Q3 Earnings Show Strong Performance Among S&P 500 Companies

Note: The following is an excerpt from this week’s Earnings Trends report. For the full report, which includes detailed historical statistics and estimates for current and upcoming periods, please click here>>>

Key Highlights:

- Through Wednesday, October 30th, total Q3 earnings from the 258 S&P 500 companies that have reported are up +8.9% on +5.0% higher revenues. Notably, 74.4% exceeded EPS estimates, and 59.3% surpassed revenue estimates.

- When considering Q3 as a whole, combining actual results with projections for remaining reporters, total S&P 500 earnings are expected to increase +4.4% compared to last year, supported by +5.2% higher revenues.

- For Q3 2024, earnings for the Tech sector reflect strong performance, marking the 5th consecutive quarter of growth at +14.6%. Excluding the Tech sector, earnings for the remaining index would only be up +0.4%.

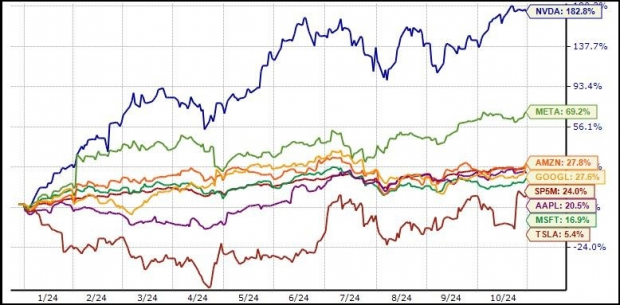

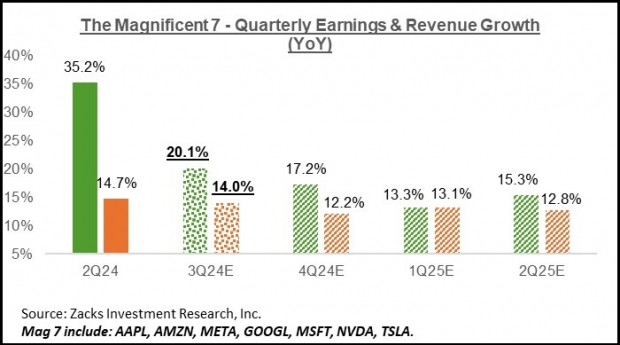

- The earnings for the ‘Magnificent 7’ companies are anticipated to rise +20.1% from the previous year, with revenues increasing by +14.0%. This follows a remarkable +35.2% earnings growth in Q2. Without the ‘Mag 7’, Q3 earnings growth for the rest of the index would only be +0.7%.

Impressive Earnings from the Magnificent 7

The excitement began with Tesla’s Q3 report last week, marking the start of the reporting season for the ‘Mag 7’. Although Tesla fell slightly short on revenue, it exceeded earnings expectations. Year-over-year, Tesla’s Q3 earnings grew by +16.9% with a revenue increase of +7.8%.

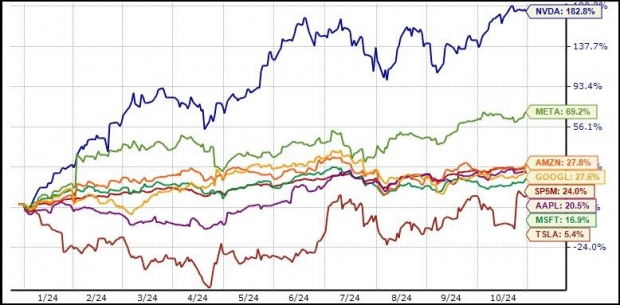

This year, Tesla shares lagged behind the ‘Mag 7’ group but have since climbed +5.4% following a roughly +20% surge after the report. Investors were particularly pleased with improved margins, which may have benefited from a higher proportion of deliveries from Tesla’s Shanghai factory. This margin growth signals some stabilization amid competitive pressures in the electric vehicle market.

While Tesla’s results weren’t indicative for the rest of the ‘Mag 7’, Alphabet’s results certainly impacted market sentiment. Following a dip in investor confidence after its July 23rd quarterly release, Alphabet’s third-quarter performance was positively received. Concerns revolved around rising costs associated with its artificial intelligence ventures.

