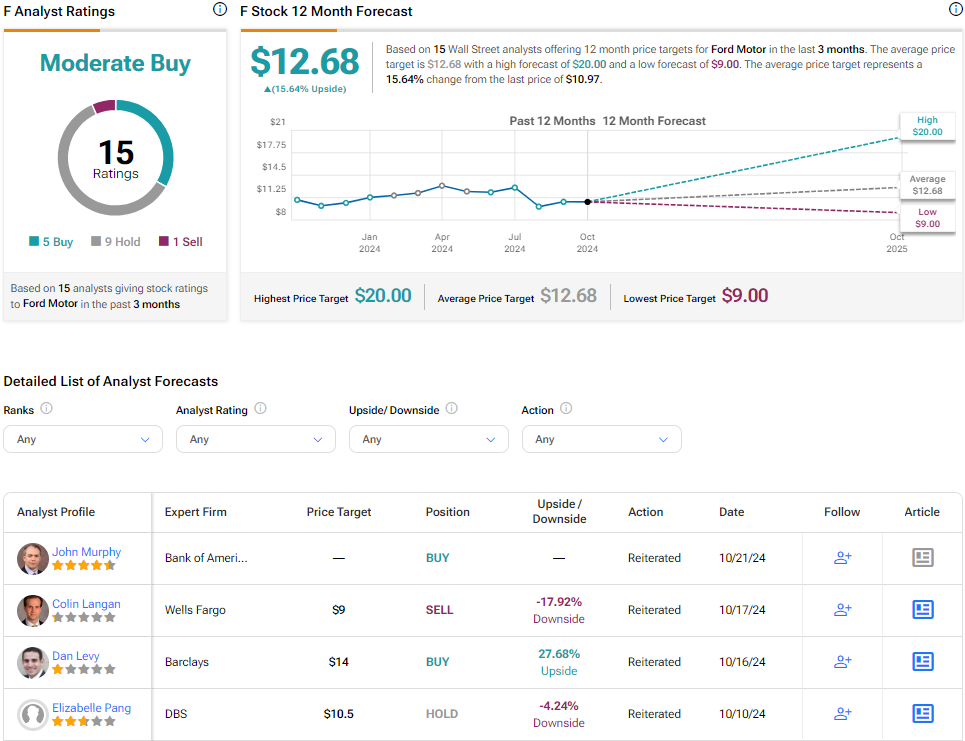

Currently, Ford (F) holds a Moderate Buy rating on TipRanks with five Buys, nine Holds, and one Sell over the past three months. Analysts set an average price target of $12.68, indicating a potential upside of 15.64%.

If you are considering following a particular analyst, Michael Ward from Benchmark Co. is noteworthy. With an average return of 11.88% per rating and a success rate of 50%, his insights could be valuable for trading decisions.

See more F analyst ratings

Conclusion: Should You Invest in Ford Stock?

Analysts have a mixed outlook regarding Ford Motor stock. The slow sales growth of its vehicles and challenges with the BlueCruise subscription service are concerning. With an earnings report on the horizon, there is potential for disappointment.

In light of these factors, it may be prudent for investors to hold off on purchasing Ford stock until the third-quarter 2024 financial results are revealed. As a cautious investor, I’m leaning slightly bearish on F stock and will remain on the sidelines for now.

Disclosure

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.