Michael Burry’s Contrarian Moves: A Deep Dive into China Stocks

Even if you’re just a casual investor, you might recognize Michael Burry. He gained fame as a hedge fund manager featured in The Big Short, a book and film that detailed how some investors anticipated the 2008 financial collapse and profited from it.

Through his firm, Scion Capital Management, Burry made $725 million for his investors by betting against mortgage-backed securities at that time, earning himself $100 million in the process.

Building a Chinese Tech Portfolio

Now, Burry is at it again, and he has a significant part of his portfolio—about 46%—invested in three Chinese tech companies. As of the end of the second quarter, Alibaba (NYSE: BABA) accounted for 21.3%, followed by Baidu (NASDAQ: BIDU) at 12.4%, and JD.com (NASDAQ: JD) at 12.3%. Burry began acquiring these stocks in the fourth quarter of 2022.

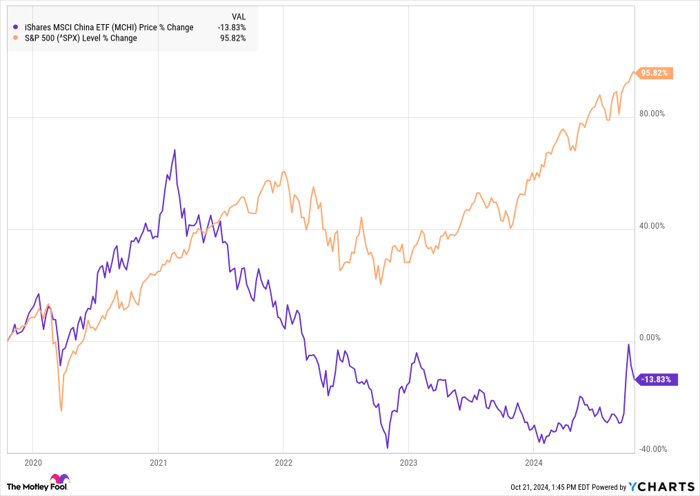

The Chinese sector has been considered out of favor recently. The chart below indicates that the iShares MSCI China ETF has significantly underperformed compared to the S&P 500.

MCHI data by YCharts

In recent weeks, gains have come as Beijing has relaxed lending rates and restrictions, hinting that Burry’s strategy may be proving fruitful.

David Tepper Joins the Chinese Stock Trend

Burry isn’t alone in this bet. Billionaire hedge fund manager David Tepper, head of Appaloosa Management, has also been increasing his investments in Chinese companies. His largest holding is also Alibaba, which represents 12.2% of his portfolio. In addition, he has invested in Pinduoduo’s parent company, PDD Holdings (NASDAQ: PDD), making up 4.2%. Tepper also owns shares in Baidu, the Kraneshares CSI China ETF (NYSEMKT: KWEB), JD.com, and KE Holdings (NYSE: BEKE), which together constitute 6.6% of his portfolio.

Overall, around 25% of Tepper’s investment portfolio is now in Chinese stocks, beginning with his acquisition of Alibaba in the second quarter of 2022.

Evaluating the Case for Buying Chinese Stocks

Should investors follow their lead into Chinese stocks? There are reasons to consider this possibility, as well as reasons for caution.

Many prominent investors, including Warren Buffett, have noted that the U.S. stock market might be overvalued. In fact, Buffett has sold off some U.S. stocks this year, opting for Treasuries instead.

Conversely, Chinese stocks appear undervalued. The iShares MSCI China ETF, with major holdings in Tencent and Alibaba, trades at a price-to-earnings ratio of 11.6, starkly lower than the iShares Core S&P 500 ETF, which has a P/E ratio of 29.4.

This disparity in valuation has caught the attention of investors like Burry and Tepper, particularly as AI stocks drive the S&P 500’s valuation higher, leading many to seek better returns in less expensive markets, like China.

Approach with Caution: Risks Remain

Investing in Chinese stocks has not been without downside for many, and the issues that have contributed to their decline still persist.

Although declining interest rates and decreased restrictions might suggest recovery, the Chinese economy needs more than just these factors to gain strength. Current consumer spending levels are low, and it is uncertain if these changes will be sufficient to revive it.

It’s also suspicious that stocks like Alibaba and JD.com may struggle to return to their pre-pandemic growth levels. U.S. export bans on critical technology could hinder China’s advancement in sectors like AI. Additionally, the threat of renewed government crackdowns, reminiscent of the 2020 blocking of Ant Financial’s IPO, lingers.

Ultimately, while Chinese stocks seem appealing due to low valuations, they carry significant risks.

Evaluating Potential Investments in Chinese Stocks

After careful consideration, it seems wiser to avoid most Chinese stocks until the economy stabilizes further. Nevertheless, one company does stand out.

PDD Holdings, the parent company of Pinduoduo and Temu, has consistently outperformed Alibaba and JD.com, showing significant growth despite the broader economic challenges. Additionally, Temu’s success in international markets provides it with an advantageous new revenue stream.

This stock has shown positive performance recently, holding a fair price relative to its growth potential, making it a worthwhile consideration for investors interested in the sector.

A Second Chance at a Potentially Profitable Opportunity

Have you ever felt like you missed a great investment opportunity? Leaders in the financial sector often offer recommendations that can lead to impressive gains. Here’s a look at a few examples:

- Amazon: A $1,000 investment in 2010 would be worth $20,803 today!*

- Apple: A $1,000 investment in 2008 has grown to $43,654!*

- Netflix: An investment of $1,000 in 2004 now stands at $404,086!*

Currently, analysts are identifying three impressive companies worth considering, and the opportunity may not last long.

Explore these three promising stocks now »

*Stock Advisor returns as of October 21, 2024

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Baidu, JD.com, Nvidia, and Tencent. The Motley Fool recommends Alibaba Group. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.