Alphabet’s Upcoming Earnings Report: Analysts Optimistic for Q3 2024

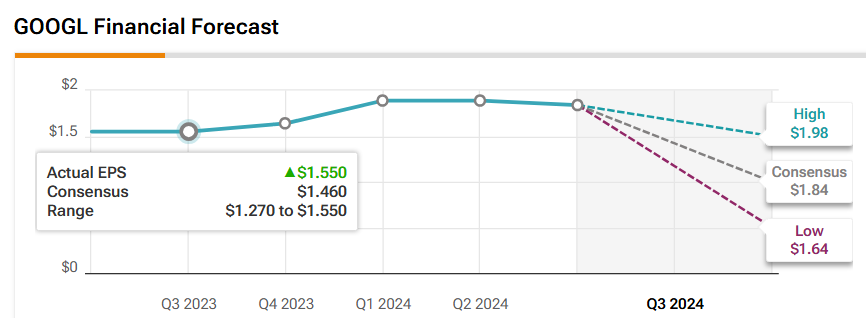

Alphabet (GOOGL) is set to announce its third-quarter earnings on October 29, 2024. Analysts on Wall Street are predicting a positive outlook, anticipating growth in both revenue and earnings for the technology giant. They expect earnings per share to hit $1.84, marking an 18% increase compared to last year. Additionally, revenue is projected to rise by 13% year-over-year, reaching $86 billion, as per data from TipRanks Forecast.

Notably, Alphabet has exceeded consensus earnings per share estimates for the past six quarters, showcasing its ability to perform consistently under challenging market conditions.

Analysts Share Mixed Views Ahead of Earnings

Using the TipRanks Bulls & Bears tool, analysts present varying perspectives on Alphabet as the earnings date approaches. The bullish analysts emphasize Alphabet’s growth prospects, citing the potential of generative AI to enhance monetization strategies in its search cloud segment. They predict that Google Cloud will see a robust 30% growth, highlighting the company’s strong position in the cloud sector. Additionally, Alphabet’s powerful foothold in digital advertising allows it to capitalize on emerging market trends and drive innovation via AI.

Conversely, the bearish analysts express concerns about Alphabet’s financial future. They point out potential risks related to rising capital expenditures, which could impact operating income and earnings per share in the upcoming quarters. Furthermore, competition remains fierce, especially with platforms like Amazon’s (AMZN) Prime Video and Netflix (NFLX) challenging YouTube. Regulatory scrutiny also lingers, as Google faces antitrust allegations that could threaten its market standing.

Options Traders Expect a 6.40% Movement

TipRanks’ Options tool offers insight into what options traders predict for Alphabet’s stock following the earnings announcement. By analyzing the at-the-money straddle, traders expect a potential price swing of 6.40% in either direction.

Should Investors Buy Alphabet Stock?

According to Wall Street analysts, Alphabet stock currently holds a consensus rating of Hold, with 19 Buy ratings and seven Hold ratings over the last three months. At its current price of $199.17, the average price target suggests a potential upside of 22.4% for investors.

See more GOOGL analyst ratings

Disclosure

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.