Keybanc Begins Coverage of Regency Centers with Positive Outlook

Analysts Predict Price Increase for Regency Shares

Fintel reports that on October 25, 2024, Keybanc initiated coverage of Regency Centers (NasdaqGS:REG) with a Overweight recommendation.

Price Target Indicates Potential Growth

As of October 22, 2024, the average one-year price target for Regency Centers stands at $77.78/share, with forecasts ranging from a low of $71.71 to a high of $85.05. This average target suggests a 9.53% increase from its latest reported closing price of $71.01/share.

For additional insights, see our leaderboard of companies with the largest price target upside.

Projected Financial Performance

The projected annual revenue for Regency Centers is estimated at $1,270 million, reflecting a decrease of 12.97%. The anticipated annual non-GAAP EPS is $2.31.

Institutional Investment Sentiment

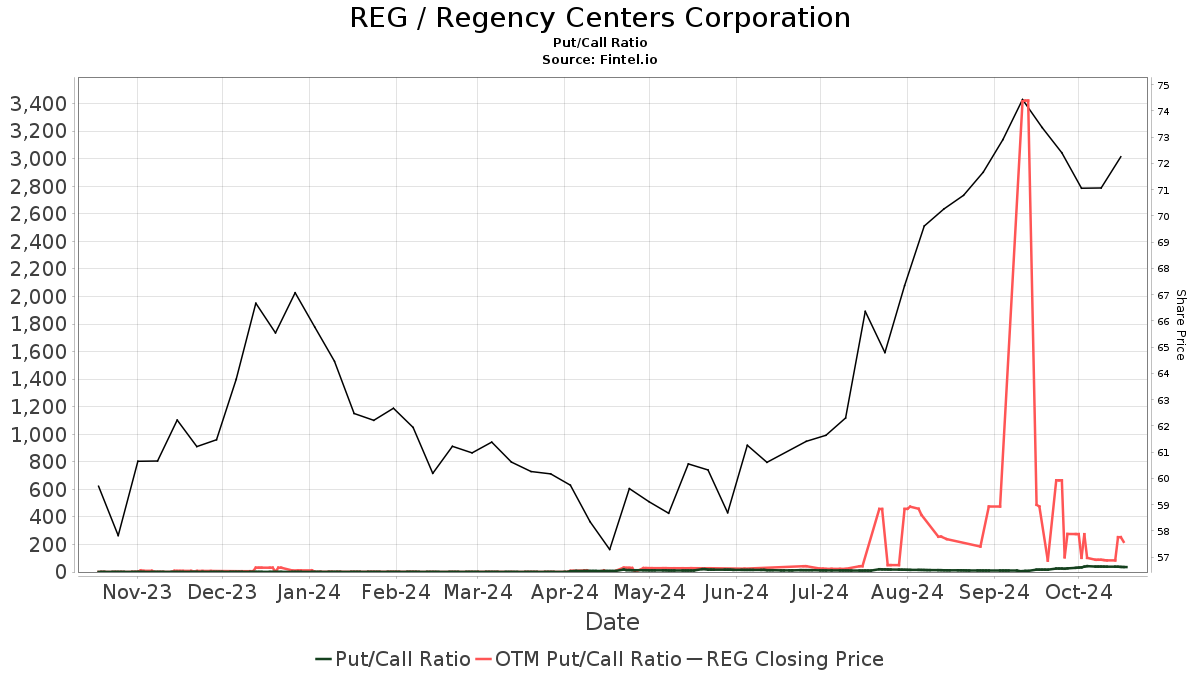

Currently, 1,075 funds or institutions report holdings in Regency Centers. This figure marks a decrease of 22 institutions or 2.01% from the last quarter. The average portfolio weight of all funds dedicated to REG has increased by 2.37% to 0.24%. In the past three months, total shares owned by institutions rose by 5.93%, totaling 197,403,000 shares.  The current put/call ratio for REG is 2.06, indicating a bearish market sentiment.

The current put/call ratio for REG is 2.06, indicating a bearish market sentiment.

Recent Transactions by Major Shareholders

Norges Bank currently holds 17,052,000 shares, which equates to 9.42% ownership of the company. This represents a 100.00% increase from its previous filing of 0 shares.

JPMorgan Chase owns 10,654,000 shares, reflecting a 5.89% stake. This is an increase of 21.61% from its earlier report of 8,352,000 shares, although the firm has decreased its overall portfolio allocation in REG by 80.07% over the last quarter.

Price T Rowe Associates holds 9,643,000 shares, amounting to 5.33% ownership. This reflects a 6.16% increase from the previous report of 9,049,000 shares. The firm has increased its portfolio allocation in REG by 6.86% over the last quarter.

Principal Financial Group owns 8,923,000 shares, indicating 4.93% ownership. This is a 4.00% increase from last quarter’s holding of 8,566,000 shares. However, the firm has cut its portfolio allocation in REG by 40.95% recently.

The Vanguard Real Estate Index Fund Investor Shares holds 7,031,000 shares, showing 3.88% ownership. This is a decrease of 1.82% from 7,159,000 shares previously reported, with a 0.50% reduction in portfolio allocation over the last quarter.

About Regency Centers

Background Information

(Description provided by the company.)

Regency Centers is a leading owner, operator, and developer of shopping centers situated in wealthy, densely populated suburban areas. Its portfolio features busy properties that include top-performing grocers, restaurants, service providers, and leading retailers, all designed to connect with their communities. As a fully integrated real estate company, Regency Centers operates as a self-administered, self-managed qualified real estate investment trust and is a member of the S&P 500 Index.

Fintel stands out as one of the most comprehensive investing research platforms available for individual investors, traders, financial advisors, and small hedge funds. Our data encompasses fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and more. Additionally, our tailored stock picks are supported by advanced, backtested quantitative models aimed at enhancing profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.