Is Now the Right Time to Invest in Alphabet Inc. Stock?

Google’s parent company, Alphabet Inc (GOOGL), is set to release its third-quarter earnings results before trading starts on Tuesday. With the stock’s recent decline, many investors are wondering if it’s a good time to buy.

Fortunately, Alphabet’s advancements in artificial intelligence and diverse market presence are likely to lead to stable profits and potentially higher stock prices.

Anticipated Earnings Could Lift Share Prices

In the upcoming report, Alphabet is expected to post impressive third-quarter earnings for 2024. Analysts predict that the company will report earnings per share (EPS) of $1.83, up from $1.55 last year, reflecting an 18.1% increase.

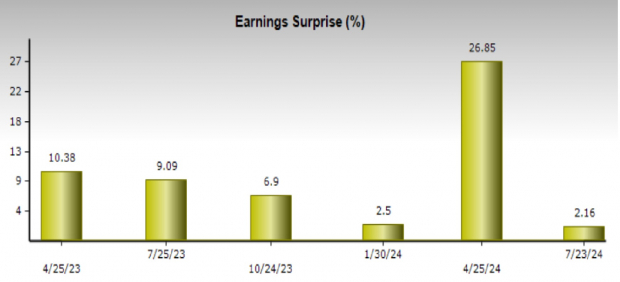

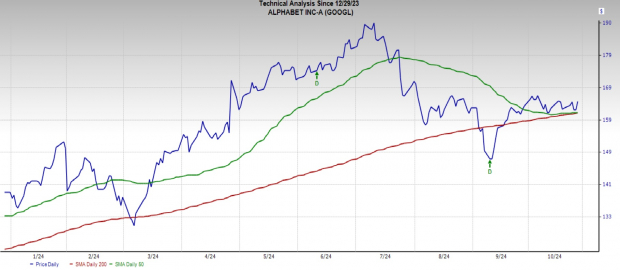

Additionally, Alphabet has a solid track record, boasting a 9.6% average earnings surprise over the last four quarters. This trend suggests the company has a good chance of posting earnings growth.

Image Source: Zacks Investment Research

Revenue is forecasted to reach $72.85 billion, a 13.7% increase from last year’s $64.05 billion. The surge in AI technology is expected to enhance Alphabet’s infrastructure and generative AI solutions, contributing positively to both revenue and earnings.

Moreover, the company’s ongoing share buyback program helps lower the number of outstanding shares, which can boost EPS significantly over time. The Zacks Consensus Estimate for EPS stands at $7.65, up 15.2% year-over-year.

Image Source: Zacks Investment Research

Strength in the Cloud Division

Although Alphabet’s cloud division faces competition from Microsoft Corporation (MSFT) and Amazon.com, Inc. (AMZN), it continues to thrive. The rising demand for AI products, which often require extensive cloud support, helped the cloud revenues grow 29% year-over-year, totaling $10.3 billion last quarter.

As Alphabet’s Gemini and large language models gain global traction, experts forecast the Google Cloud division could reach $100 billion in annual revenue over the next five years, leading to expanded profit margins.

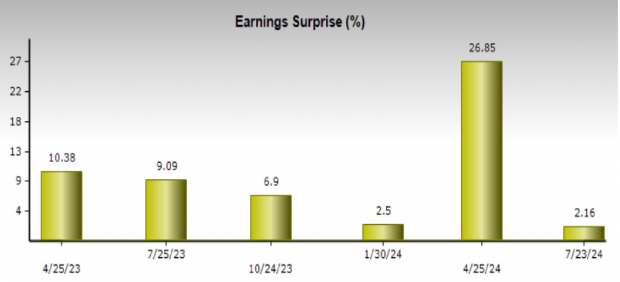

Currently, Alphabet’s net profit margin stands at 26.7%, slightly surpassing the industry average of 26.4%, showcasing effective expense management.

