Magnite and Disney Extend Partnership: A Promising Future in Advertising

Magnite, Inc MGNI stock benefitted from a renewed agreement with Walt Disney Co DIS on Wednesday.

New Deal Marks Six Years of Collaboration

The two companies have extended their partnership for another two years, continuing a successful collaboration that spans six years.

Magnite: Disney’s Preferred Partner for Ad Technology

Magnite will continue as Disney’s main supply-side technology partner, helping to monetize ad-supported content across Disney’s vast portfolio.

Expanding Monetization Opportunities

Magnite facilitates transactions with over 30 demand-side platforms (DSPs) for Disney, with plans for further global expansion.

Jamie Power, Senior Vice President of Addressable Sales at Disney, stated, “Magnite plays a critical role in allowing buyers to access Disney’s inventory by connecting to more than 30 demand-side platforms in the US and starting to expand globally.”

Strategic Initiatives Under the New Agreement

As part of the extended partnership, Disney will utilize Magnite to execute personalized deals through its ClearLine offering. This includes monetizing live College Football streams on ESPN, expanding into Latin America, and providing podcast inventory for ESPN and ABC News.

Sean Buckley, Chief Revenue Officer at Magnite, commented, “In addition to enabling Disney’s programmatic transactions, we’re actively innovating in new areas like live streaming to bring added value to our partnership.”

Disney’s Commitment to Streaming

Disney is steadfast in its streaming ambitions, having recently raised the prices of its Disney+ and Hulu services. The company also encouraged subscribers to evade Apple Inc’s AAPL App Store fees when signing up for its streaming services.

Disney’s Growing Profitability in Streaming

Disney’s streaming division posted an operating profit of $47 million in the third quarter, a notable turnaround from a loss of $(512) million the previous year.

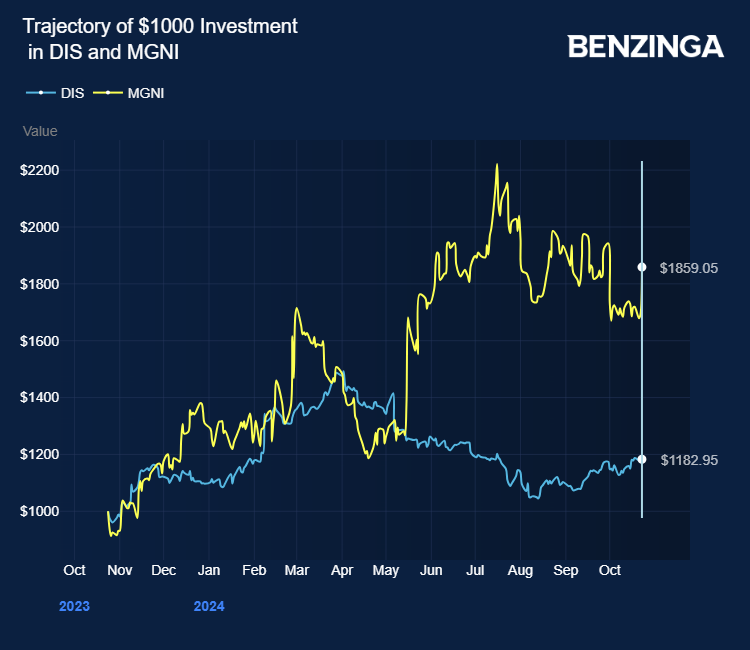

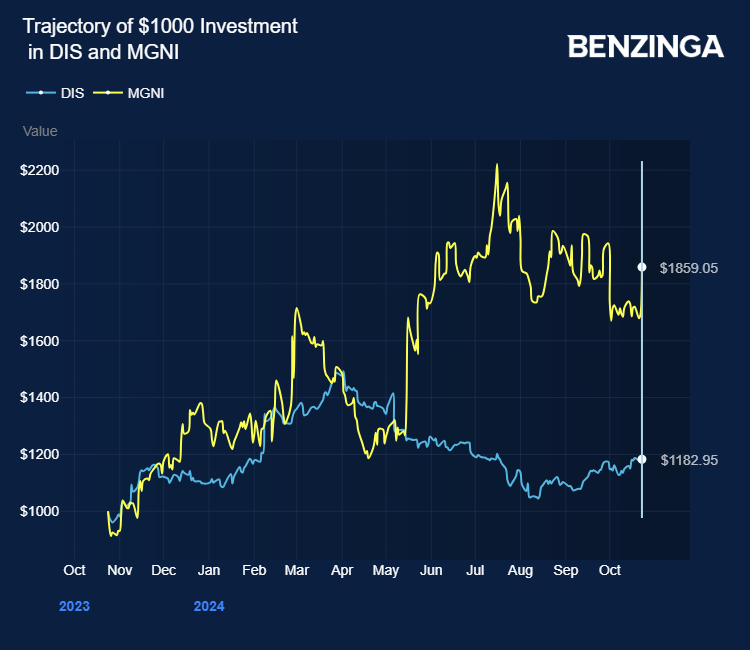

Stock Performance Overview

Magnite’s stock has surged over 86% in the last 12 months, while DIS has increased by over 16%.

Price Actions: At last check on Wednesday, MGNI stock was up 2.11% at $12.33, while DIS stock was down 0.17% at $96.58.

Also Read:

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs