C3.ai: A Potential Major Player in the Expanding AI Software Market

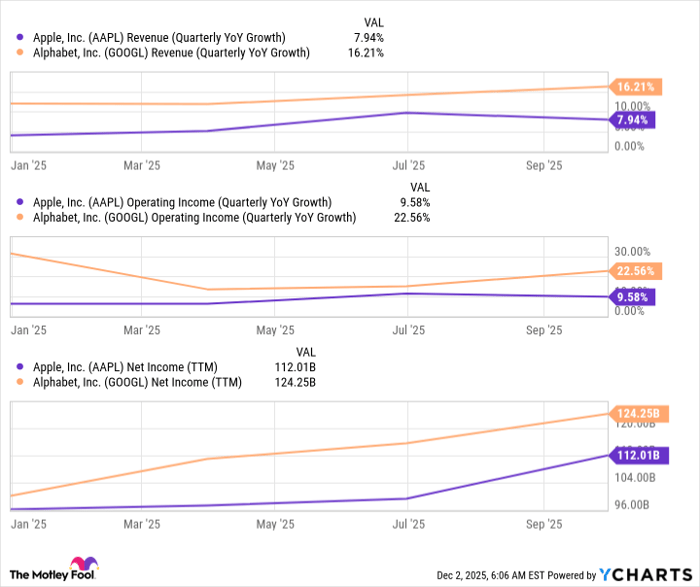

Ark Investment Management, led by Cathie Wood, sees great potential in AI software companies, predicting they could yield $8 for every $1 spent on chips from suppliers such as Nvidia. Wood has already invested in top AI software start-ups, including OpenAI, Anthropic, and xAI through the Ark Venture Fund, in addition to holding leading companies like Meta Platforms, Tesla, and Microsoft in its ETFs.

If Wood’s projection is accurate, C3.ai (NYSE: AI) may emerge as one of the sector’s top winners.

Image source: Getty Images.

C3.ai: The Pioneer in Enterprise AI

Founded in 2009, C3.ai was the first company to specialize in predictive analytics, now widely recognized as AI. It offers over 40 customizable AI applications for businesses across 19 industries, including oil, gas, and manufacturing. Many companies seek help from C3.ai because building AI from the ground up requires significant time, financial resources, and specialized skills. C3.ai can deliver tailored applications to clients in as little as six months.

A notable user, Georgia-Pacific, utilizes C3.ai’s Reliability application to enhance predictive maintenance for its machines, each equipped with over 5,000 sensors producing one billion data points daily. This partnership has led to a 5% increase in overall equipment effectiveness. Employees now dedicate 80% of their time to solving issues rather than searching for them.

Other companies, such as oil giant Shell, have also seen success with C3.ai. Shell employs over 100 customized applications to oversee over 10,000 pieces of equipment, which has reduced carbon emissions and minimized the risk of failures. Similarly, Dow, a leading chemical manufacturer, reported a 20% reduction in equipment downtime thanks to C3.ai’s innovations.

Demand for C3.ai’s software is increasing rapidly. In the first quarter of fiscal 2025 (ended July 31), the company secured 51 agreements through partnerships with major firms like Alphabet’s Google Cloud, Amazon Web Services, and Microsoft Azure, marking an impressive 151% rise from the same period last year.

Record Revenue and Rapid Growth

C3.ai achieved a record revenue of $87.2 million in Q1, representing a 21% year-over-year increase—the fastest growth rate in nearly two years. This success follows a strategic shift initiated at the start of fiscal 2023, which transitioned from a subscription-based to a consumption-based revenue model. This change streamlined the customer onboarding process, allowing for swifter agreements.

The adjustment initially slowed business operations as existing customers adapted to the new model, but it is now leading to quicker customer acquisitions and higher revenue growth.

Despite these positive results, C3.ai is currently reporting losses. The company posted a net loss of $62.8 million in Q1, an improvement from last year’s loss of $64.3 million. On a non-GAAP basis, the adjusted loss was $6.8 million. Notably, revenue growth (21%) is outpacing operating expenses (8.8% in Q1), indicating a potential path to profitability in the coming quarters.

Stock Valuation: An Attractive Opportunity

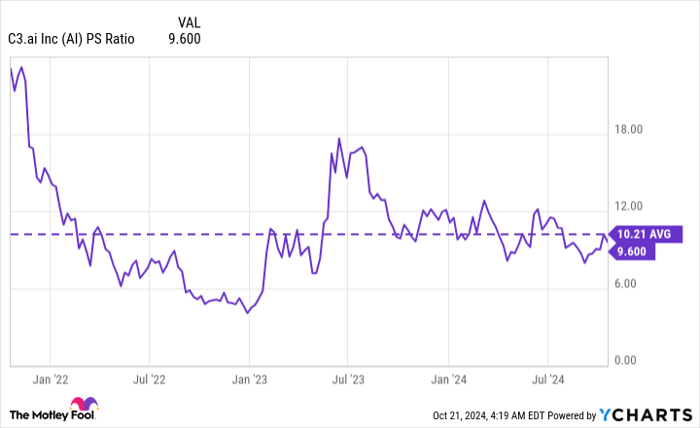

C3.ai went public in December 2020 amidst a stock market surge driven by low interest rates and federal stimulus funding. It reached a high of $161 soon after its initial public offering, but currently trades 84% lower.

Due to its lack of profitability, traditional price-to-earnings (P/E) ratios cannot be applied. Instead, a price-to-sales (P/S) ratio is used, calculated by dividing the market cap by the revenue over the past 12 months. Currently, C3.ai’s P/S ratio stands at 9.6, significantly down from its peak of over 80 in December 2020, representing a more sustainable valuation.

This current valuation is also a discount compared to its three-year average P/S ratio of 10.2, suggesting that the stock could be undervalued at this moment:

AI PS Ratio data by YCharts

Thomas Siebel, CEO of C3.ai, considers the AI software market to be a transformative opportunity, akin to the early days of the internet and smartphones. He estimates the AI software market at around $450 billion today, with the potential to reach $1.3 trillion by 2032. This aligns with Cathie Wood’s optimistic view on the future of AI software.

Given its current revenue, C3.ai has just begun to tap into its potential. Now, at its current stock price, investors may find a promising opportunity for long-term gains.

A Potential Investment Opportunity Awaits

Have you ever felt like you missed out on buying successful stocks? You might want to consider this news.

Our expert analysts occasionally issue a “Double Down” recommendation for companies they believe are about to surge. If you fear you’ve missed your chance, now could be the ideal time to invest before it’s too late. The numbers are compelling:

- Amazon: A $1,000 investment when we doubled down in 2010 would be worth $21,294 today!*

- Apple: Invested $1,000 when we doubled down in 2008? That would be $44,736 today!*

- Netflix: A $1,000 investment in 2004 would have grown to $416,371 by now!*

Currently, we are issuing “Double Down” alerts for three remarkable companies—don’t miss your chance.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 21, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is also on the board. Anthony Di Pizio holds no position in any of the stocks mentioned herein. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Tesla, and also recommends C3.ai, along with the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.