Analysts See Growth Potential for First Trust Large Cap Value ETF

Recent assessments reveal significant upside for specific stocks within the First Trust Large Cap Value AlphaDEX Fund ETF (Symbol: FTA). This analysis encompasses the ETF’s underlying holdings and their projected target prices set by analysts.

The implied analyst target price for FTA is pegged at $88.28 per unit, indicating a substantial difference compared to its current trading price of $78.29. This suggests that analysts anticipate a 12.76% rise for the ETF based on the average target prices of the companies it holds. Key performers include Horton Inc (Symbol: DHI), SS&C Technologies Holdings Inc (Symbol: SSNC), and Reinsurance Group of America, Inc. (Symbol: RGA).

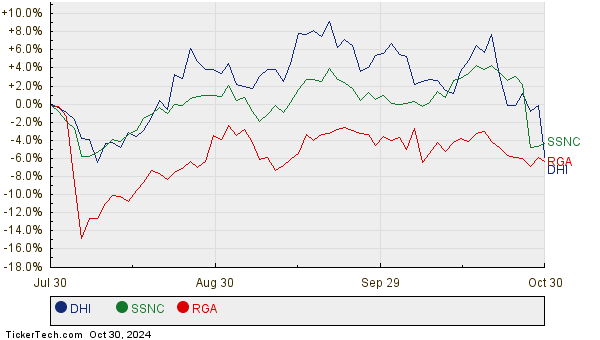

Horton Inc is currently valued at $167.32 per share, with an impressive average analyst target of $197.36, reflecting a 17.95% potential increase. Similarly, SS&C Technologies, trading at $70.45, has a target price of $82.11—suggesting a 16.55% upside. Meanwhile, RGA’s price of $211.43 is 15.70% short of its target of $244.62. Below is a twelve-month price history chart displaying the performance of these stocks:

For quick reference, here is a summary of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| First Trust Large Cap Value AlphaDEX Fund ETF | FTA | $78.29 | $88.28 | 12.76% |

| Horton Inc | DHI | $167.32 | $197.36 | 17.95% |

| SS&C Technologies Holdings Inc | SSNC | $70.45 | $82.11 | 16.55% |

| Reinsurance Group of America, Inc. | RGA | $211.43 | $244.62 | 15.70% |

As investors consider these targets, key questions arise. Are analysts accurately forecasting future prices, or are they overly optimistic? Understanding whether these projections are based on sound reasoning or outdated insights is vital for making informed investment decisions. Investors are encouraged to conduct further research to clarify these uncertainties.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

● FLYX Videos

● Top Ten Hedge Funds Holding KBLM

● PHD Historical Stock Prices

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.