Concerns about AI spending have been prevalent among investors in other ‘Mag 7’ firms, especially Microsoft. However, Alphabet’s Q3 report appeared to alleviate some of those worries by highlighting how AI efforts were enhancing operational efficiencies and driving growth.

In Q3, Alphabet’s cloud revenues rose by +35%, improving from +29% in Q2 and +28% in Q1. Management linked this success to AI, noting that AI-driven code-writing now represents about a quarter of their programming activities—crucial given the heavy coding involved in Alphabet’s offerings.

Despite a recent pullback in market leadership, ‘Mag 7’ companies could reclaim a dominant position if upcoming earnings align with the positive trends seen in Tesla and Alphabet.

The year-to-date performance chart illustrates that aside from Nvidia and Meta, other ‘Mag 7’ stocks have been trailing behind the broader market.

Image Source: Zacks Investment Research

The remaining Q3 earnings reports will further clarify prospects for these companies, especially for Alphabet, Microsoft, and Amazon, amidst ongoing discussions of AI’s implications.

Regardless of the current market apprehensions, the ‘Mag 7’ companies are poised to post substantial earnings. Collectively, they project Q3 earnings of $116.1 billion on $488.7 billion in revenues, reflecting +20.1% earnings growth and +14.0% revenue growth year-over-year.

Image Source: Zacks Investment Research

Remarkably, the ‘Mag 7’ trio is set to account for 21.7% of the S&P 500’s total earnings this quarter. Without their significant contribution, Q3 earnings for the remaining S&P 500 companies would reflect a minor decline.

The Overall Earnings Landscape

Combining reported earnings with estimates for upcoming results, overall Q3 earnings for the S&P 500 index are expected to increase by +4.4% compared to last year, driven by +5.2% revenue growth.

If it weren’t for a decline of -26.6% in the Energy sector, the overall growth pace would rise to +6.8%. Conversely, stripping out the Tech sector’s significant gains (with a growth rate of +14.6%) would yield only a +0.4% growth in earnings.

Predictions suggest that quarterly earnings will improve moving into the next quarter. The following chart illustrates this anticipated trend.

Image Source: Zacks Investment Research

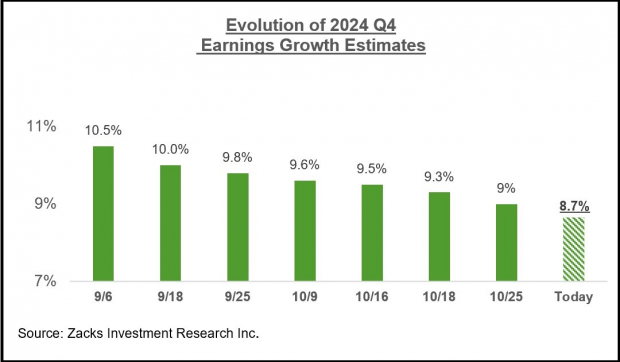

For the upcoming period (Q4 2024), total S&P 500 earnings are projected to increase by +8.7% with +5.2% higher revenues. If not for the Energy sector’s impact, earnings growth would be +10.5%.

While forecast estimates have begun to decline since the quarter started, the extent of negative revisions appears less severe compared to Q3. The chart below tracks changes in Q4 estimates over recent weeks.

Image Source: Zacks Investment Research

Another chart provides a broader view of the annual earnings picture.

Image Source: Zacks Investment Research

This year’s earnings growth of +7.3%, alongside +1.9% revenue increases, highlights weaknesses within the Finance sector. Adjusting for Finance, earnings growth improves to +6.3%, and revenue growth to +4.2%, indicating that nearly half of this year’s earnings growth stems from revenue gains, with the remainder attributed to margin enhancements.

Zacks Highlights Top Semiconductor Stock

While this stock is just 1/9,000th the size of NVIDIA, which has surged more than +800% since we recommended it, our new top semiconductor choice has the potential for significant growth.

Driven by strong earnings and a growing customer base, this company is set to leverage the surging demand for Artificial Intelligence, Machine Learning, and Internet of Things technologies. Global semiconductor manufacturing is predicted to expand from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Want the latest stock recommendations from Zacks Investment Research? Download our report on “5 Stocks Set to Double” for free today.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.