Boeing Faces Downgrade as Institutional Investors Shift Positions

Fintel reports that on October 30, 2024, Bernstein downgraded their outlook for Boeing (BRSE:BA) from Outperform to Market Perform.

Analyzing Fund Sentiment

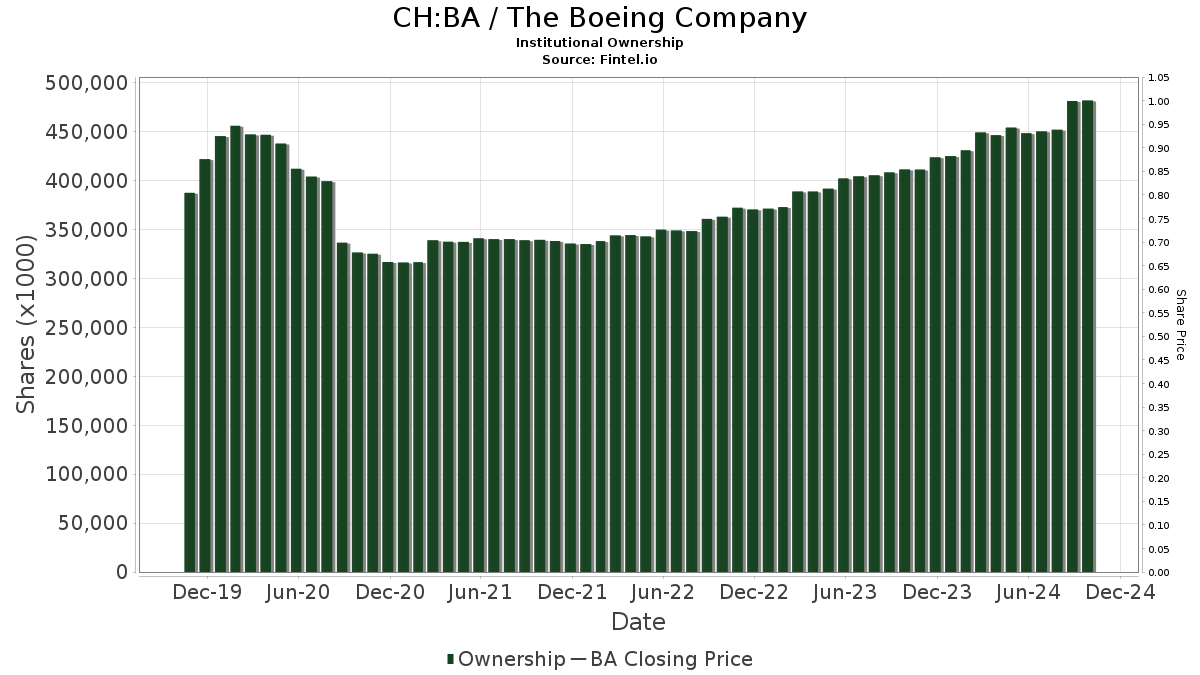

Currently, 2,840 funds or institutions hold positions in Boeing. This represents a drop of 140 owners, or 4.70%, from the last quarter. The average portfolio weight of all funds invested in BA stands at 0.36%, reflecting an increase of 1.50%. Over the past three months, total shares owned by institutions rose by 11.16%, totaling 491,026K shares.

Activity of Major Shareholders

Newport Trust holds 31,640K shares, accounting for 4.33% ownership of Boeing. In its previous filing, they reported 31,252K shares, marking a 1.23% increase, although they reduced their portfolio allocation in BA by 11.74% last quarter.

Capital Research Global Investors possesses 26,539K shares, representing 3.63% of Boeing. In their last filing, they owned 16,446K shares, which is a significant 38.03% increase. Their portfolio allocation in BA surged by 47.59% this past quarter.

The VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 19,405K shares for 2.66% ownership. Their previous holdings were 19,188K shares, resulting in a 1.12% increase, but they decreased their portfolio allocation in BA by 7.25% over the last quarter.

AGTHX – GROWTH FUND OF AMERICA controls 16,540K shares, providing 2.26% ownership. In its last report, the fund owned 12,367K shares, which reflects a 25.23% increase. They increased their portfolio allocation in BA by 24.42% during the last quarter.

Loomis Sayles & Co L P has 14,829K shares, equal to 2.03% ownership of Boeing. Previously, they reported 13,447K shares, resulting in a 9.32% increase. They increased their allocation in BA by 0.79% over the last quarter.

Fintel is a comprehensive investing research platform catering to individual investors, traders, financial advisors, and small hedge funds.

Our platform provides global data, including fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, our exclusive stock picks leverage advanced, backtested quantitative models aimed at improving profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.