Rivian’s OSHA Violations Weigh on Stock Amid Safety Concerns

Shares of Rivian (RIVN) are falling today following a Bloomberg report revealing that the electric vehicle manufacturer has faced 16 serious OSHA (Occupational Safety and Health Administration) violations at its factory in Normal, Illinois, over the past 21 months. These incidents include serious injuries such as an amputated finger and a cracked skull, as well as workers experiencing vomiting due to inadequate protection when exposed to paint. Notably, Rivian’s number of violations is higher than that of larger companies like Ford (F).

Workers like Addison Zwanzig have reported significant health issues after painting vehicles without proper respirators, leading to her vomiting blue bile. The company only provided adequate safety equipment after these troubling incidents came to light. In response, Rivian stated that safety remains a priority and claimed that the Bloomberg report misrepresented the facts. The company pointed out improvements made and noted it received only two serious OSHA citations in 2023.

Despite these safety challenges, Rivian is actively hiring more staff and has shifted plans to produce the R2 SUV at its Illinois plant instead of in Georgia. However, with increased media scrutiny, the company must prioritize safety measures moving forward.

Analyst Outlook: Buy or Sell for RIVN Stock?

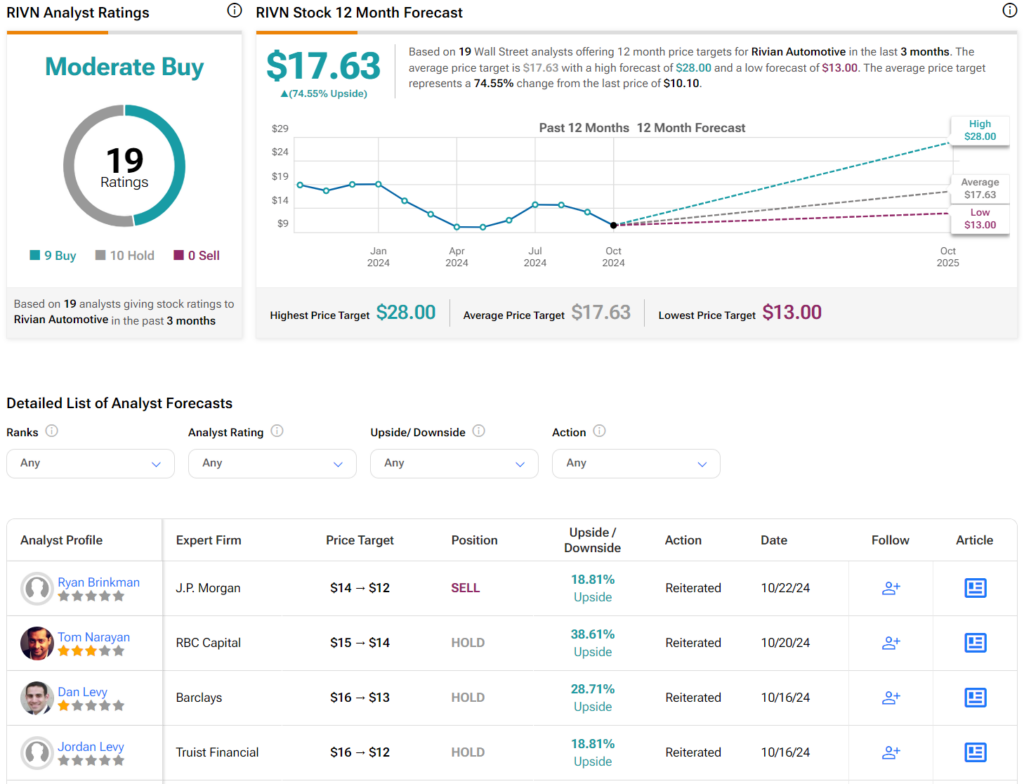

According to Wall Street, analysts have a Moderate Buy consensus on RIVN stock, with nine Buys, ten Holds, and no Sells recorded in the last three months. After a 42% drop in share price over the past year, the average target for RIVN stands at $17.63 per share, suggesting a 74.55% potential upside.

Interestingly, many analysts have revised their price targets lower for Rivian stock. The most significant reduction was from Jordan Levy of Truist Financial, who cut his estimate from $16 per share to $12 per share.

See more RIVN analyst ratings

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.