Applied Digital Corporation: Strong Growth and Promising Future

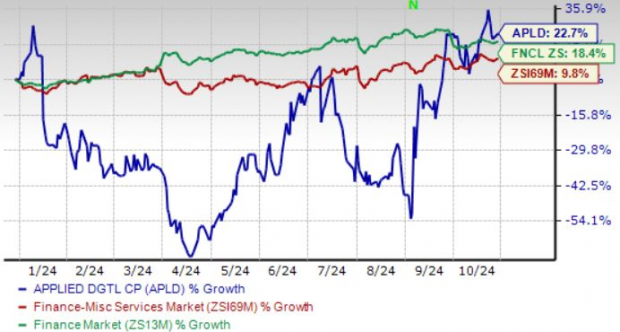

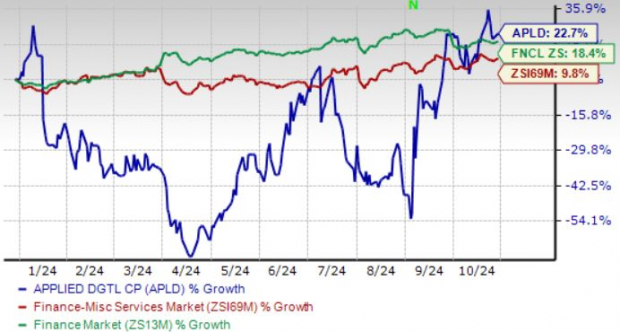

Applied Digital Corporation (APLD) has seen its shares rise 22.7% this year, surpassing the Finance sector’s return of 18.4% and the Zacks Financial Miscellaneous Services industry’s growth of 9.8%.

This company designs, builds, and operates advanced digital infrastructure tailored for high-performance computing, cloud services, and data center hosting. Its strong revenue growth is a key factor behind its recent success.

In the first quarter of fiscal 2025, Applied Digital’s revenues surged 67% compared to the previous year, reaching $60.7 million. This rise primarily stemmed from robust Cloud Services contracts, with the Data Center hosting segment contributing $34.8 million and the Cloud Services segment adding $25.9 million.

Impressive Year-to-Date Performance

Image Source: Zacks Investment Research

Expansion of Data Center Capacity Supports Growth

Applied Digital is nearing a lease agreement with a U.S.-based hyperscaler for a 100 MW facility currently under construction. This facility, over 369,000 square feet, is designed for high-performance computing (HPC) applications, including AI technologies.

Additionally, APLD is working on designs for two more buildings at this site to increase total capacity to 400 MW.

The company’s Data Center Hosting Business operates facilities that provide space to crypto mining customers. By August 31, 2024, APLD’s 106 MW facility in Jamestown, ND, and its 180 MW facility in Ellendale, ND, were operating at full capacity.

Applied Digital plans to monetize its more than 1.4 gigawatt pipeline, with expectations to deploy additional clusters in the second half of fiscal 2025, starting December 1.

Having a strong partner network is beneficial; APLD collaborates with NVIDIA (NVDA), Super Micro Computer, Hewlett Packard (HPE), and Dell Technologies (DELL). As part of its partnership with Hewlett Packard, the latter supplies powerful, energy-efficient supercomputers through APLD’s cloud services, alongside a supply agreement with Dell for AI and GPU servers.

Strong Balance Sheet Enhances Future Prospects

APLD’s financial outlook is bolstered by improving liquidity. On September 5, 2024, the company secured a $160 million private placement from institutional and accredited investors, including NVIDIA.

As of the end of the first quarter in fiscal 2025, APLD maintained $86.6 million in cash, cash equivalents, and restricted cash, a significant increase from $31.7 million at the close of fiscal 2024. Its debt was $143.6 million, compared to $125.4 million one year prior.

Positive Revenue Estimates for APLD

The Zacks Consensus Estimate forecasts fiscal 2025 revenues at $270.77 million, reflecting a year-over-year growth of 63.54%. The estimated loss is now expected to be 69 cents per share, showing notable improvement from a loss of $1.12 just a month earlier and from a loss of $1.31 reported in the same quarter last year.

For the second quarter of fiscal 2025, the revenue estimate stands at $63.65 million with a year-over-year growth of 50.83%. The loss estimate has improved to 20 cents per share, compared to the previous 34 cents and a loss of 10 cents per share in the prior year.

Applied Digital Corporation Price and Consensus

Applied Digital Corporation price-consensus-chart | Applied Digital Corporation Quote

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

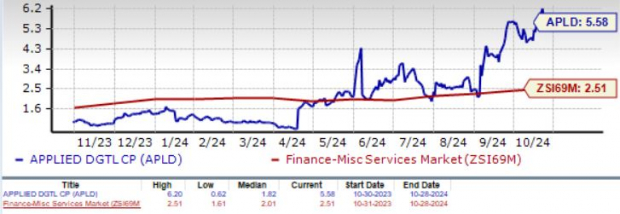

APLD Shares Trade at a Premium Valuation

Currently, APLD stock is considered a bit expensive. Its Value Score of F suggests a stretched valuation. The forward 12-month Price/Sales (P/S) ratio is 5.58X, significantly exceeding its median of 1.82X and the industry’s 2.51X.

Price/Sales Ratio (F12M)

Image Source: Zacks Investment Research

What Should Investors Consider Regarding APLD Shares?

The expansion of Applied Digital’s data center capacity is promising for future growth, suggesting that current shareholders can look forward to potential long-term rewards. However, the company’s stretched valuation raises concerns. Increased expenses related to leasing data center space could be a challenge for future profitability.

Currently, APLD holds a Zacks Rank #3 (Hold), indicating that investors may prefer to wait for a more favorable entry point to purchase shares.

You can examine the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Research Chief Names “Single Best Pick to Double”

Out of thousands of stocks, five Zacks experts have selected their favorites likely to rise by 100% or more in the coming months. From this pool, Sheraz Mian, the Director of Research, identifies one stock with the strongest upside potential.

This company targets millennial and Gen Z audiences, having generated nearly $1 billion in revenue last quarter. A recent dip in share price presents an opportune moment for investment. While not every top pick succeeds, this particular stock could far exceed earlier successful Zacks selections, such as Nano-X Imaging, which increased by +129.6% in just over nine months.

Get the latest recommendations from Zacks Investment Research! Today, download our guide on 5 Stocks Set to Double for free.

Dell Technologies Inc. (DELL): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE): Free Stock Analysis Report

Applied Digital Corporation (APLD): Free Stock Analysis Report

To access this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.