Is Clean Energy Fuels Corp. a Good Investment? Analyzing Recent Trends

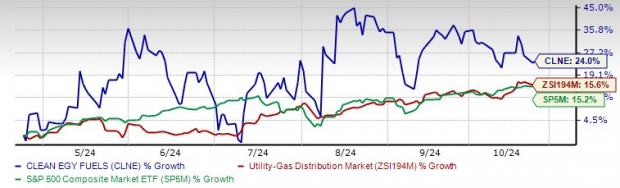

Shares of natural gas supplier Clean Energy Fuels Corp. (CLNE) have gained 24% over the past six months, closing at $2.84 yesterday. This performance significantly outpaces its industry peers and the S&P 500. The stock price boost has been fueled by Clean Energy’s strong position in the renewable natural gas (RNG) market, impressive EBITDA growth, and beneficial collaborations.

Clean Energy Fuels Corp. Stock Performance Over 6 Months

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Are Clean Energy shares still a worthwhile investment, or is it time to consider exiting? Some analysts suggest it might be prudent to take profits before the stock becomes a risky bet for investors. Let’s take a closer look at the company’s strengths and challenges.

Overview of Clean Energy Fuels Corp.

Clean Energy Fuels is a prominent renewable energy company that focuses on the procurement and distribution of RNG and conventional natural gas. The company operates over 600 fueling stations across the U.S. and Canada, catering mainly to the heavy-duty transportation sector. Clean Energy is dedicated to expanding its RNG production, aiming to play a significant role in the transition to cleaner energy sources for commercial transportation.

Factors Contributing to Clean Energy’s Rise

Demand for Renewable Natural Gas: One of the key reasons behind CLNE’s investment appeal is its position as the largest provider of RNG in North America. RNG significantly reduces emissions—by 300% compared to diesel—making Clean Energy a strong contender in the increasing demand for eco-friendly transportation options. The growing focus on reducing carbon footprints in heavy-duty trucking gives CLNE a favorable outlook in the energy sector.

Enhanced Financial Performance: The second quarter showed improvements for CLNE, which despite a net loss, reported a positive non-GAAP EPS and an adjusted EBITDA of $18.9 million, up from $12.1 million a year earlier. The positive operating cash flow of $21.4 million in the first half of 2024 marks a significant recovery compared to negative cash flow last year. With $250 million in cash reserves, CLNE has the liquidity to sustain operations without diluting its stock. This strengthens the company’s path toward profitability.

Infrastructure Development and Partnerships: Clean Energy is strategically expanding its infrastructure across North America. Collaborations with major companies like Amazon (AMZN) and partnerships with others like Tourmaline to develop fueling stations in Canada further enhance its market position. These partnerships aim to fortify CLNE’s recurring revenue, setting the stage for potential stock growth.

Vertical Integration and Margin Potential: Clean Energy’s initiative to increase its ownership of RNG production facilities through joint ventures with BP plc (BP) and TotalEnergies (TTE) positions the company to capture better margins. Transitioning from solely distribution to production allows CLNE to benefit from additional environmental credits, which could significantly enhance EBITDA margins.

Image Source: Clean Energy Fuels Corp.

Image Source: Clean Energy Fuels Corp.

Evaluating CLNE’s Valuation

Despite its impressive fundamentals, CLNE’s valuation raises concerns. When assessed using EV/EBITDA (Enterprise Value/Earnings before Interest, Taxes, Depreciation, and Amortization), Clean Energy does not appear as attractive compared to peers in the renewable energy sector, especially given its historically low market cap of $632 million; this is a far cry from its previous highs of $3.5 billion. The stock also holds a concerning Value Score of D, despite its affordability.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Challenges Ahead for Clean Energy

Uncertain Revenue Growth: Clean Energy has faced difficulties in achieving consistent revenue growth over the years. Although revenue levels mirror those of 2014, financial performance remains erratic due to fluctuations. This inconsistent revenue growth raises concerns about the company’s ability to take full advantage of the rising interest in RNG.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Decreased Sales Volume: In the second quarter of 2024, Clean Energy sold 57.1 million gallons of RNG, which is down from 58.6 million during the same period last year. This decline can be traced back to a decrease in non-repeating sales of RNG outside their station network. Although the company is working to boost in-house RNG distribution, it faces challenges due to reduced sales volume, which may hinder revenue growth.

Reliance on External RNG Supply: Clean Energy’s dependency on third-party RNG supplies remains a significant hurdle. Despite joint ventures aimed at increasing its proprietary production, less than 10% of total RNG sold will come from its own operations. This creates vulnerability to price fluctuations and supply chain risks, limiting CLNE’s competitive advantage.

Final Thoughts: Caution for Potential Investors

Given its focus on RNG and extensive distribution network, Clean Energy Fuels is well-positioned to tap into the growing demand for renewable fuels. The strength of its joint ventures and partnerships, along with improvements in operational efficiency, bolsters investor confidence in CLNE’s potential. However, challenges related to valuation, uncertain revenue growth, and high reliance on external supplies warrant caution for new investors.

Those seeking high-risk, high-reward opportunities might find Clean Energy appealing. In contrast, conservative investors may choose to approach with caution for now. As sentiment toward clean energy firms improves, particularly with the rising emphasis on environmental sustainability, CLNE’s stock has the potential to thrive.

Clean Energy Fuels currently holds a Zacks Rank #3 (Hold).

Explore today’s top Zacks #1 Rank (Strong Buy) stocks here.

Zacks Research Highlights Leading Stock with Potential Upside

Our expert team recently identified five stocks with a high potential for growth of 100% or more in the near future. Among these, Director of Research Sheraz Mian emphasizes one stock expected to rise the most.

This standout stock is at the forefront of innovation in the financial sector, boasting a rapidly expanding customer base of over 50 million and a portfolio of cutting-edge solutions, setting the stage for significant gains. While not every selection may succeed, this stock could exceed previous Zacks’ notable picks like Nano-X Imaging, which surged by +129.6% in just over nine months.

Free: Discover Our Top Stock and Four Additional Selections

Interested in Zacks Investment Research’s latest recommendations? Download “5 Stocks Set to Double” for free today!

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

BP p.l.c. (BP) : Free Stock Analysis Report

Clean Energy Fuels Corp. (CLNE) : Free Stock Analysis Report

TotalEnergies SE Sponsored ADR (TTE) : Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views of the author and do not necessarily reflect those of Nasdaq, Inc.