Target Corporation Braces for Q3 Earnings Report Amid Market Challenges

Minneapolis-based Target Corporation (TGT) is a well-known retailer that operates a network of general merchandise stores and online businesses. Trailing a market cap of $68.8 billion, the company offers a mix of general merchandise and food discount items, along with branded credit cards for qualified customers. Target is set to release its fiscal third-quarter earnings for 2024 on Wednesday, November 20.

Analysts Expect Positive Q3 Results

In the upcoming report, analysts predict TGT will post a profit of $2.28 per share on a diluted basis, indicating an 8.6% increase from $2.10 per share in the same quarter last year. The company has surpassed consensus estimates in three of the last four quarters but fell short in one occasion.

Full-Year Earnings Projections

Looking ahead, analysts forecast TGT’s full-year earnings per share (EPS) to reach $9.53, reflecting a 6.6% increase from $8.94 in fiscal 2024. Furthermore, EPS is anticipated to rise by 10.8% year over year, reaching $10.56 in fiscal 2026.

Target’s Stock Performance

Over the past year, TGT shares have seen a 38% growth, lagging behind the S&P 500’s 41.7% rise but outperforming the Consumer Staples Select Sector SPDR Fund’s (XLP) 20.8% gains.

Challenges Facing Target

Target’s recent struggles largely stem from consumer behavior shifts as shoppers increasingly prioritize budget-friendly options. This trend may lead to a decline in demand for non-essential items. Additionally, mismanagement of inventory has affected the company’s gross margin and overall profitability. Concerns regarding consumer spending, inflated inventory, and rising inflation create further uncertainty for Target, which heavily relies on consumer purchases and is vulnerable to economic fluctuations.

Latest Q2 Performance and Future Expectations

After a positive Q2 earnings report on August 21, where revenue grew 2.6% year-on-year to $25 billion and adjusted EPS reached $2.57, TGT shares jumped over 10%. For Q3, the company forecasts adjusted EPS between $2.10 and $2.40, with anticipated full-year adjusted EPS ranging from $9 to $9.70.

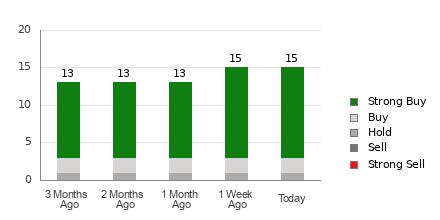

Analysts’ Ratings and Price Target

The consensus among analysts for TGT stock leans toward a “Moderate Buy.” Out of 33 analysts covering the stock, 17 recommend a “Strong Buy,” three suggest a “Moderate Buy,” 12 opt for a “Hold,” and one rates it as a “Strong Sell.” The average analyst price target stands at $177.28, representing a potential upside of 19.8% from current prices.

More Stock Market News from Barchart

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.