Consumer confidence in the U.S. has risen significantly since last month. A large interest rate cut from the Federal Reserve and positive expectations for more cuts soon have led to increased optimism about the economy’s strength.

With this upbeat sentiment, now may be the right time to invest in discretionary stocks like American Outdoor Brands, Inc. AOUT, Crocs, Inc. CROX, Norwegian Cruise Line Holdings Ltd. NCLH, Netflix, Inc. NFLX, and Mattel, Inc. MAT. These stocks hold strong Zacks Ranks of #1 (Strong Buy) or #2 (Buy), suggesting they could offer solid returns. To see the full list of today’s Zacks #1 Rank stocks, you can click here.

Consumer Confidence Rises Sharply

The Conference Board reported that the consumer confidence index jumped to 108.7 in October, up from 99.2 in September. This marks the highest level in nine months.

The Present Situation Index, which reflects consumers’ views on current business and job market conditions, climbed by 14.2 points to hit 138. Meanwhile, the Expectations Index, indicating consumers’ short-term outlook on income and jobs, rose 6.3 points to 89.1, comfortably above the recession warning threshold of 80.

This boost in consumer confidence follows a significant drop in September, driven by concerns about a slowing economy. Interestingly, confidence has rebounded despite signs of a cooling job market, as reflected in the Labor Department’s report of job openings reaching a three-and-a-half-year low in September.

Anticipated Rate Cuts Fuel Optimism

Earlier in the month, markets faced uncertainty when new inflation data indicated a slight uptick in September. This stirred fears about the economy’s direction, causing market volatility.

Nonetheless, consumers remain hopeful that inflation can reduce to the Federal Reserve’s target of 2%. The Fed recently implemented a 50 basis point interest rate cut, its first since March 2020.

Looking ahead, the Federal Reserve has signaled that additional rate cuts may occur if inflation continues to decline. According to the CME FedWatch tool, there is a 98.9% likelihood of a 25-basis point cut in November and a 76.6% chance of a 20-basis point cut in December. These lower borrowing rates traditionally benefit growth stocks, particularly within technology and consumer discretionary sectors.

Top Discretionary Stocks to Consider

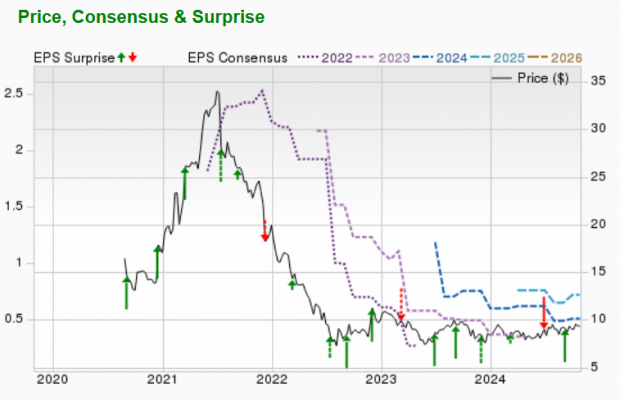

American Outdoor Brands

American Outdoor Brands, Inc. specializes in outdoor goods, including hunting, fishing, and personal defense products. This company produces items under well-known brands such as Caldwell, Smith & Wesson, and Uncle Henry.

For the current year, American Outdoor Brands expects an impressive earnings growth rate of 59.4%. The Zacks Consensus Estimate for earnings has increased by 4.1% over the last two months, giving AOUT a Zacks Rank of #1.

Image Source: Zacks Investment Research

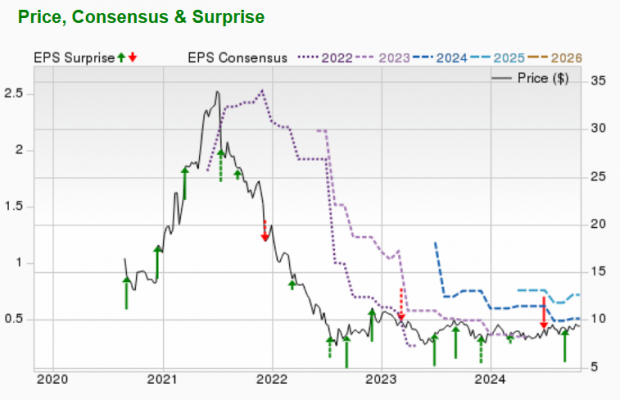

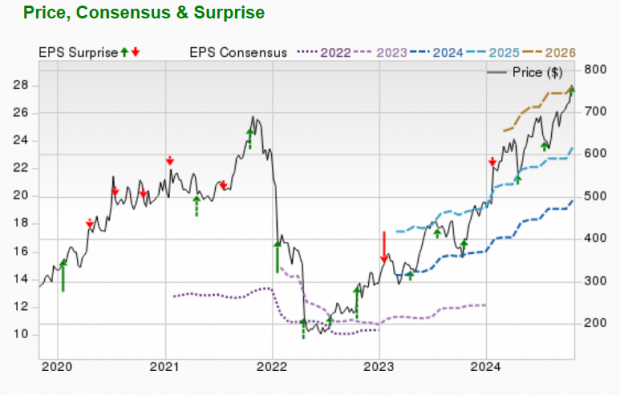

Crocs, Inc.

Crocs, Inc. is a well-known footwear company dedicated to comfort and style, offering a wide range of products, including sandals and slides.

