PayPal Surprises with Strong Q3 Earnings and Raises 2024 Guidance

PayPal Holdings PYPL delivered an impressive third-quarter 2024, posting non-GAAP earnings of $1.20 per share, exceeding the Zacks Consensus Estimate by 11.11% and demonstrating a solid 22.4% increase compared to the previous year.

The company has now exceeded earnings estimates in each of the last four quarters, highlighting its consistent performance.

Discover the latest EPS estimates and surprises on Zacks Earnings Calendar.

Net revenues reached $7.847 billion, a 6% rise year-over-year, matching this growth on both reported and forex-neutral bases. Nonetheless, it fell short of the consensus estimate by 0.20%.

Transaction margin climbed to $3.7 billion, an increase of more than 8% on a reported basis, and over 6% when excluding interest on customer balances. This growth was fueled by higher interest income, branded checkout services, Venmo, Braintree, and improvements in technology-led risk management strategies.

PayPal Holdings, Inc. Price, Consensus and EPS Surprise

PayPal Holdings, Inc. price-consensus-eps-surprise-chart | PayPal Holdings, Inc. Quote

Following this robust quarterly performance, PYPL updated its 2024 non-GAAP earnings guidance upward, a positive signal for investors. Year to date, PayPal’s shares have increased by 28.2%, outpacing the Zacks Computer & Technology sector’s growth of 27.6%.

PYPL Outperforms Sector in YTD

Image Source: Zacks Investment Research

Before exploring PYPL’s potential for investors, let’s take a closer look at its latest quarterly performance.

PYPL’s Revenues Benefit from Increased Payment Volume

The total payment volume for the reported quarter was $422.641 billion, marking a 9% increase year-over-year, on both a spot-rate and forex-neutral basis. This figure also surpassed the Zacks Consensus Estimate by 0.31%.

Transaction revenues totaled $7.067 billion, accounting for 90.1% of net revenues and showing a year-over-year increase of 6.2%. Meanwhile, Value-Added Services revenues reached $780 million (9.9% of net revenues), reflecting a year-over-year rise of 2.1%.

U.S. revenues grew by 6% year-over-year to $4.518 billion, representing 58% of total net revenues. International revenues came in at $3.329 billion, a 5% year-over-year increase on a reported basis and 6% on a forex-neutral basis.

PayPal also reported a 1% year-over-year growth in total active accounts, reaching 432 million and exceeding the Zacks Consensus Estimate by 0.48%.

Although the total number of payment transactions hit 6.631 billion—up 6% compared to the previous year—it missed the consensus estimate by 4.22%.

With 61.4 million payment transactions per active account, the figure increased by 9% from a year ago.

Operating expenses for PayPal amounted to $6.456 billion in the third quarter, a rise of 3.3% year-over-year. Notably, as a percentage of net revenues, operating expenses dropped by 200 basis points to 82.3%.

The transaction expense rate decreased to 0.91% from 0.93% in the year-ago quarter, contributing to a transaction margin improvement of 120 basis points to 46.6%. Meanwhile, the non-GAAP operating margin expanded by 200 basis points year-over-year to 19%.

Strong Balance Sheet for PYPL

As of September 30, 2024, PayPal reported cash, cash equivalents, and investments totaling $16.2 billion, alongside a long-term debt balance of $9.976 billion.

The company generated $1.614 billion in cash from operations, with free cash flow reaching $1.54 billion in the third quarter.

During this period, PayPal returned $1.8 billion to shareholders through share repurchases.

PayPal Ups Its FY24 Earnings Outlook

For the fiscal year 2024, PayPal expects non-GAAP earnings to grow in the high teens, an upgrade from earlier guidance of low to mid-teens growth over 2023. The Zacks Consensus Estimate for earnings stands at $4.44 per share, reflecting a 12.94% decline compared to 2023’s reported amount. Revenue estimates also indicate a positive outlook at $31.93 billion, representing a 7.27% growth from last year.

PayPal anticipates mid-single-digit dollar growth in transaction margin for 2024.

Looking ahead to the fourth quarter of 2024, the company projects low-single-digit revenue growth. The Zacks Consensus Estimate for revenues is $8.49 billion, showing a year-over-year growth of 5.76%.

Non-GAAP earnings are expected to see a low to mid-single-digit decrease year-over-year, with the Zacks Consensus Estimate pegged at $1.10 per share, indicating a decline of 25.68% from the year-ago quarter.

Expanding Portfolio and Partnerships Strengthen PYPL’s Future

PayPal’s robust portfolio enables it to build strong, reliable relationships with both merchants and consumers. Its two-sided platform fosters direct financial connections with customers and merchants alike.

The introduction of Fastlane, enhancing guest checkout by allowing one-click purchases, illustrates PayPal’s commitment to innovation. This feature is currently available in the U.S. and draws on the company’s extensive experience in payment processing.

Furthermore, collaborations with Apple AAPL and Alphabet GOOGL to integrate the Venmo debit card with Apple Pay and Google Pay highlight PayPal’s growth strategy.

Globally, PayPal has become a preferred payment method on platforms within the Meta Platforms’ META ecosystem. Creators and developers increasingly utilize Hyperwallet, while Braintree is deployed for credit card processing.

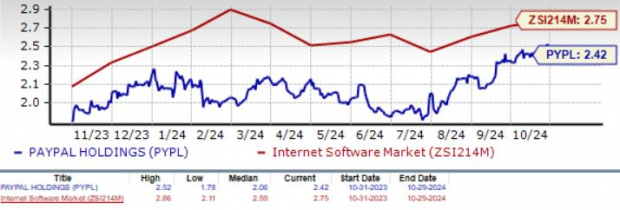

PayPal Stock at a Competitive Valuation

Currently, PayPal is trading at a forward Price/Sales ratio of 2.42X, presenting a discount compared to the industry average of 2.75X. This suggests considerable investment potential.

With a Value Score of B, PYPL represents an attractive opportunity for discerning investors.

Price/Sales Ratio (F12M)

Image Source: Zacks Investment Research

Conclusion

PayPal continues to benefit from the rising demand for peer-to-peer payments and digital wallets. Investors currently holding the stock can look forward to promising long-term growth prospects.

Nonetheless, PYPL faces short-term challenges due to tough macroeconomic conditions and weakened consumer spending, contributing to a more cautious Growth Score of D.

Presently, PayPal holds a Zacks Rank #3 (Hold), suggesting it may be prudent to await a more favorable entry point for investment. Explore today’s Zacks #1 Rank (Strong Buy) stocks to evaluate further opportunities.

Zacks Names #1 Semiconductor Stock

Although it is only 1/9,000th the size of NVIDIA—whose stock has soared over 800% since our initial recommendation—this new top chip stock is poised for significant growth potential.

With robust earnings growth and an expanding customer base, this stock is positioned to meet the increasing demand for Artificial Intelligence, Machine Learning, and the Internet of Things. Global semiconductor manufacturing is expected to skyrocket from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

For the latest recommendations from Zacks Investment Research, download 5 Stocks Set to Double for free today.

Apple Inc. (AAPL): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

PayPal Holdings, Inc. (PYPL): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.