Berkshire Hathaway’s Bold Move: Selling Apple Shares Raises Eyebrows

Warren Buffett and Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) are under scrutiny as they navigate the investment landscape. With a net worth exceeding $145 billion and a market cap nearing $1 trillion, every decision they make is closely watched.

Berkshire Hathaway Cuts Apple Shares Drastically

Recently, Berkshire Hathaway made headlines by selling a substantial portion of its Apple (NASDAQ: AAPL) holdings. In the first half of 2024, the company unloaded roughly 505 million Apple shares—115 million in Q1 and 390 million in Q2. This reduction left Berkshire with 400 million Apple shares, which now constitute 29.4% of its stock portfolio.

Despite this sell-off, Apple remains Berkshire Hathaway’s largest holding, far ahead of its second-largest stake in American Express, which makes up 13.1% of the portfolio. Other key holdings include Bank of America (10.3%), Coca-Cola (8.7%), and Chevron (5.7%).

Understanding the Apple Sell-Off: Motivations Explored

Several reasons likely influenced Berkshire Hathaway’s decision to divest a significant amount of its Apple shares. For one, higher interest rates may have made cash more appealing to Buffett and his team. The current stock market environment also suggests that many stocks, including Apple, may be overvalued.

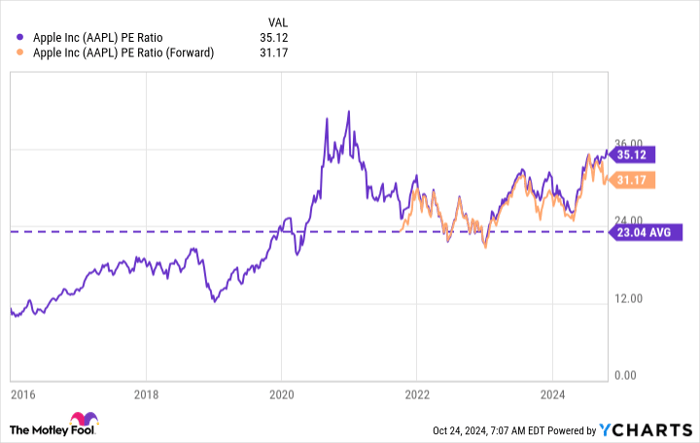

Apple is currently trading at 31 times its projected earnings, which is considerably higher than its average valuation over the past five years. When Berkshire began increasing its stake in Apple in 2016, the valuation was much lower.

Additionally, the decision to sell could be a strategic move to lock in profits before anticipated increases in capital gains tax rates. Proposed changes by political figures like Vice President Kamala Harris could affect tax rates in ways that make current selling advantageous. By acting now, Berkshire Hathaway may save millions or billions for both the company and its investors.

Should You Imitate Buffett’s Moves?

If you currently hold Apple shares, there is no pressing need to sell. The tax implications that affect a massive corporation differ significantly from those facing everyday investors.

Apple continues to be a powerhouse, generating $85.8 billion in revenue for its most recent quarter ending June 29. The company’s net income for that period reached $21.5 billion, outpacing revenue accumulated by Adobe over the last four quarters combined. Overall, Apple still presents a strong investment opportunity.

That said, the company’s slowing revenue growth complicates the decision for individual investors contemplating a follow-the-leader approach. Apple has recently seen only 5% year-over-year revenue growth, which might not justify its premium valuation. Despite its market challenges, the company is responding by working to enhance sales and streamline the upgrade cycle.

Warren Buffett has often stated, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” While opinions on the fairness of current pricing may vary, the consensus remains that Apple is a strong business. Long-term investors should focus on future potential rather than short-term fluctuations.

Investing in Apple: Is It Time to Dive In?

Before investing in Apple, consider this advice:

The Motley Fool Stock Advisor team recently identified their top 10 stocks for current investors, and Apple is notably absent from this list. The listed stocks hold the promise of significant returns in the years ahead.

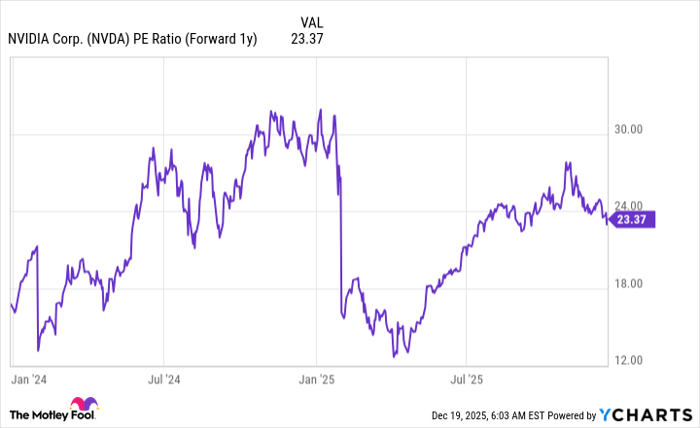

For example, when Nvidia was included in this list back on April 15, 2005, an investment of $1,000 would have grown to around $867,372 today!*

Stock Advisor offers a straightforward approach for investors seeking success, with advice on portfolio building and regular updates from financial experts. Since 2002, it has more than quadrupled the returns of the S&P 500.*

Explore the 10 recommended stocks »

*Stock Advisor returns as of October 21, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. American Express is also an advertising partner of The Ascent. Stefon Walters is an investor in Apple. The Motley Fool has positions in and recommends Adobe, Apple, Bank of America, Berkshire Hathaway, and Chevron. The Motley Fool follows a disclosure policy.

The views and opinions expressed here are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.