Microsoft Stock: Analysis of Recent Performance and Future Outlook

Microsoft (MSFT) is currently attracting significant attention from visitors on Zacks.com. A review of the upcoming factors influencing the stock’s short-term performance could be beneficial.

Over the past month, Microsoft shares have decreased by -1.5%, contrasting with the Zacks S&P 500 composite’s increase of +1.4%. The Zacks Computer – Software industry, which includes Microsoft, has seen a slight decline of 0.1% during this period. The pressing question is: What is the stock’s potential trajectory moving forward?

Understanding Earnings Estimate Revisions

At Zacks, we focus heavily on changes in future earnings projections for a company, as this is key to determining a stock’s fair value. Analysts review and adjust their estimates based on the latest business trends, which directly affects investor interest. If earnings estimates rise, the fair value of the stock increases, often leading to higher stock prices. Research shows a strong connection between changes in earnings estimates and short-term stock price movements.

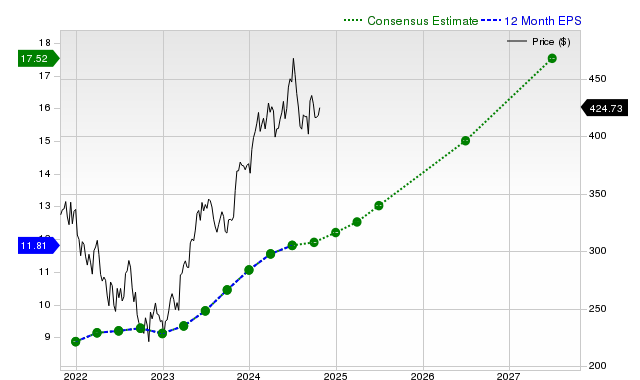

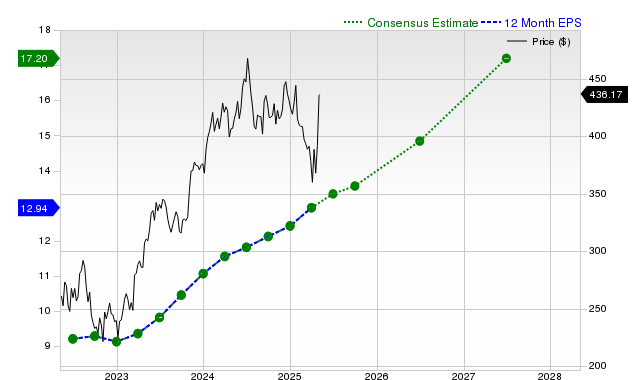

This current quarter, Microsoft is predicted to report earnings of $3.08 per share, reflecting a +3% change from the same quarter last year. However, the Zacks Consensus Estimate has dipped by -0.1% in the past 30 days.

Looking at the current fiscal year, the consensus earnings estimate stands at $13.03, signaling a growth of +10.4% year-over-year, with a recent -0.1% adjustment in estimates. For the following fiscal year, the estimated earnings are projected to be $15.01, representing a +15.2% change from last year, also with a -0.1% change in the estimate.

The Zacks Rank, which utilizes revisions in earnings estimates, offers insight into a stock’s probable near-term price direction. Based on recent movements in the consensus estimate and additional earnings-related factors, Microsoft currently holds a Zacks Rank of #3 (Hold).

12-Month EPS Overview

Forecasting Revenue Growth

While earnings growth is crucial in assessing a company’s financial health, sustained growth in revenues is equally important. A company’s ability to grow its revenues directly influences its capacity to achieve long-term earnings growth.

For the current quarter, the consensus sales estimate for Microsoft is $64.41 billion, indicating an increase of +14% year-over-year. For the current and next fiscal years, sales estimates of $277.29 billion and $314.36 billion imply growths of +13.1% and +13.4%, respectively.

Recent Financial Results and Surprise Metrics

In the last quarter, Microsoft reported revenues of $64.73 billion, showing a +15.2% increase compared to the previous year. The earnings per share (EPS) for this period reached $2.95, up from $2.69 a year earlier.

These results exceeded the Zacks Consensus Estimate of $64.19 billion, resulting in a revenue surprise of +0.84%. The EPS surprise was even higher at +1.72%.

Microsoft managed to surpass consensus EPS estimates for the last four consecutive quarters, achieving similar successes with revenue figures as well.

Evaluating Valuation

An informed investment decision requires careful consideration of a stock’s valuation. Understanding whether a stock’s current price accurately reflects the underlying business’s value and growth potential is crucial.

Comparing Microsoft’s valuation multiples—like price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF)—with both its historical values and those of its peers can help ascertain whether the stock is overvalued, fairly valued, or undervalued.

According to the Zacks Style Scores system, Microsoft has received a D rating for its value, indicating it is currently trading at a higher price compared to its industry peers. Click here to view some of the key valuation metrics contributing to this assessment.

Conclusion

The insights discussed here, along with further details on Zacks.com, may help assess whether the market buzz surrounding Microsoft warrants attention. The Zacks Rank of #3 suggests that Microsoft could follow the broader market trends in the near future.

Top Stock Picks for the Coming Month

Recently released: Experts have identified 7 prime stocks from a pool of 220 Zacks Rank #1 Strong Buys, which are considered “Most Likely for Early Price Pops.”

Since 1988, a full list of these stocks has outperformed the market by more than double, averaging a +23.7% gain each year. These selections merit your immediate attention.

For the latest recommendations from Zacks Investment Research, download 5 Stocks Set to Double for free.

Microsoft Corporation (MSFT): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.