Image Source: Zacks Investment Research

Boost from Digital Ad Spending

Alphabet stands to benefit from the growth of the digital advertising sector. As a leading player in this market, with Google Search and YouTube each attracting over 2 billion monthly users, the company is well-positioned.

With AI innovations enhancing user experience, digital ad spending is expected to increase by 10% annually through 2028, according to eMarketer.

Monopoly in Search Engines

Alphabet maintains a dominant position in the search market, claiming over 90% of the market share. Although platforms like ChatGPT have gained traction, they haven’t diminished Alphabet’s stronghold.

This dominance allows Alphabet to leverage economies of scale in search, which solidifies its revenue, primarily driven by Google Search.

Growth Potential from Robotaxi Services

Another promising area for Alphabet is its subsidiary, Waymo LLC, which focuses on autonomous ride-hailing. Analysts predict remarkable growth in the robotaxi market, expected to rise by 67% annually through 2030.

Waymo plans to launch its ride-hailing service in Austin and Atlanta by next year, in partnership with Uber Technologies, Inc. (UBER). Analysts estimate Waymo’s revenues might hit $75 million this year, with more substantial growth in the future.

Why Now is a Good Time to Buy Alphabet Stock

With anticipated growth across AI, cloud services, digital advertising, search, and robotaxi markets, Alphabet is poised for consistent profitability and increasing share prices.

Market analysts have set a short-term average price target for GOOGL stock at $201.78, indicating a potential 24% upside from its last closing price of $162.72. Some forecasts even suggest a high target of $225, representing a 38.3% increase.

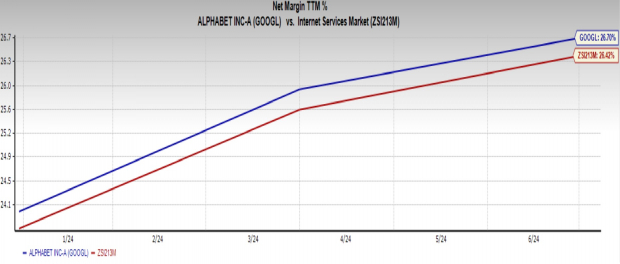

Image Source: Zacks Investment Research

Furthermore, GOOGL stock is currently trading above the 50-day and 200-day moving averages, indicating a bullish trend—a signal that it may be an opportune time to buy.

Image Source: Zacks Investment Research

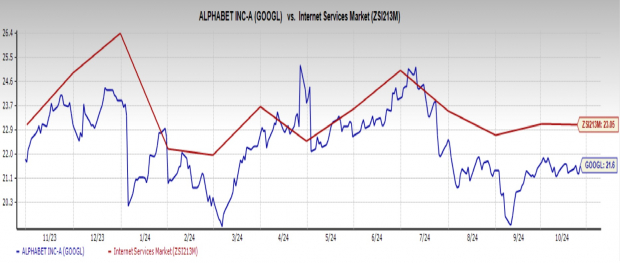

Trading at 21.6 times forward earnings, GOOGL is priced lower than the industry’s average of 23.0 times forward earnings, making it an attractive buy.

Image Source: Zacks Investment Research

Currently, GOOGL holds a Zacks Rank of #2 (Buy), reflecting positive analyst sentiments.

Exclusive Offer for Stock Recommendations

We’re serious about our deals.

Several years ago, we surprised our members by offering a 30-day access pass to our stock picks for just $1. There’s no obligation to spend more.

Thousands have seized this chance, while many others assumed there must be a catch. Our intention is simply to showcase our portfolio services, including Surprise Trader, Stocks Under $10, Technology Innovators, and more, which recorded 228 positions with double- and triple-digit gains in 2023 alone.

Want the latest stock recommendations? Download “5 Stocks Set to Double” for free!

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Bank of America Corporation (BAC): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Uber Technologies, Inc. (UBER): Free Stock Analysis Report

For the full article, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.