By RoboForex Analytical Department

USD/JPY Hits 151.79 Amid Political Uncertainty in Japan

The USD/JPY currency pair has reached nearly three-month highs, climbing to 151.79. This surge is primarily fueled by a stronger US dollar and increasing US government bond yields. Positive macroeconomic data from the United States and heightened demand for safe-haven assets ahead of the upcoming US elections have further bolstered the dollar’s position.

Japan’s Political Instability Affects the Yen

As Japan approaches its general elections this weekend, the political atmosphere remains uncertain. Preliminary polls suggest that the ruling Liberal Democratic Party may lose its majority, raising concerns about political stability and the future of the Bank of Japan’s monetary policy. This uncertainty could hinder the Japanese yen’s ability to recover against a strong US dollar.

Bank of Japan’s Response Under Scrutiny

Given the current situation, it appears unlikely that the Bank of Japan will effectively intervene. Market expectations indicate that attempts at intervention may be ignored due to the strong demand for the dollar. The fate of the yen is now closely tied to Japan’s election results and potential decisions by the Bank of Japan regarding interest rates.

Technical Analysis of USD/JPY

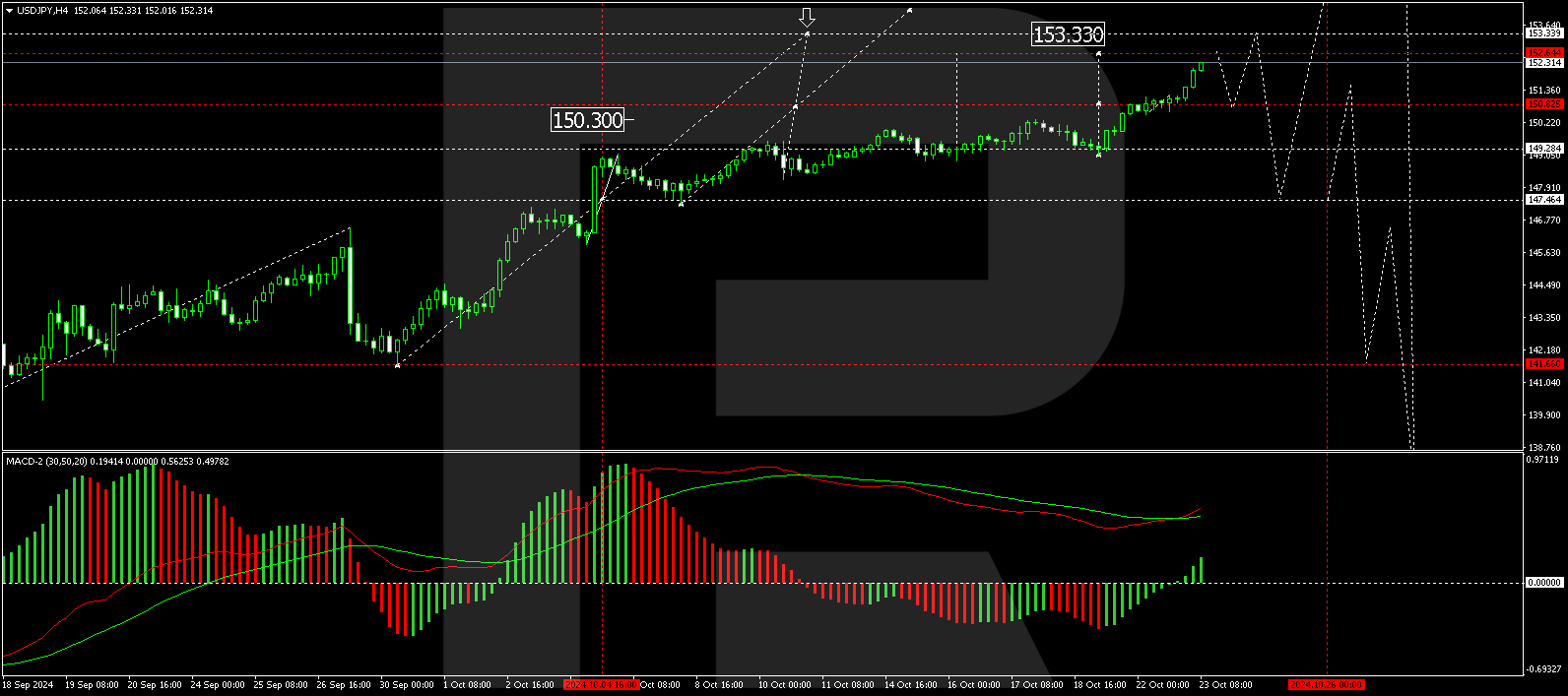

When we analyze the USD/JPY, it has been trading within a narrow range around 150.85 before breaking upwards, heading towards a target of 152.52. After reaching this level, a possible correction back to 150.85 may occur, before another potential rise to 152.72. The MACD indicator reinforces this bullish trend, showing a strong upward momentum with its signal line significantly above zero.

