Wells Fargo Adjusts Aon’s Outlook to Equal-Weight

Aon sees slight decline in projected price targets despite institutional interest.

Fintel reports that on October 28, 2024, Wells Fargo upgraded their outlook for Aon (LSE:0XHL) from Underweight to Equal-Weight.

Projected Price Target and Revenue Drop

As of October 22, 2024, the average one-year price target for Aon stands at 367.43 GBX/share. Forecasts vary, with a low of 318.40 GBX and a high of 453.95 GBX. This average target suggests a decrease of 2.71% from its last closing price of 377.66 GBX/share.

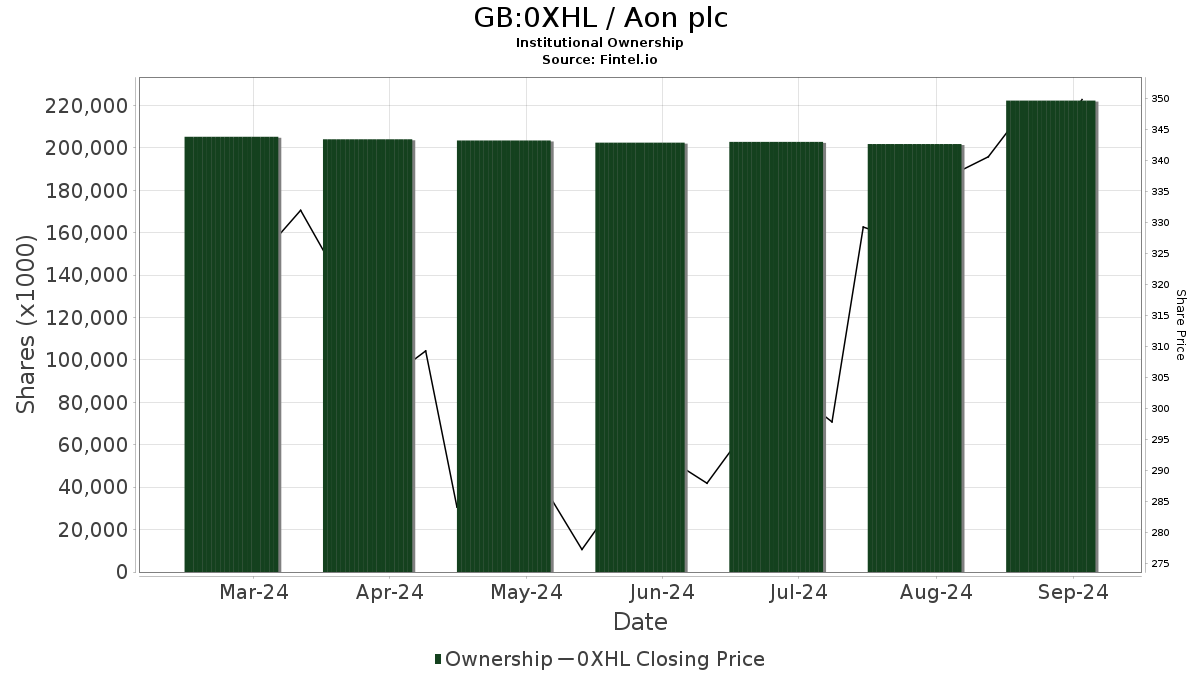

Institutions Show Increased Interest

The projected annual revenue for Aon is expected to reach 14,053MM, reflecting a decrease of 5.85%. The estimated annual non-GAAP earnings per share (EPS) is 16.39.

Fund Ownership Trends

There are 1,925 funds or institutions reporting positions in Aon, a rise of 66 holders or 3.55% compared to the previous quarter. The average portfolio weight of all funds in Aon is now 0.49%, marking a 25.07% increase. Total shares owned by institutions have risen by 14.14% to 222,504K shares.

Institutional Investors’ Shareholdings

Massachusetts Financial Services has 12,553K shares, equating to 5.80% ownership. This marks an increase from the 12,243K shares they owned previously, although their portfolio allocation in Aon has decreased by 85.75% over the last quarter.

Capital World Investors owns 12,037K shares, or 5.57% of Aon, a notable increase from 9,747K shares previously, reflecting a 19.03% rise in holdings and a 7.04% increase in their portfolio allocation.

Vanguard Total Stock Market Index Fund Investor Shares holds 6,533K shares, making up 3.02% of the company. This represents a 9.23% increase from 5,930K shares reported earlier, though they have reduced their allocation by 5.76% recently.

Meanwhile, Vanguard 500 Index Fund Investor Shares has 5,581K shares, or 2.58% ownership, showing a 9.59% growth from the prior 5,046K shares, despite a 7.89% drop in portfolio allocation.

Mawer Investment Management reports 4,406K shares, accounting for 2.04% ownership, with a slight increase from 4,354K shares, even as their allocation fell by 9.20% in the last quarter.

Fintel is a well-regarded investing research platform offering insights for individual investors, traders, and financial advisors.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.