Hello, Reader.

With Halloween approaching, I have a critical question for you…

Trick or Treat?

Trick: Stock valuations in the United States are nearing record highs, and historically, stocks with high valuations often yield poor returns.

Treat: Cash can be a powerful tool when stock prices decline.

Given the current lofty valuations, I advise building up cash reserves strategically. This doesn’t mean liquidating your entire portfolio; instead, consider trimming positions or taking profits when stocks are performing well. The only way to have cash when prices are low is to accumulate it when prices are high.

One investor who exemplified the importance of cash and patience is Jean-Marie Eveillard. In the late 1990s, he managed the SoGen International Fund, which is now known as the First Eagle Global Fund.

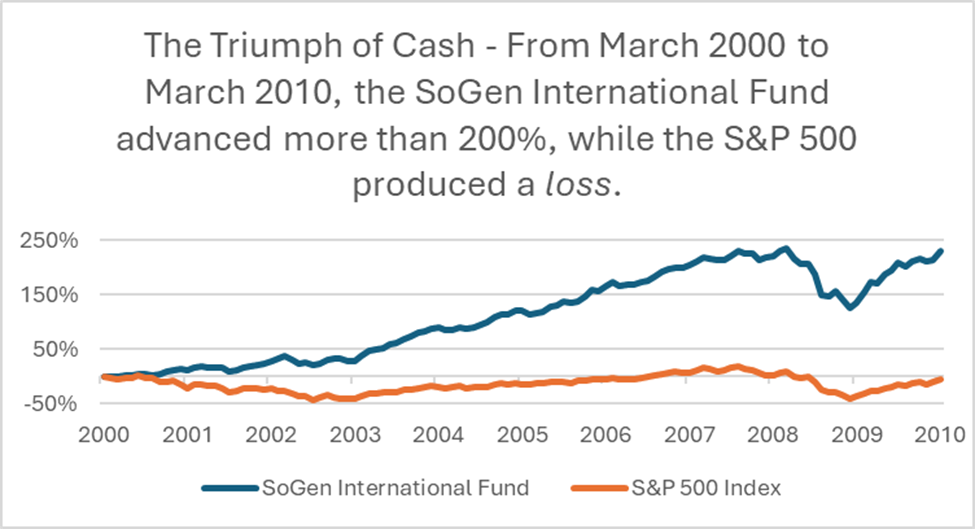

Eveillard had a remarkable record as an investor. However, during the dot-com bubble, while the broader market soared, his fund’s performance suffered. From 1997 to the end of 1999, the S&P 500 more than doubled, but the SoGen fund only increased by 29%. His significant cash allocation and focus on precious metals weighed down returns.

Many began to question his investment strategy, and some shareholders criticized his cautious approach, leading to withdrawals from his fund. But Eveillard remained steadfast. While others reveled in their stock gains, he focused on accumulating cash.

At the height of the bubble, he famously stated, “I’d rather lose half our shareholders than half our shareholders’ money.” This resolve cost him half of his investors, but proved wise in hindsight.

When the tech bubble burst, he did not suffer the same steep losses, unlike many who faced dire consequences.

Eveillard’s journey was challenging, and for three years, he navigated a tough market. His fund nearly shut down, but his cautious strategy ultimately triumphed.

From March 31, 2000, to March 31, 2010, the S&P 500 produced a negative return, while Eveillard’s fund saw its value more than triple during that same period, reinforcing the idea that cash is not merely a starting point for investment; it is valuable in itself.

This remarkable strategy allowed Eveillard to avoid suffering massive losses, positioning him for future gains instead. Cash becomes increasingly important as an investment, particularly in times of market distress.

To better understand this, we should change our perspective on investing. Instead of viewing stocks as specific amounts of money, consider that cash represents a specific quantity of stocks.

For instance, if I have a $100 bill and want to buy a $5 stock, “Stock X,” that bill can purchase 20 shares of Stock X (i.e., $100 divided by $5). If Stock X doubles in value to $10, that $100 is now worth only 10 shares of that stock. If it rises to $100, that $100 is just worth one share, meaning its value has diminished by 95% in share terms.

Conversely, when stocks decline, cash gains value. For example, if Stock X drops from $100 to $50, the value of the $100 bill effectively becomes worth two shares.

This illustrates that cash is not a passive asset; its value can increase as prices of other assets fall.

Cash stands as a crucial shield against capital loss. While it may not offer immediate visible returns, it helps retain your financial stability by mitigating risks.

An adequate cash reserve allows your portfolio to capitalize on attractive opportunities when they arise.

Now, let’s recap what we’ve covered this week at Smart Money…

Smart Money Roundup

Prepare for Possible Post-Election Market Shifts

As Election Day nears, the tension intensifies. Both political parties perceive the other not merely as an opposing choice but as a threat to the American identity. In this week’s Smart Money, Louis Navellier analyzes how the electoral drama may disrupt the stock market and offers insights on how investors can find opportunities amidst the turmoil.

Election 2024: Navigating Upcoming Uncertainty

The aftermath of the election raises significant concerns about deficit spending and unregulated artificial intelligence. Both parties agree on tax cuts yet neglect to address AI regulation and workforce protection. Thomas Yeung shares insights into this unpredictable landscape and provides tips on how to prepare before it’s too late.

Preparing for Post-Election Uncertainty: The Role of Gold

In a climate marked by uncertainty, gold shines as a reliable asset that can protect your investments. In Saturday’s Smart Money, Eric explores the historical connection between market instability and gold. He also discusses a robust trading system that turns market fluctuations into profitable ventures.

Market Reactions to Election Uncertainty

Last December, Louis Navellier predicted that President Joe Biden might withdraw from the presidential race. With Election Day approaching, he warns of potential market chaos. Whichever candidate wins, the challenges related to national spending will persist. Louis is positioned to guide investors on the best strategies to navigate these uncertain times.

Looking Ahead

Stay tuned for the next Smart Money update, where we will explore opportunities in AI along with other key trends.

The countdown to Election Day is on.

As colleague Louis Navellier notes, we are entering what he calls the Age of Chaos in America.

Fortunately, there’s still time to get prepared and navigate the upcoming turmoil.

Join Louis for his special “Day-After Summit” presentation tomorrow at 7 p.m. Eastern, where he’ll unveil a method to not only withstand post-election market changes but also to capitalize on them.

The system he will showcase has outperformed the S&P 500 by 6-to-1 in back-testing since 1990. Currently, of the 19 open trades using this system, 18 are profitable.

According to Louis, using this approach allows you to “potentially triple your investment in a matter of weeks while avoiding the substantial losses predicted from the forthcoming market reactions.”

Louis aims to help investors leverage these fluctuations for profit at his “Day-After Summit” tomorrow evening. He will also offer a complimentary post-election trade that is structured to benefit regardless of the election outcome.

Click here to reserve your spot.

Regards,

Eric Fry, Smart Money