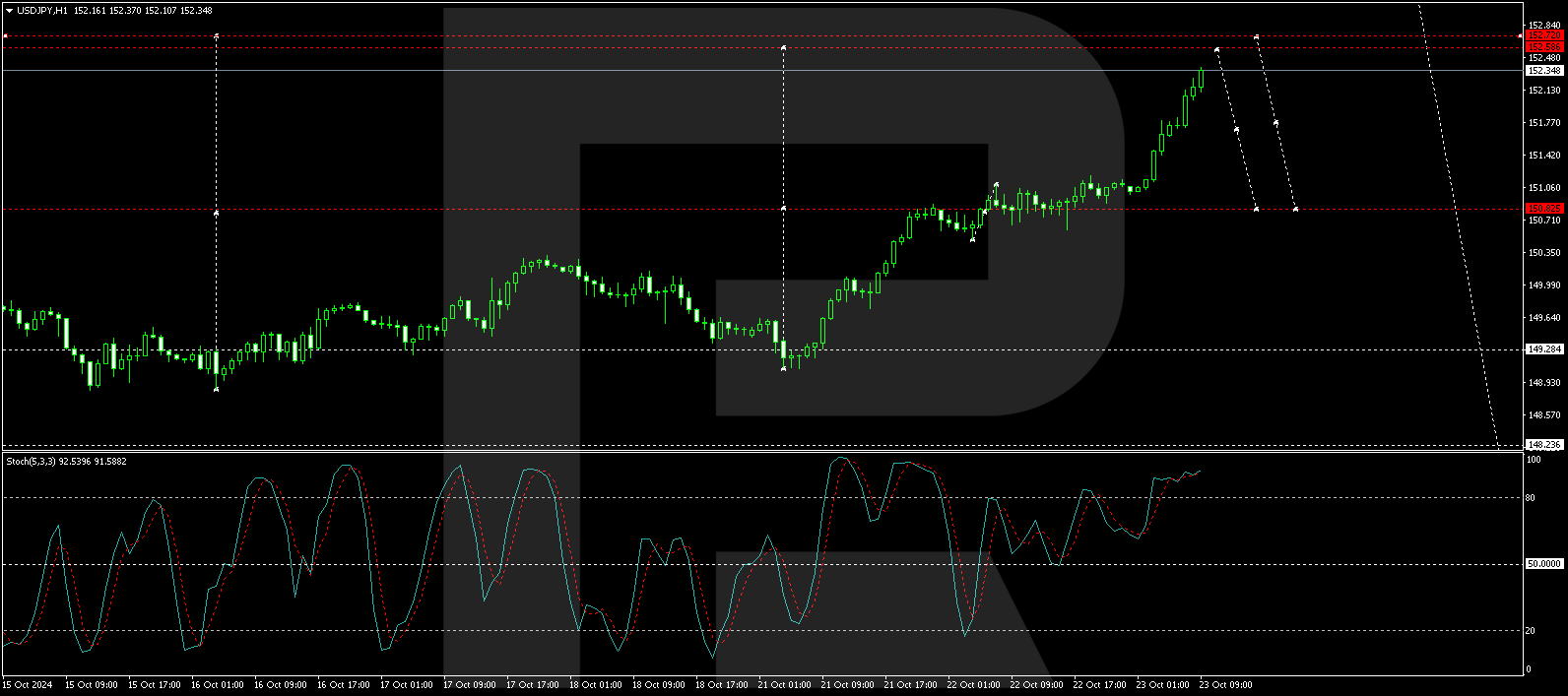

On the hourly chart, the USD/JPY formation indicates further growth towards 152.85. Once this target is hit, a corrective phase back towards 150.85 is expected, with the first correction target at 151.70. The Stochastic oscillator indicates that a pullback is likely, as its signal line remains above 80 but is trending downward towards 20, signaling an upcoming adjustment before potential further gains.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Market News and Data brought to you by Benzinga APIs