The projected earnings growth rate for Crocs this year is 7.3%, with the Zacks Consensus Estimate up by 0.5% in the last two months. At present, CROX holds a Zacks Rank of #2.

Image Source: Zacks Investment Research

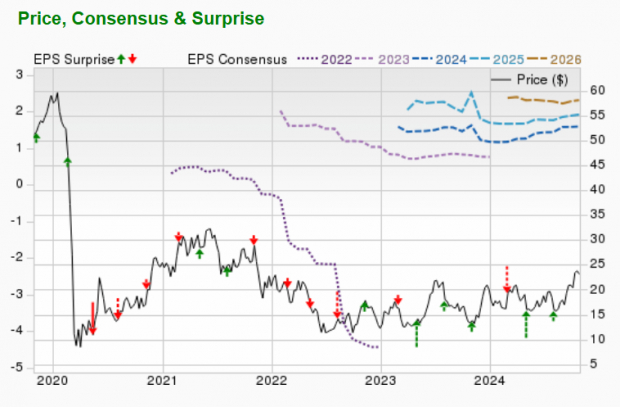

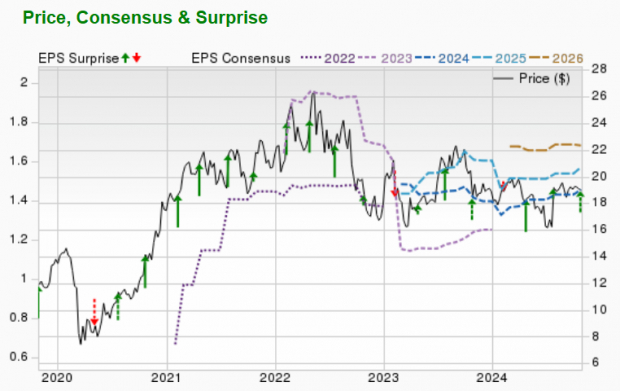

Norwegian Cruise Line Holdings Ltd.

Norwegian Cruise Line Holdings Ltd. is a major player in the cruise industry, operating brands like Oceania Cruises and Regent Seven Seas Cruises.

Norwegian Cruise Line is projected to have earnings growth exceeding 100% this year, with the Zacks Consensus Estimate rising by 1.9% recently. NCLH currently enjoys a Zacks Rank of #2.

Image Source: Zacks Investment Research

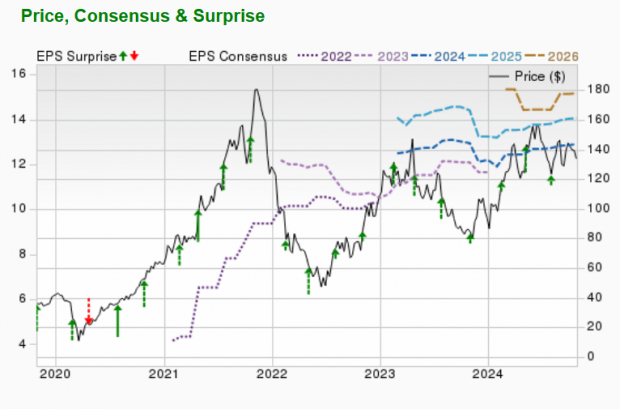

Netflix, Inc.

Netflix, Inc. is a leading streaming service that invests heavily in original programming to maintain its competitive edge against newcomers like Disney+ and established services like Amazon Prime Video.

Netflix expects a 64.4% increase in earnings this year. The Zacks Consensus Estimate for earnings has grown by 3.7% over the past two months, leading NFLX to have a Zacks Rank of #2.

Image Source: Zacks Investment Research

Mattel, Inc.

Mattel, Inc. is the largest toy manufacturer globally and distributes products through brands such as Fisher-Price and American Girl in markets across the world.

Mattel projects a 20.3% growth in earnings this year. The Zacks Consensus Estimate has improved by 3.5% in the last 60 days, giving MAT a Zacks Rank of #2.

Image Source: Zacks Investment Research

Zacks Highlights Top Semiconductor Stock

It’s…

Unlocking Potential: A New Semiconductor Stock Poised for Growth

Only 1/9,000th the size of NVIDIA, which has increased by over +800% since our initial recommendation. NVIDIA continues to perform well, but our new top semiconductor stock has greater growth potential ahead.

Strong Earnings and Growing Demand

This new player is experiencing robust earnings growth and is broadening its customer base. It is well-positioned to meet the surging demand for Artificial Intelligence, Machine Learning, and the Internet of Things. According to projections, global semiconductor manufacturing is expected to soar from $452 billion in 2021 to $803 billion by 2028.

Discover This Stock for Free >>

Additional Insights and Recommendations

For those interested in more investment insights, Zacks Investment Research offers a downloadable report featuring 5 stocks poised to double in value. Click the link to access this free report below.

Get 5 Stocks Set to Double – Free Report

Stock Analysis Reports

Explore these free stock analysis reports:

- Netflix, Inc. (NFLX)

- Mattel, Inc. (MAT)

- Crocs, Inc. (CROX)

- Norwegian Cruise Line Holdings Ltd. (NCLH)

- American Outdoor Brands, Inc. (AOUT)

Stay Informed

To read more insights on market trends, you can visit the [Zacks article](https://www.zacks.com/stock/news/2361023/5-discretionary-stocks-to-buy-as-consumer-confidence-hits-9-month-high?cid=CS-NASDAQ-FT-analyst_blog%7Cinvestment_ideas-2361023).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.