Teleflex Incorporated (TFX) Set to Release Q3 Earnings Amid Market Challenges

Teleflex Incorporated (TFX), based in Pennsylvania, specializes in creating single-use medical devices for various diagnostic and therapeutic needs, including critical care and surgical applications. With a market cap of $11.1 billion, TFX utilizes its extensive knowledge in vascular access, interventional cardiology, anesthesia, and urology to serve a diverse global clientele. The company is scheduled to release its fiscal third-quarter earnings for 2024 on Thursday, October 31, prior to market opening.

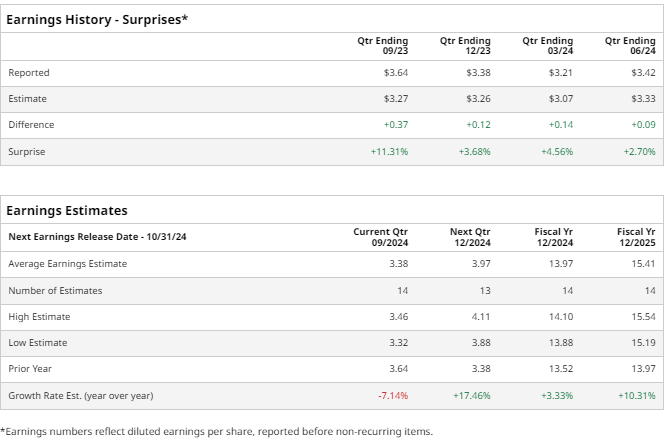

Analysts Predict Lower Quarterly Earnings

In anticipation of the earnings announcement, analysts forecast that TFX will report a profit of $3.38 per share, adjusted for dilution. This reflects a 7.1% decline from the prior year’s earnings of $3.64 per share. Notably, TFX has consistently outperformed Wall Street’s expectations for earnings per share (EPS) in its last four quarterly reports, having reported an EPS of $3.42 in the most recent quarter, exceeding forecasts by 2.7%.

Annual Earnings Expectations

For the full fiscal year, analysts predict that TFX’s EPS will reach $13.97, marking a 3.3% increase from $13.52 in fiscal 2023.

Year-to-Date Performance

Year-to-date, TFX stock has declined by 5.1%, lagging behind the S&P 500’s gains of 22.7% and the Healthcare Select Sector SPDR Fund’s (XLV) increase of 10.8% during the same period.

Market Reactions to Q2 Earnings

Despite facing challenges this year, TFX shares rose by 6.8% on August 1, following the release of its Q2 earnings. Although the company fell short of revenue estimates, it managed to exceed EPS expectations. Additionally, Teleflex raised its earnings guidance for the full year and announced a $500 million share repurchase program, which helped boost investor confidence.

Analysts Remain Optimistic on TFX Stock

The consensus among analysts regarding TFX stock is largely positive, with a “Moderate Buy” rating overall. Among the 13 analysts covering the stock, three recommend a “Strong Buy,” three favor a “Moderate Buy,” while seven opt for a “Hold” recommendation.

Currently, the average analyst price target for TFX stands at $265.09, suggesting a potential upside of 12% from its current trading levels.

More Stock Market News from Barchart

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.