Lumen Technologies Strengthens AI Network with Meta Partnership

Lumen Technologies, Inc. (LUMN) has teamed up with Meta Platforms, Inc. (META) to enhance Meta’s network capabilities. This collaboration will provide a dedicated interconnection aimed at bolstering Meta’s advanced infrastructure.

Lumen’s Private Connectivity Fabric (PCF) is engineered to offer the network bandwidth necessary for artificial intelligence (AI) advancements. The initiative involves exclusive access to both existing and new fiber routes linking data centers. Lumen has indicated that this partnership will enable Meta to deliver a seamless and adaptable network, catering to the increasing interactions of its customers with AI services across various platforms.

As interest in AI continues to grow, establishing a reliable network is becoming increasingly vital. Meta’s AI applications can handle complex functionalities such as multilingual conversations and real-time text-to-image translation, significantly enhancing user experiences. The partnership is set to provide secure, on-demand bandwidth to Meta, further improving its ability to innovate in AI and enhance overall user engagement.

Surging AI Demand Fuels Lumen’s Momentum

The quick expansion of AI is opening up substantial avenues for Lumen, creating a notable increase in demand for its PCF solutions.

In July 2024, Lumen revealed that it secured $5 billion in new business, driven by the intensifying demand for AI-integrated connectivity solutions. Additionally, Microsoft chose Lumen to upgrade its network capacity to meet the growing requirements of its data centers, a move spurred by the rapid advancements in AI technology. Utilizing Lumen’s AI-enhanced PCF will improve connectivity between Microsoft’s data centers, providing the necessary capacity, performance, and speed to accommodate increased data requirements for current and future needs.

As the appetite for AI capabilities continues to rise, businesses across multiple industries are urgently pursuing fiber capacity, which is increasingly recognized as both valuable and, at times, limited. The expanding adoption of Lumen’s PCF solutions is expected to positively influence the company’s revenues in the long run.

Lumen Technologies, Inc. Stock Price Analysis

Lumen Technologies, Inc. price-consensus-chart | Lumen Technologies, Inc. Quote

Lumen anticipates finalizing more AI contracts worth $7 billion, though increasing competition in the sector could hinder revenue growth.

Lumen reported a 10.7% decrease in total revenues year-over-year, amounting to $3,268 million in the second quarter, impacted by divestitures, commercial agreements, and the sale of its CDN business. Furthermore, the company has revised its adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) guidance for 2024, now projected to be between $3.9 billion and $4 billion, down from the previous estimate of $4.1 billion to $4.3 billion. For 2025, Lumen expects EBITDA to fall below the projected levels of 2024 due to significant investment initiatives.

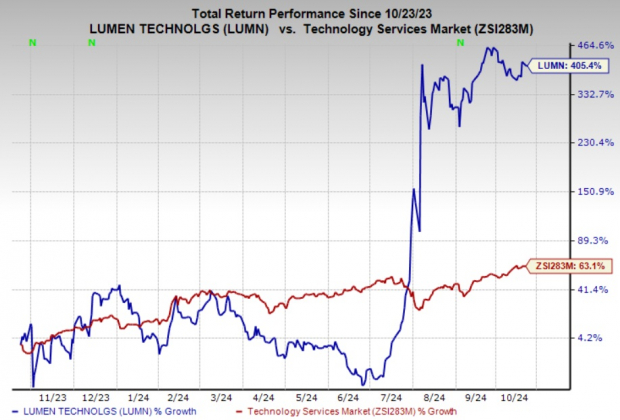

LUMN’s ZACKS Rank and Stock Performance

Currently, LUMN is rated with a Zacks Rank #5 (Strong Sell). In the past year, the company’s stock soared 405.4%, outpacing its sub-industry growth which stood at 63.1%.

Image Source: Zacks Investment Research

Stocks Worth Watching

Other stocks to consider within the technology sector include Cirrus Logic, Inc. (CRUS) and BlackSky Technology Inc. (BKSY). BKSY currently has a Zacks Rank #1 (Strong Buy), while CRUS holds a Zacks Rank #2 (Buy). You can view the complete list of today’s Zacks #1 Rank stocks here.

BlackSky Holdings offers real-time geospatial intelligence and global monitoring services, boasting an average earnings surprise of 10.1% across three of the last four quarters. In its most recent quarter, BKSY achieved an earnings surprise of 33.3%.

Cirrus Logic has seen strong performance due to rising shipments in the smartphone market, supported by growth in the laptop sector and noteworthy next-generation flagship smartphone designs. CRUS experienced an average earnings surprise of 56.6% across the last four quarters.

Infrastructure Investment Opportunities Loom

A significant initiative to revitalize the deteriorating U.S. infrastructure is on the horizon. This process is expected to be bipartisan, urgent, and inevitable, with trillions allocated to the effort. Great fortunes may be created.

The pressing question remains: “Will you invest in the right stocks early on when their growth potential is at its peak?”

Zacks has published a Special Report to assist you in identifying such opportunities, available at no charge. Discover 5 unique companies that stand to benefit greatly from the extensive construction and repair of roads, bridges, and buildings, as well as energy transformation.

Download your FREE copy: How To Profit From Trillions on Infrastructure Spending >>

For more recommendations from Zacks Investment Research, you can download 5 Stocks Set to Double. This report is available at no cost.

Cirrus Logic, Inc. (CRUS) : Free Stock Analysis Report

Lumen Technologies, Inc. (LUMN) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

BlackSky Technology Inc. (BKSY) : Free Stock Analysis Report

To view this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.