“`html

Understanding Today’s Unusual Market Dynamics and Future Predictions

How often have both gold and the S&P 500 risen 25% in the same year?

Never.

The SPY is up around 24% this year, while gold has gained 33%.

These insights come from quant investor and Cambria Investment Management CIO Meb Faber, highlighting a crucial point about the current market conditions.

While you may be enjoying positive returns in your portfolio this year, it’s vital to recognize the strange nature of the current market situation. Today, let’s explore some of these anomalies to understand how unusual the landscape has become.

Conflicting Trends in Market Behavior

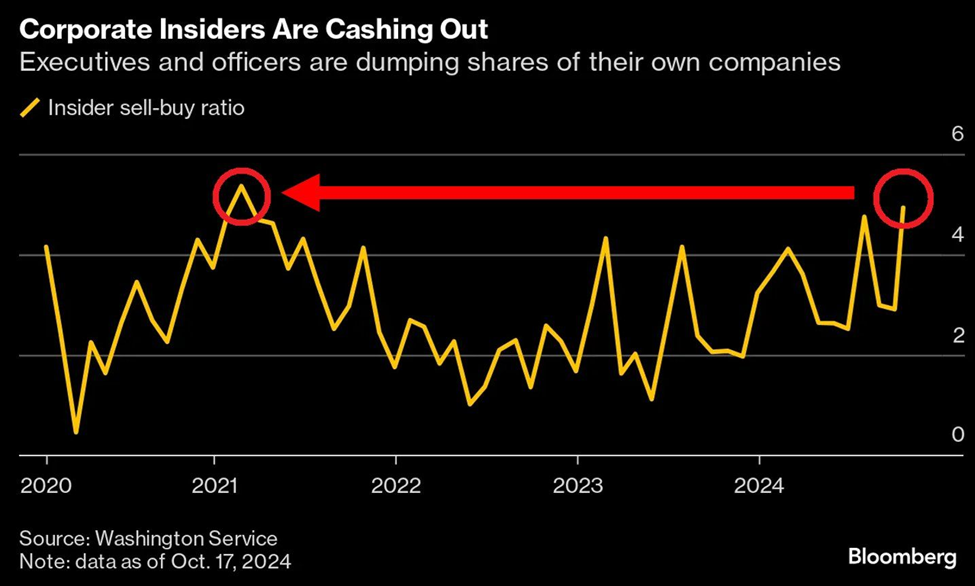

U.S. executives are increasingly selling their shares. The insider “sell-to-buy” ratio has now reached its highest mark since 2021.

Source: Global Markets Investor, Bloomberg

This trend raises questions about executives’ confidence in their companies’ futures.

Conversely, in October, hedge funds have ramped up their buying of U.S. stocks at a pace not seen in 2024.

Source: Barchart

Valuation Concerns and Cash Reserves

Recent evaluations show that U.S. stocks are currently at their highest overvaluation recorded, according to the “Buffett Indicator.” This indicator assesses the market capitalization of a country’s stock market against its Gross Domestic Product (GDP), helping to reveal whether a market is overpriced or considered a good deal.

Warren Buffett has previously warned that if this ratio approaches 200%, investors should be cautious.

As per Barchart, this indicator has reached 199%, surpassing levels seen during the Dot Com Bubble and the Global Financial Crisis.

Furthermore, Global Markets Investor reports that the S&P’s price to book ratio stands at 5.2X, also a record high, reflecting concern similar to that experienced at the burst of the Dot-Com bubble.

Even without the “Magnificent Seven” stocks, the price-to-book ratio sits at 4.2X, indicating an alarming trend.

Source: StealthQE4 (@QE Infinity) on X, JP Morgan

As we analyze available cash, some investors argue that “cash on the sidelines” will support this ongoing bull market. However, current levels of cash in relation to the total market capitalization are not significant enough to serve as a strong bullish factor moving forward.

Charles-Henry Monchau, CIO at the Syz Group, highlights a concerning trend: cash allocations are lower now than at the peaks of previous tech and housing bubbles. He poses a critical question: if everyone is fully invested, where will new money come from to drive the market higher?

“`

Global Tensions Rise Ahead of U.S. Presidential Election: Are Investors Prepared?

Unusual Developments from the BRICS Summit

Although it didn’t dominate the news, the recent BRICS summit in Kazan, Russia, raised eyebrows. This group, which started with Brazil, Russia, India, China, and South Africa, now includes Iran, Egypt, Ethiopia, the United Arab Emirates, and Saudi Arabia. Additional nations like Turkey, Azerbaijan, and Malaysia have also expressed interest in joining.

What makes this significant? Chinese President Xi Jinping’s declaration emphasized the need for the BRICS to create a new global financial system, a clear challenge to the dominance of the U.S. dollar.

Jinping stated:

“There is an urgent need to reform the international financial architecture, and BRICS must play a leading role in promoting a new system that better reflects the profound changes in the international economic balance of power.”

According to AP News, Russia is advocating for an alternative payment system to the global SWIFT network, aiming to bypass Western sanctions and facilitate trade with allies.

Summit attendees heard from Russian President Vladimir Putin, who accused the U.S. of misusing the dollar, calling it a significant error.

In a related context, JPMorgan CEO Jamie Dimon warns that we may already be amidst World War III. He noted the conflicts in Ukraine and the Middle East, along with the increasing collaboration among U.S. adversaries like Russia, China, North Korea, and Iran.

Dimon commented:

“The risk is extraordinary… you already have battles on the ground being coordinated in multiple countries.”

Implications of the Upcoming U.S. Presidential Election

As the election approaches, Vice President Kamala Harris and former President Donald Trump are neck and neck in the polls. Partisan entries often sway economic forecasts, but both candidates may worsen the national debt and fiscal deficit, making the debate over who is worse feel trivial.

High-profile investors, regardless of which candidate emerges victorious, express increasing worries about the nation’s debt. Billionaire hedge fund manager Paul Tudor Jones highlights concerns regarding the U.S. fiscal deficit and potential overspending post-election.

Jones stated to CNBC:

“We’re going to be broke really quickly unless we get serious about dealing with our spending issues.”

He cautioned that rampant government spending could trigger a significant sell-off in the bond market, resulting in soaring interest rates.

Jones effectively raised a critical question: will the United States experience a “Minsky moment,” where recognition of the unsustainable fiscal path leads to a sharp drop in asset prices?

Investors Should Brace for Challenges

This sentiment resonates with seasoned investors like Louis Navellier and geopolitical strategist Charles Sizemore, who suggest many investors are ill-prepared for potential volatility.

Navellier noted:

“Most folks are simply preparing for a repeat of the contested election results of 2020. The truth is unlike anything you’re prepared for…”

As uncertainty looms, they predict turmoil in the stock market immediately following the election.

To better equip investors, Louis and Charles will conduct a session titled “The Day After” tomorrow at 7 PM ET, discussing strategies to navigate post-election volatility.

Market Overview: A Bull Market with Caution

Despite enjoying a strong bull market, it’s important to acknowledge the unique challenges confronting investors today. Factors like record-high stock valuations, geopolitical risks, and potential election turmoil suggest that volatility may be on the horizon. Having a solid plan to safeguard wealth is crucial in these uncertain times.

Best wishes,

Jeff Remsburg