Analysts Predict Growth for Invesco S&P MidCap Quality ETF

Recent analysis reveals significant upside potential for the Invesco S&P MidCap Quality ETF (Symbol: XMHQ), based on its underlying holdings.

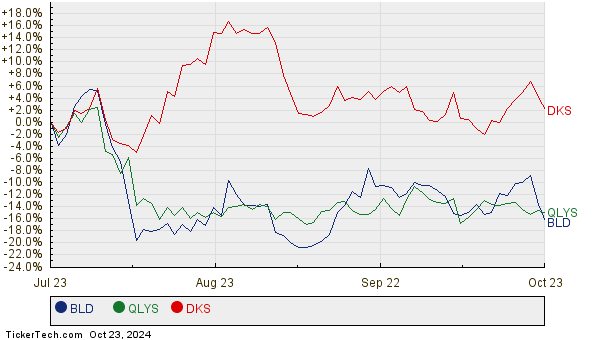

After reviewing the underlying stocks held by XMHQ, the average analyst target price for this ETF stands at $112.86 per unit. Currently, XMHQ is priced at approximately $102.11 per unit, implying a possible 10.52% increase in value. Notable contributors to this optimism include TopBuild Corp (Symbol: BLD), Qualys, Inc. (Symbol: QLYS), and Dick’s Sporting Goods, Inc. (Symbol: DKS). For instance, TopBuild’s recent price is $378.69 per share, but analysts anticipate an 18.47% rise to an average target of $448.64. Similarly, Qualys shows an 18.01% potential gain from its current price of $123.52, projecting to reach $145.76. Dick’s Sporting Goods has a target price of $245.80, which is 17.83% higher than its recent price of $208.60. Below is a chart showing the stock performance for these companies over the past year:

Here’s a summary of the current analyst target prices for the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco S&P MidCap Quality ETF | XMHQ | $102.11 | $112.86 | 10.52% |

| TopBuild Corp | BLD | $378.69 | $448.64 | 18.47% |

| Qualys, Inc. | QLYS | $123.52 | $145.76 | 18.01% |

| Dick’s Sporting Goods, Inc | DKS | $208.60 | $245.80 | 17.83% |

Are these analyst targets realistic, or are expectations too high as we look to the next year? Various factors, including recent developments in the companies and their industries, can influence these projections. A high target can signal optimism but may also lead to adjustments if market conditions shift unexpectedly. This presents an opportunity for investors to conduct further research.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Additional Information:

• NNN Options Chain

• Norfolk Southern Technical Analysis

• Institutional Holders of TWOU

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.