Jefferies Starts Coverage of DTE Energy Company Corporate Bond with a Hold Rating

Analysts Expect Moderate Price Growth

On October 21, 2024, Jefferies initiated coverage of DTE Energy Company – Corporate Bond (NYSE:DTB) with a Hold recommendation. The average one-year price target for this bond, as of September 25, 2024, is $22.58 per share. Predicted targets range from a low of $20.89 to a high of $24.59, suggesting a potential upside of 6.83% based on the most recent closing price of $21.14 per share.

DTE Energy’s Revenue Looks Promising

The projected annual revenue for DTE Energy Company – Corporate Bond is set at $16,277 million, showing an impressive increase of 31.30%. Analysts project an annual non-GAAP EPS of 6.76.

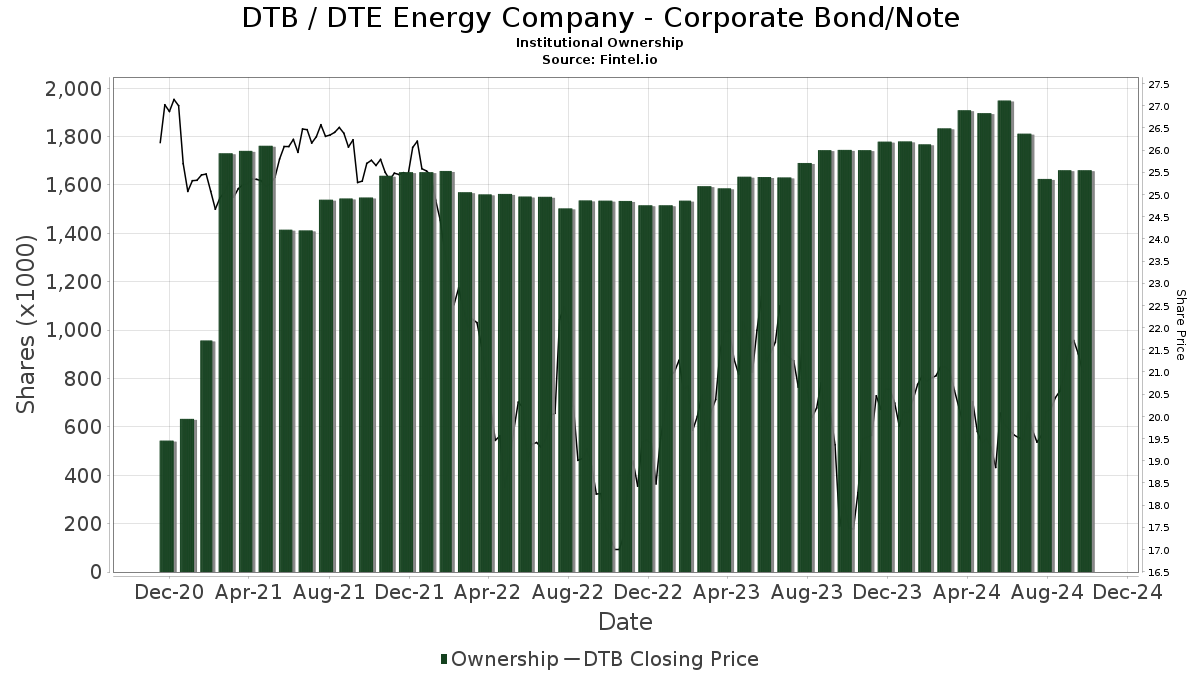

Institutional Interest in DTE Energy

Currently, 12 funds or institutions hold positions in DTE Energy Company – Corporate Bond, reflecting a decrease of 2 owners, or 14.29%, in the last quarter. The average portfolio weight of all related funds in DTB has risen by 26.89% to 0.12%. However, total shares owned by institutions have decreased by 9.08% over the past three months, dropping to 1,648,000 shares.

Fund Holdings and Changes

PFF – iShares Preferred and Income Securities ETF currently holds 943,000 shares, up from 895,000 shares previously, indicating a 5.11% increase. They raised their portfolio allocation to DTB by 3.21% last quarter.

PGX – Invesco Preferred ETF holds 348,000 shares, down from 357,000 shares, showing a 2.31% decrease in holdings. Their portfolio allocation has decreased by 4.19%.

NRIAX – Nuveen Real Asset Income Fund possesses 145,000 shares, down from 152,000 shares, which is a decrease of 4.82%. This fund also reduced its portfolio allocation to DTB by 6.57%.

FSDIX – Fidelity Strategic Dividend & Income Fund maintains its holding of 100,000 shares with no changes last quarter.

Nuveen Real Asset Income & Growth Fund holds 73,000 shares, with no change as well.

Fintel serves as a comprehensive platform for investment research, providing data to individual investors, traders, financial advisors, and small hedge funds.

The platform covers a diverse range of data, including fundamentals, analyst reports, ownership information, and fund sentiment. Fintel’s advanced, backtested quantitative models also assist in stock selection for improved investment outcomes.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.