Parker-Hannifin Poised for Strong Earnings in Q1 2025

Cleveland’s Industrial Leader Set to Announce Results

Parker-Hannifin Corporation (PH), headquartered in Cleveland, Ohio, stands as a significant player in the motion and control technologies industry. The company, with a market capitalization of $82.2 billion, supplies a wide array of products including hydraulics, pneumatics, filtration, and fluid handling systems. Investors are awaiting the fiscal 2025 first-quarter earnings announcement, scheduled for Thursday, October 31, before the market opens.

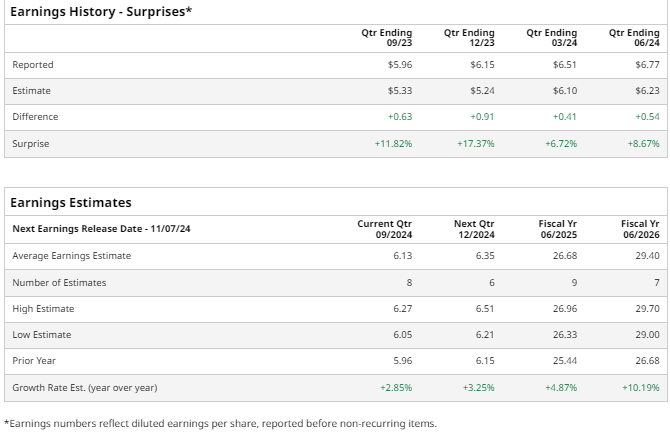

Analysts are projecting PH will report a profit of $6.13 per share on a diluted basis, marking a 2.9% increase from last year’s $5.96. Remarkably, Parker-Hannifin has consistently exceeded Wall Street’s earnings per share (EPS) expectations in each of its last four quarterly reports. In the previous quarter, the EPS reached $6.77, surpassing predictions by 8.7% thanks to strong business performance and operational enhancements.

Looking at the full year, expectations are for an EPS of $26.68, which is a 4.9% increase from the $25.44 reported for fiscal 2023.

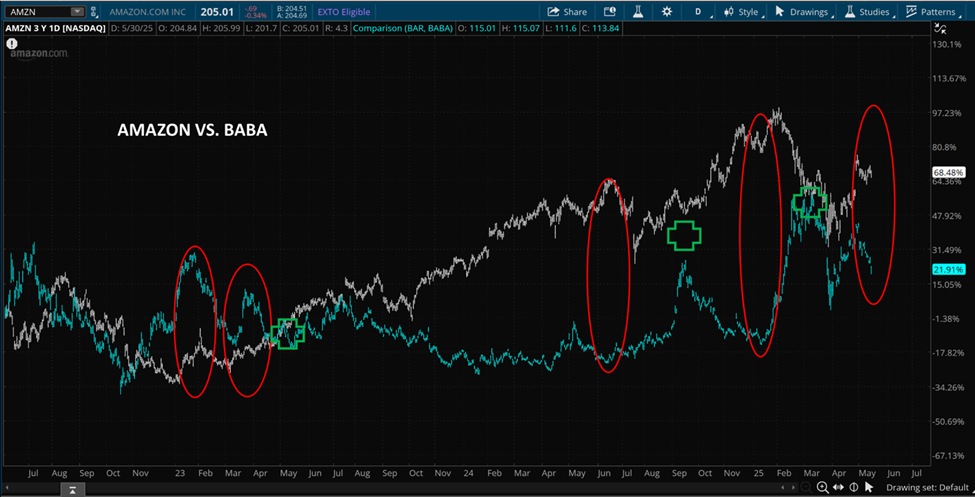

Over the last 52 weeks, PH stock has significantly outperformed the S&P 500’s gains of 38.5%. It has increased by 68.7% during this period and has also outstripped the Industrial Select Sector SPDR Fund’s (XLI) 38.9% rise.

PH shares surged more than 10% on August 8 following impressive Q4 earnings that exceeded market expectations. For fiscal 2025, the company anticipates adjusted EPS between $26.30 and $27, alongside revenue growth projected between 1.5% and 4.5%.

The consensus among analysts is overwhelmingly positive for PH stock, earning a “Strong Buy” rating overall. Out of 17 analysts, 14 suggest a “Strong Buy,” one recommends a “Moderate Buy,” and two analysts advise a “Hold.”

The average analyst price target for Parker-Hannifin is set at $698.50, suggesting an 11% potential upside from current market prices.

More Stock Market News from Barchart

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.