Analyzing Shopify’s Stock: A Rollercoaster Ride of Profits and Losses

Shopify (NYSE: SHOP) has experienced significant fluctuations over the past few years. After a substantial 400% increase following the pandemic’s peak due to heightened demand for e-commerce software and payment solutions, shares faced a sharp decline, plunging nearly 90% as the pandemic-related demand waned. Currently, the stock has climbed 55% in the last year but remains significantly below its 2021 highs.

High-growth stocks like Shopify often face volatility, but an examination of the company’s financials reveals substantial strides in growth and profitability. Is Shopify stock a smart buy below $100 a share?

A Return to Core Values

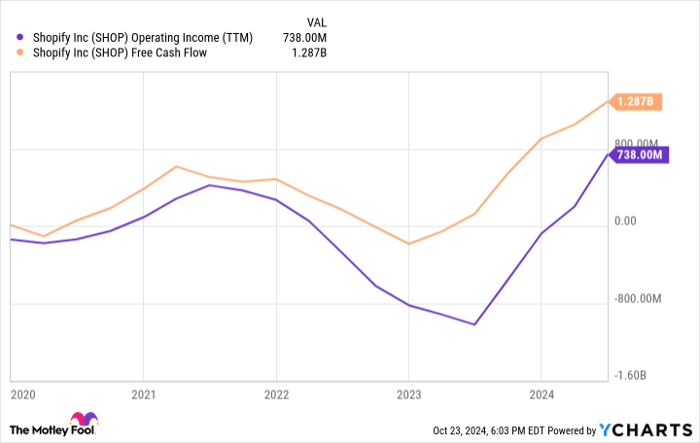

During the COVID-19 pandemic, Shopify set ambitious goals, aiming to compete directly with Amazon through establishing a logistics network, exploring cryptocurrencies, and acquiring a robotics company. However, it recently curtailed these initiatives and sold off its logistics business, laying off 20% of its workforce in the process. These expansive plans led to a lack of focus, resulting in substantial losses, including a $1 billion operating loss at the start of 2023 along with negative free cash flow.

Now, Shopify is realigning with its core products. The primary offerings consist of a suite of e-commerce tools enabling businesses to create and manage online experiences, and payment solutions for processing transactions both online and at retail points. These products contribute to Shopify’s impressive $7.7 billion in annual revenue.

Revenue Growth and Turning Profitable

After eliminating its logistics business, Shopify reported a year-over-year revenue growth of 25% last quarter, hitting $2 billion. Remarkably, this follows a 31% revenue increase during the same period the previous year. The overall e-commerce sector isn’t growing as rapidly, indicating that Shopify is gaining market share.

The company is also demonstrating improved pricing power with its subscription services, leading to minimal customer loss, a sign of its solid business model poised for continued growth.

Efficiency is increasing; Shopify’s free cash flow margin jumped to 16% last quarter, compared to 6% the previous year. Its operating margin stood at 11.8%, which includes stock-based compensation expenses.

Shopify’s management expects continued growth, predicting revenue increases in the mid-20% range and maintaining double-digit free cash flow margins throughout 2024. Long-term prospects remain bright as Shopify is likely to capture more market share in e-commerce, particularly as this sector is expected to outpace traditional retail through the decade.

SHOP Operating Income (TTM) data by YCharts

Is Buying Below $100 a Smart Move?

The critical question arises regarding Shopify’s valuation. Even at a 50% decline from its previous highs, the stock trades at a substantial market capitalization of $100 billion, reflecting more than 10 times its trailing-12-month sales.

To evaluate Shopify’s current valuation, let’s model future performance. If we assume 20% revenue growth over the next five years, income would rise from $7.7 billion to roughly $19 billion. Forecasting an increase in the operating margin from 11.8% to 20% suggests potential earnings of $3.8 billion in five years.

In comparison to the stock’s market cap, this equates to a five-year forward price-to-earnings ratio (P/E) of 26, similar to the current S&P 500 index. This indicates that Shopify’s stock price reflects future growth expectations. If it only measures up to a market multiple in five years, the current price seems unappealing.

At present, it’s advisable to stay away from Shopify stocks. Even below $100, it lacks an attractive valuation.

Thinking of Investing $1,000 in Shopify?

Before deciding to invest in Shopify, consider this:

The Motley Fool Stock Advisor analyst team recently highlighted their choice of the 10 best stocks for investors at this time—Shopify did not make the list. The selected stocks could yield exceptional returns over the coming years.

Reflect on when Nvidia was recommended on April 15, 2005… had you invested $1,000 then, it would now be worth $867,372!*

Stock Advisor offers a straightforward strategy for success, including portfolio-building advice, analyst updates, and two new stock picks monthly. This service has more than quadrupled the S&P 500’s returns since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 21, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board. Brett Schafer holds positions in Amazon. The Motley Fool has positions in and recommends both Amazon and Shopify, following a disclosure policy.

The views and opinions expressed here belong to the author and do not necessarily reflect those of Nasdaq, Inc.