Macquarie Boosts NIO’s Outlook with Promising Price Forecast

Fintel reports that on October 28, 2024, Macquarie upgraded their outlook for NIO (SEHK: 9866) from Neutral to Outperform.

Analysts See Significant Upside Potential

As of October 22, 2024, the average one-year price target for NIO is HK$58.74 per share, suggesting a potential rise of 41.36% from its latest closing price of HK$41.55 per share. The forecasts vary widely, with estimates ranging from a low of HK$30.92 to a high of HK$152.68.

Strong Revenue Growth Expected

NIO’s projected annual revenue stands at HK$124,935 million, indicating an impressive increase of 96.67%. However, the anticipated annual non-GAAP EPS is -0.47.

Fund Sentiment and Institutional Holdings

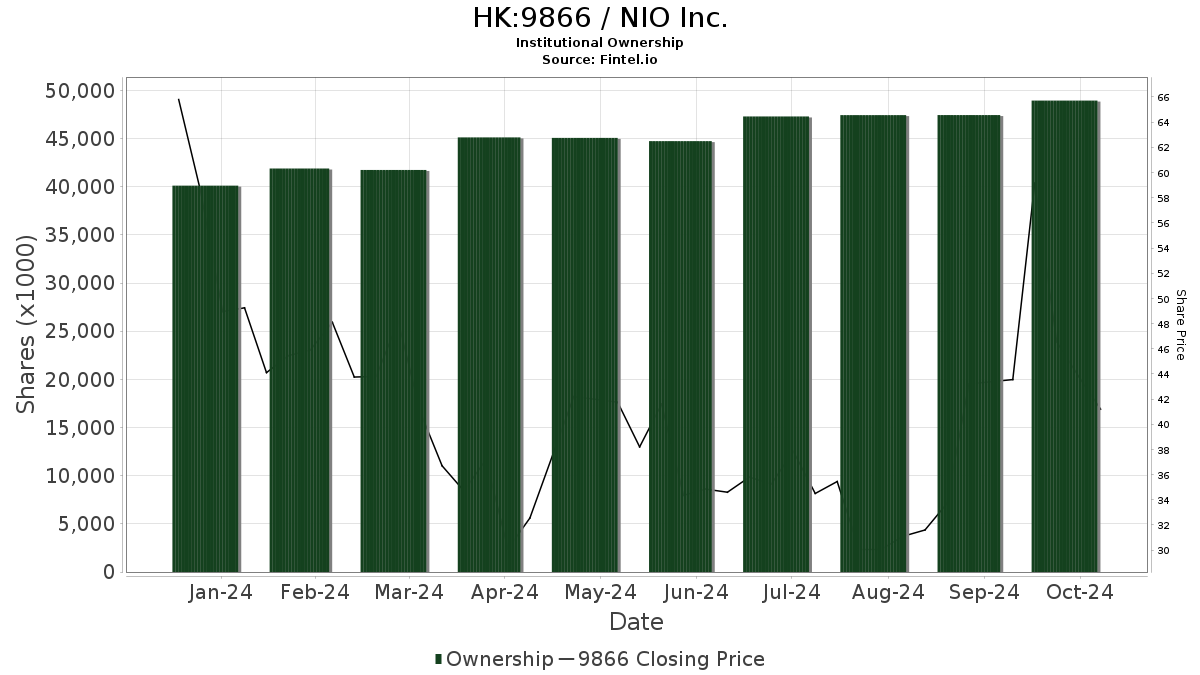

Currently, 36 funds or institutions are holding positions in NIO, showing a decrease of 1 owner or 2.70% over the last quarter. The average portfolio weight for these funds in NIO is 0.27%, which has increased by 21.84%. Additionally, total shares owned by institutions have risen by 5.19% in the past three months, now totaling 49,892K shares.

Institutional Shareholders’ Movements

Among the notable institutional stakeholders:

- VGTSX – Vanguard Total International Stock Index Fund Investor Shares: Holds 18,700K shares (0.96% ownership), up 3.78% from 17,994K shares. However, its portfolio allocation in NIO decreased by 7.57% last quarter.

- VEIEX – Vanguard Emerging Markets Stock Index Fund Investor Shares: Owns 17,429K shares (0.89% ownership), up 0.80% from 17,290K shares, yet reduced its portfolio allocation in NIO by 8.20% last quarter.

- VEU – Vanguard FTSE All-World ex-US Index Fund ETF Shares: Holds 2,627K shares (0.13% ownership), reflecting a minor increase of 0.51% from 2,614K shares, with a portfolio allocation drop of 8.43% last quarter.

- XT – iShares Exponential Technologies ETF: Holds 2,115K shares (0.11% ownership), down 1.05% from 2,137K shares, with an 11.66% portfolio allocation decrease.

- IDRV – iShares Self-Driving EV and Tech ETF: Owns 1,739K shares (0.09% ownership), representing a significant increase of 15.86% from 1,464K shares, and boosted its portfolio allocation in NIO by 27.84% last quarter.

Fintel is a leading platform providing comprehensive investment research tailored for individual investors, traders, financial advisors, and small hedge funds. Their data encompasses global fundamentals, analyst reports, ownership data, fund sentiment, insider trading, and more.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.