Significant Fund Outflow in Consumer Staples ETF

Consumer Staples Select Sector SPDR Fund (XLP) Sees $96.5 Million Exit

Recent data from ETF Channel highlights a notable shift in the Consumer Staples Select Sector SPDR Fund (Symbol: XLP). This exchange-traded fund (ETF) has experienced an outflow of approximately $96.5 million, marking a 0.6% decline in shares outstanding, from 210,771,809 to 209,571,809. Key holdings in XLP include major companies such as PepsiCo Inc (Symbol: PEP), which is down about 0.4%, Philip Morris International Inc (Symbol: PM) trading flat, and Mondelez International Inc (Symbol: MDLZ), which has risen by approximately 0.6%. For more detailed information, visit the XLP Holdings page »

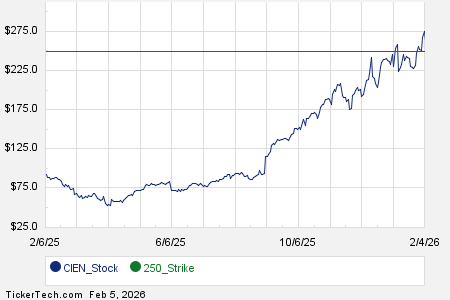

The accompanying chart illustrates the one-year price performance of XLP in relation to its 200-day moving average:

Within the past year, XLP reached a low of $67.34 per share and a high of $84.53. Currently, its trading price sits at $80.33. Analyzing the latest share price against the 200-day moving average can be an effective tool for technical analysis—learn more about the 200-day moving average ».

Exchange-traded funds, such as XLP, function similarly to stocks. However, instead of ‘shares,’ investors are trading ‘units.’ These units can fluctuate based on investor demand and may also be created or destroyed as needed. Each week, we monitor changes in the number of shares outstanding to identify funds with significant inflows (indicating new units being created) or outflows (suggesting existing units are being liquidated). A creation of new units necessitates purchasing the underlying assets of the ETF, while the destruction of units involves selling these assets, potentially affecting the individual components held within these funds.

![]() Click here to find out which 9 other ETFs experienced notable outflows »

Click here to find out which 9 other ETFs experienced notable outflows »

Also see:

- Funds Holding TTHI

- Funds Holding WISE

- KUB Videos

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.