Positive Trends for PowerFleet (AIOT): Analysts Anticipate Significant Upside

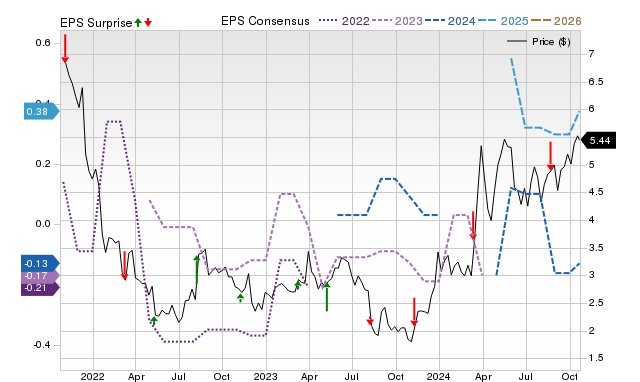

Shares of PowerFleet (AIOT) increased by 10.8% over the past month, closing the last session at $5.44. This rise suggests that there might still be considerable upside potential in the stock. Wall Street analysts project a mean price target of $9, which reflects a potential upside of 65.4%.

A Closer Look at Price Targets

The average price target from analysts consists of six short-term estimates, ranging from a low of $7 to a high of $13, with a standard deviation of $2.28. The lowest prediction indicates an increase of 28.7% from the current price, while the most optimistic forecast suggests a maximum upside of 139%. Analysts’ estimates are shown to be more reliable when they exhibit a smaller standard deviation, which indicates a stronger consensus.

Are Price Targets Always Reliable?

Investors often rely on consensus price targets, but they should approach these with caution. Analysts, while knowledgeable about company fundamentals, can sometimes set targets that are overly optimistic. This trend could be influenced by the interests of their firms, which may seek to boost share prices for companies they are associated with.

Although it is important not to disregard price targets, relying exclusively on them can lead to poor returns on investment. A tight cluster of targets, shown by lower standard deviation, suggests that analysts agree on future price movements, but this is just a starting point for deeper analysis.

Potential for Growth in AIOT

Recent positive sentiment among analysts has emerged regarding PowerFleet’s earnings forecasts. The consensus among them posits a legitimate expectation for stock price increases. Research indicates a strong link between earnings estimate revisions and short-term price movements.

In the past 30 days, three estimates for the current year increased, with no downward revisions. This has led to a 20% rise in the Zacks Consensus Estimate.

PowerFleet holds a Zacks Rank #2 (Buy), placing it among the top 20% of over 4,000 stocks analyzed based on earnings estimate factors. This favorable ranking indicates potential near-term upside for the stock. The full list of Zacks Rank #1 (Strong Buy) stocks is available for review.

Expert Predictions on Future Stock Performance

Experts at Zacks Investment Research have identified stocks with the highest probability of increasing by 100% or more soon. Among these recommendations, Director of Research Sheraz Mian highlights one particular stock expected to excel.

This leading pick stands out for its innovative approach within the financial sector, boasting a rapidly expanding customer base exceeding 50 million and a range of cutting-edge solutions. Although not all stock picks succeed, this one has the potential to outperform previous Zacks’ predictions, such as Nano-X Imaging, which surged by +129.6% in just nine months.

For your free report on the top stock and four additional contenders, view the download link provided.

PowerFleet, Inc. (AIOT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.