Melius Research Raises Rating on 3M to Buy, Signaling Growth Potential

Analysts Predict Solid Price Gains Ahead

On October 22, 2024, Melius Research announced an upgrade of 3M (LSE:0QNY) from Hold to Buy.

The average one-year price target for 3M now stands at 124.26 GBX/share. Analysts set the forecasts with a range from 86.32 GBX to 146.84 GBX. This new target indicates a potential upside of 7.26% from the most recent closing price of 115.85 GBX/share.

Annual Revenue and Earnings Predictions

The expected annual revenue for 3M is 33,236MM, reflecting a modest rise of 1.83%. Meanwhile, the anticipated annual non-GAAP EPS is projected to be 9.61.

Fund Sentiment Analysis

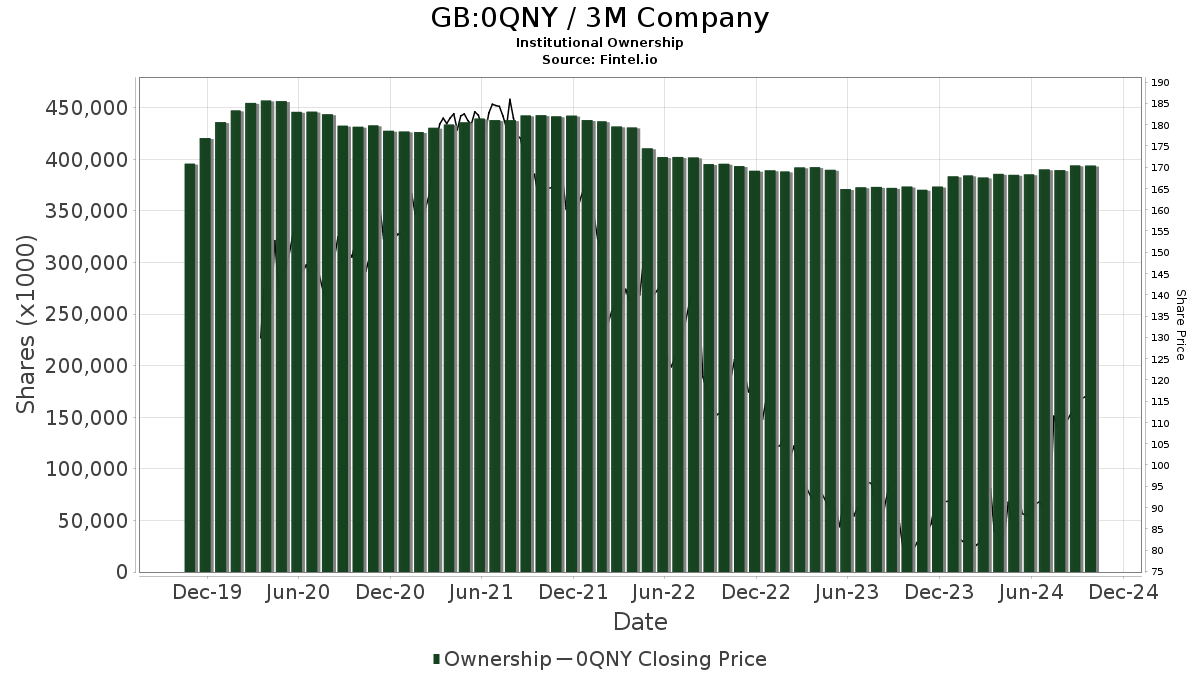

A total of 2,807 funds or institutions have reported positions in 3M, marking an increase of 102 owners, or 3.77%, in the past quarter. The average portfolio weight across all funds for 0QNY is 0.30%, which is an increase of 9.73%. Additionally, institutional ownership grew by 4.05% over the last three months, bringing the total to 394,579K shares.

Institutional Investor Activity

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 17,506K shares, which is 3.19% of the company. This represents a slight increase of 0.70% from their previous filing when they owned 17,383K shares. However, their portfolio allocation in 0QNY fell by 5.65% last quarter.

VFINX – Vanguard 500 Index Fund Investor Shares owns 14,203K shares, accounting for 2.59% of 3M. Their previous filing indicated ownership of 13,928K shares, showing a 1.94% increase. Nonetheless, this firm also reduced its allocation in 0QNY by 7.00%.

Geode Capital Management owns 11,288K shares, representing 2.05% of 3M. This marks a 1.66% increase from 11,100K shares previously, although their portfolio allocation in 0QNY dropped significantly by 41.95% in the last quarter.

State Farm Mutual Automobile Insurance maintains 8,277K shares, holding steady at 1.51% ownership with no changes in the last quarter.

Newport Trust possesses 7,592K shares, representing 1.38% of the company. In its last filing, it reported owning 7,802K shares, indicating a decrease of 2.77%, and their portfolio allocation in 0QNY declined by 13.34% over the last quarter.

Fintel is a robust investing research platform that serves individual investors, traders, financial advisors, and small hedge funds.

Our comprehensive data encompasses various aspects including fundamentals, analyst reports, ownership insights, fund sentiment, options trades, and more. Additionally, our exclusive stock picks utilize advanced, backtested quantitative models for enhanced returns.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.