Kellanova Faces Declining Earnings Ahead of Q3 2024 Report

Kellanova K is expected to report slumps in both revenue and earnings when it releases its third-quarter 2024 earnings on Oct. 31. Analysts predict revenues will drop to $3.2 billion, nearly 20% lower than the same period last year. The Zacks Consensus Estimate for quarterly earnings stands at 85 cents per share, unchanged over the last month, marking a 17.5% decline from last year’s figures. Kellanova, formerly known as Kellogg Company, has averaged a 12.4% earnings surprise over its last four reported quarters.

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

Factors Impacting Kellanova’s Performance

Kellanova is grappling with significant economic pressures that are affecting consumer spending. Rising inflation and increased input costs have squeezed the company’s profitability. Additionally, it faces industry-wide challenges, which are dampening demand for popular products like snacks and cereals. The company’s global footprint leaves it vulnerable to fluctuations in currency exchange rates. These challenges likely impacted Kellanova’s performance in the upcoming quarter.

To counteract these difficulties, Kellanova is introducing new products and investing in key brands. The company is also implementing cost-saving strategies aimed at improving its profitability and efficiency. These efforts may provide some relief during the third quarter.

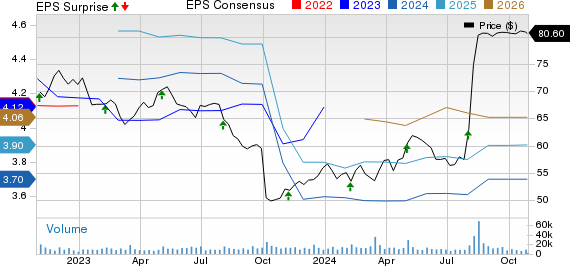

Kellanova Price, Consensus and EPS Surprise

Kellanova price-consensus-eps-surprise-chart | Kellanova Quote

Earnings Predictions for Kellanova

Kellanova’s chances for an earnings beat are unclear this time. A successful earnings prediction requires a positive Earnings ESP along with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold), which is not currently the case. Kellanova has a Zacks Rank of #2 and an Earnings ESP of 0.00%.

Other Stocks with Promising Earnings Potential

Investors might consider the following companies that show promising potential for an earnings beat:

US Foods Holding Corp. USFD has an Earnings ESP of +0.69% and a Zacks Rank of #3. The company is expected to report a profit increase, with a quarterly earnings estimate of 82 cents per share, reflecting a 17.1% rise from last year. Additionally, revenues are projected to grow to $9.7 billion, up 6.6% year over year.

Mondelez International MDLZ brings an Earnings ESP of +0.82% along with a Zacks Rank of #3. The company is likely to showcase revenue growth with an estimated $9.1 billion, indicating a 0.5% increase year on year. Earnings are expected to be 84 cents per share, which reflects a 2.4% rise compared to the previous year.

Performance Food Group Company PFGC, which holds an Earnings ESP of +0.33% and Zacks Rank #3, is forecasted to report fiscal 2025 first-quarter earnings of $1.22, which marks a 6.1% year-over-year increase. Its estimated revenues are set to reach $15.3 billion, up 2.7% from last year’s figures.

Expert Insights on Top Stock Picks

Recently, five Zacks experts selected their top stock that could double in value soon. Among these, Director of Research Sheraz Mian identified one with the greatest upside. Targeting millennial and Gen Z markets, this company generated almost $1 billion in revenue last quarter. Recent market dips present a potentially lucrative opportunity for investors. While not every selection will thrive, this one has the potential to exceed previous highs from stocks like Nano-X Imaging, which surged +129.6% within nine months.

Free: See Our Top Stock And 4 Runners Up

Kellanova (K) : Free Stock Analysis Report

Mondelez International, Inc. (MDLZ) : Free Stock Analysis Report

Performance Food Group Company (PFGC) : Free Stock Analysis Report

US Foods Holding Corp. (USFD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.