Dover Corp. Receives Boost from Wolfe Research: Analysts Predict Growth Ahead

Fintel reports that on October 28, 2024, Wolfe Research upgraded their outlook for Dover (NYSE:DOV) from Peer Perform to Outperform.

Analysts See Potential for Significant Price Increase

As of October 21, 2024, the average one-year price target for Dover is $210.83 per share. The forecasts range from a low of $185.84 to a high of $237.30. This average price target represents a 9.54% increase from its latest recorded closing price of $192.47 per share.

See our leaderboard of companies with the largest price target upside.

Revenue and Earnings Projections

The projected annual revenue for Dover is $9,054 million, reflecting an increase of 6.84%. Additionally, the expected annual non-GAAP EPS is 9.88.

Fund Sentiment: An Overview

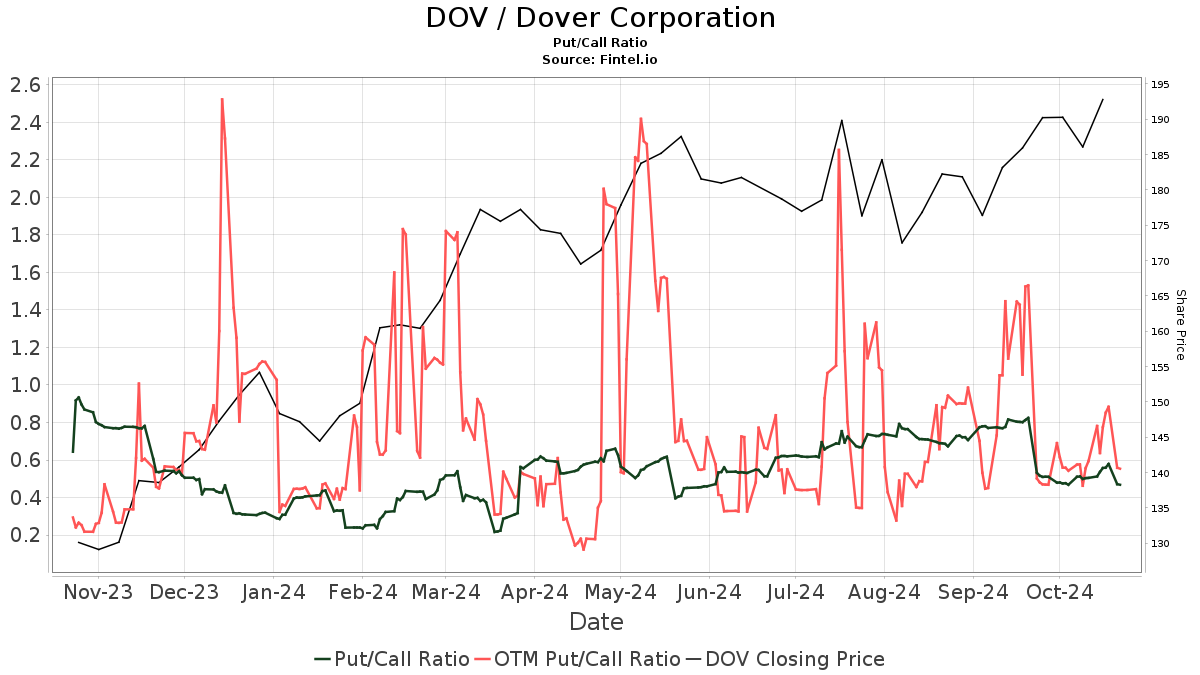

Currently, there are 1,692 funds or institutions reporting positions in Dover, an increase of 64 owners, or 3.93%, in the last quarter. The average portfolio weight of all funds dedicated to DOV is 0.22%, which is an upturn of 0.75%. Total shares owned by institutions rose by 0.59% in the past three months, amounting to 140,288K shares.  The current put/call ratio for DOV stands at 0.54, indicating a bullish outlook from the market.

The current put/call ratio for DOV stands at 0.54, indicating a bullish outlook from the market.

Key Institutional Holders and Their Moves

JPMorgan Chase holds 10,852K shares, which represents 7.91% ownership of the company. However, the firm reported a decrease in shares from 13,152K, marking a significant reduction of 21.19%. Accordingly, the firm lowered its portfolio allocation in DOV by 87.22% over the last quarter.

In contrast, Price T Rowe Associates increased its stake to 5,253K shares, representing 3.83% ownership, up from 2,633K shares, reflecting a substantial rise of 49.87%. This resulted in an 98.33% increase in their portfolio allocation in DOV over the last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares owns 4,334K shares, accounting for 3.16% ownership, slightly decreasing from 4,391K shares by 1.31% over the last quarter.

Franklin Resources holds 4,160K shares, equal to 3.03% ownership; this is down from 4,287K shares, marking a decline of 3.05%. This organization also reduced its portfolio allocation in DOV by 83.95% in the last quarter.

HLIEX – JPMorgan Equity Income Fund Class I has 3,977K shares, representing a 2.90% stake. This is down from 4,628K shares, a decrease of 16.35%, reflecting a 7.12% drop in portfolio allocation during the last quarter.

Understanding Dover Corporation

Dover Background Information

(This description is provided by the company.)

Headquartered in Downers Grove, Illinois, Dover Corporation is a global manufacturer and solutions provider with annual revenue approaching $7 billion. The company offers a wide range of innovative equipment and components, consumable supplies, aftermarket parts, software and digital solutions, and various support services through five operational segments: Engineered Products, Fueling Solutions, Imaging & Identification, Pumps & Process Solutions, and Refrigeration & Food Equipment. With a rich history of over 60 years, the organization engages a dedicated team of more than 23,000 employees who work collaboratively with customers to redefine industry standards.

Fintel is recognized as one of the most comprehensive investing research platforms, catering to individual investors, traders, financial advisors, and small hedge funds.

Our data is extensive and covers global fundamentals, analyst reports, ownership data, fund sentiment, insider trading, and much more. In addition, our unique stock picks are based on advanced backtested quantitative models designed to enhance profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.