Honeywell International’s Stock Outlook Downgraded by B of A Securities

Analysts Project Slight Price Increase Ahead

Fintel reports that on October 24, 2024, B of A Securities downgraded their outlook for Honeywell International (XTRA:ALD) from Buy to Neutral.

Analyst Expectations Reveal Moderate Growth

As of October 22, 2024, the average one-year price target for Honeywell International is set at €212.11 per share. Predictions range from a low of €189.92 to a high of €240.78. This average target implies a potential increase of 3.44% compared to its last reported closing price of €205.05 per share.

For context, this slight upside could reflect broader trends impacting the company. Investors may recall that Honeywell has historically been a stable player in the industrial sector.

Projected Financial Performance

Honeywell International is projected to report annual revenue of €39.047 billion, reflecting a growth rate of 3.16%. Additionally, the anticipated annual non-GAAP EPS stands at €10.11.

Investor Interest on the Rise

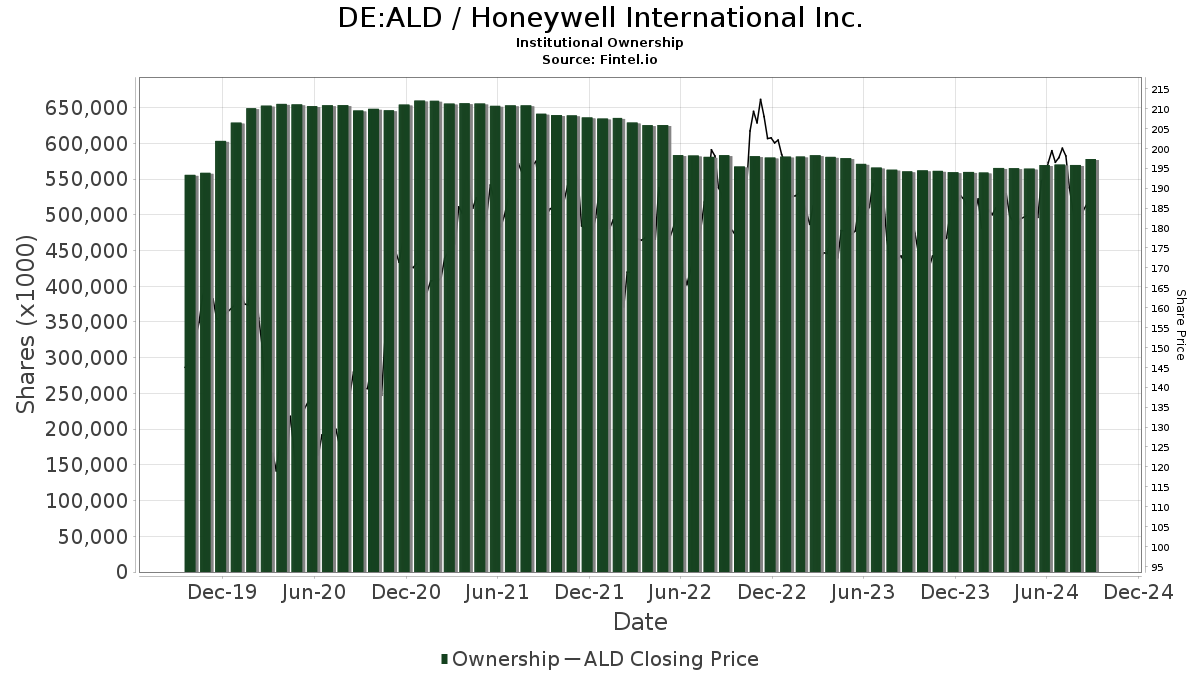

Currently, 3,576 funds or institutions hold positions in Honeywell International. This number has increased by 45 owners, or 1.27%, over the past quarter. The average portfolio weight for all funds invested in ALD has climbed to 0.45%, marking an increase of 1.03%. In total, institutional holdings increased by 1.64% in the last three months, reaching 579,383K shares.

A Closer Look at Key Shareholders

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares has reported holding 20,574K shares, translating to 3.17% ownership. This marks an increase from 20,507K shares, a rise of 0.32%. The firm boosted its allocation in ALD by 1.50% in the last quarter.

JPMorgan Chase now holds 19,148K shares, accounting for 2.95% ownership. Previously, they owned 16,520K shares, meaning an increase of 13.73%, and they raised their allocation in ALD by 17.11% over the prior quarter.

VFINX – Vanguard 500 Index Fund Investor Shares presently holds 16,713K shares, which is 2.57% ownership. This is a slight increase from their previous ownership of 16,614K shares, with the firm reducing its allocation in ALD by 0.92% recently.

Wellington Management Group LLP owns 16,450K shares representing 2.53% ownership, down from 17,581K shares, depicting a decrease of 6.88%. Their allocation in ALD was reduced by 1.91% last quarter.

Newport Trust maintains 15,678K shares, representing 2.41% ownership, showing no change over the last quarter.

Fintel is a leading research platform that provides extensive investing data for individual investors, traders, financial advisors, and smaller hedge funds.

Our comprehensive resources feature fundamentals, insider trading data, fund sentiment metrics, and more. Additionally, our exclusive stock selections utilize advanced quantitative models to enhance potential returns.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.