Alibaba: A Strong Contender in the E-Commerce Arena

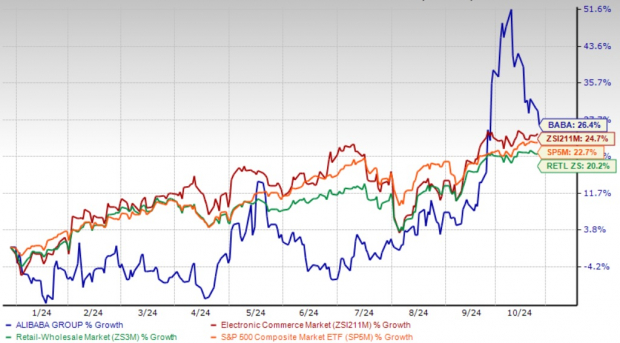

Amid the changing global e-commerce landscape, Alibaba (BABA) presents a noteworthy investment option as it showcases a robust performance. The stock has seen a remarkable rise, climbing 26.4% year-to-date, outpacing the Zacks Internet-Commerce industry’s growth of 24.7%, the Zacks Retail-Wholesale sector’s increase of 20.2%, and the S&P 500’s gain of 22.7%.

Beyond this impressive growth, Alibaba’s strong foundation rests on three key strengths: its growing international commerce division, innovative AI integrations, and stable financial position. These elements, paired with strategic partnerships and cutting-edge initiatives, set Alibaba on a promising path in the evolving digital marketplace.

Evaluating Year-to-Date Performance

Image Source: Zacks Investment Research

AIDC: Strengthening Global Market Presence

Alibaba’s growth can be largely attributed to its successful Alibaba International Digital Commerce Group (“AIDC”), which includes platforms like Lazada, AliExpress, Trendyol, and Alibaba.com. During the first quarter of fiscal 2025, AIDC reported significant growth, with revenues reaching RMB 29.29 billion ($4.03 billion), a 32% increase from the previous year. The retail side of international commerce was particularly strong, showing a 38% revenue growth to RMB 23.7 billion.

The company’s overseas e-commerce operations are thriving, thanks to robust performances from AliExpress, Trendyol, and Alibaba.com. Initiatives such as Alibaba Guaranteed and the Logistics Marketplace enhance support for small and medium-sized enterprises (SMEs) engaging in cross-border trade. The transformation of AliExpress Choice into a supply-chain-focused platform further facilitates international expansion. Notably, partnerships like the one with Magazine Luiza in Brazil illustrate Alibaba’s growing global reach.

AI Integration: Innovating for Small Businesses

Alibaba has been a leader in adopting artificial intelligence across its operations, enhancing various functionalities like product listings, multilingual searches, and personalized recommendations. This tech-driven approach particularly benefits SMEs, with 17,000 businesses currently utilizing the AI Business Assistant on Alibaba.com. The rise in searches for AI-optimized products by 37% underscores the efficacy of this strategy and highlights the importance of initiatives like Alibaba Guaranteed and Logistics Marketplace in promoting seamless trade.

Solid Financials: Supporting Growth and Returns

Alibaba’s financial health is another reason for its appeal among investors. With a net cash status of RMB 405.75 billion ($55.8 billion) and free cash flow of RMB 17.4 billion ($2.4 billion) as of June 2024, the company maintains a solid balance sheet. This financial strength has facilitated significant shareholder returns, including the repurchase of 613 million ordinary shares for $5.8 billion this past quarter.

Looking ahead, as Alibaba continues to harness its technology, broaden its global influence, and uphold financial rigor, investors have solid grounds to consider BABA stock for long-term investment. The Zacks Consensus Estimate predicts fiscal 2025 revenues at $140.46 billion, reflecting a 7.63% year-over-year growth, while the earnings estimate has seen a 3% upward revision recently, set at $8.94 per share. These figures signal rising market confidence in Alibaba’s trajectory.

Image Source: Zacks Investment Research

Find the latest earnings estimates and surprises on Zacks Earnings Calendar.

Valuation Insights: An Attractive Opportunity for Investors

Currently, Alibaba trades at a forward 12-month Price/Earnings (P/E) ratio of 10.5X, which is quite low compared to the industry average of 24.71X and below the median of 15.92X. This notably undervalued pricing presents a compelling entry point for investors, suggesting that Alibaba’s stock is trading below its true market value despite solid fundamentals. Additionally, the stock has a Value Score of A, making it an appealing option for cautious investors.

BABA’s P/E Ratio Highlights Discounted Valuation

Image Source: Zacks Investment Research

Navigating Challenges: Competitive Pressures and Economic Context

Despite its strengths, Alibaba faces significant hurdles including global uncertainties, changing consumption trends, economic downturn fears, and volatility in the market. The escalating tensions between the United States and China add uncertainty, impacting investor sentiment despite the fact that it may not directly affect the e-commerce sector.

Moreover, rising operating costs are compressing profit margins. In the first quarter of fiscal 2025, sales and marketing, general and administrative, and product development expenses increased by 180, 240, and 100 basis points year over year, respectively, leading to a 15% drop in operating income and a 300 basis point decline in operating margin compared to the previous year.

Add to this, Alibaba’s prominent position within China is challenged by global competitors such as Amazon (AMZN) and eBay (EBAY), while rapid competition in the global cloud space from leaders like Amazon, Microsoft, and Alphabet (GOOGL) poses additional obstacles.

Final Thoughts

In conclusion, Alibaba’s technological advancements, international growth strategies, and solid financial management position BABA stock as a promising long-term investment, exceeding its strong year-to-date performance. Currently, BABA carries a Zacks Rank #2 (Buy), highlighting its potential as a favorable investment choice.

5 Stocks Set to Double

Each stock featured was selected by a Zacks expert as a top pick expected to gain +100% or more in 2024. While previous recommendations have had varied success, some have surged as much as +673.0%.

Many of these stocks are currently under Wall Street’s radar, offering a great opportunity to invest early.

Today, discover these 5 potential home runs >>

For the latest recommendations from Zacks Investment Research, download the report titled 5 Stocks Set to Double.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

eBay Inc. (EBAY) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.