PROS Holdings Gets Upgraded: Strong Price Growth Expected

Analysts Bullish on Stock’s Future

According to a report from Fintel, Craig-Hallum raised its outlook for PROS Holdings (NYSE:PRO) on October 30, 2024, upgrading the stock from Hold to Buy.

Price Forecast Shows 76% Potential Growth

As of October 22, 2024, analysts have set an average one-year price target of $36.72 per share for PROS Holdings. This projection spans a low of $31.31 and a high of $42.00. If this target is reached, it would represent a significant increase of 76.03% compared to the stock’s most recent closing price of $20.86 per share.

For further insights, check out our leaderboard showcasing companies with the largest potential price target upside.

The annual revenue forecast for PROS Holdings is $338 million, with a projected growth of 4.74%. The anticipated annual non-GAAP earnings per share (EPS) stands at -0.25.

Current Fund Sentiment Towards PROS

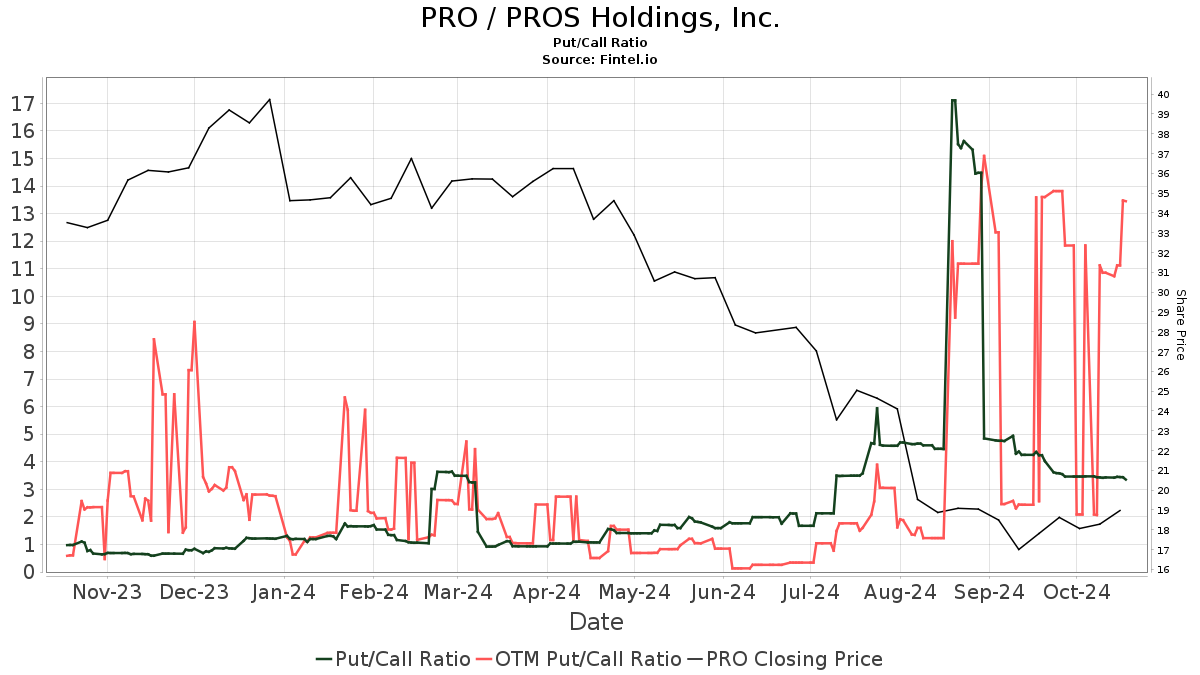

Currently, there are 383 funds or institutions holding positions in PROS Holdings, reflecting a minor decrease of 0.78% in ownership from the last quarter. The average portfolio weight dedicated to PRO is 0.20%, which is an increase of 15.82%. Over the past three months, total shares owned by institutions dipped by 4.63% to 54,672,000 shares.  The current put/call ratio stands at 6.03, indicating a generally pessimistic outlook among investors.

The current put/call ratio stands at 6.03, indicating a generally pessimistic outlook among investors.

Insights on Shareholding Trends

RGM Capital, which owns 2,979,000 shares (6.31% ownership), recorded an increase of 5.58% from its previous holding of 2,812,000 shares, despite reducing its portfolio allocation in PRO by 17.02% last quarter.

Fred Alger Management holds 2,919,000 shares (6.18% ownership), increasing from 2,545,000 shares for a gain of 12.81%, albeit with a 17.93% decline in its portfolio allocation in PRO over the same period.

Brown Advisory holds 2,581,000 shares (5.47% ownership), having reported an 8.95% drop from 2,812,000 shares, also reducing its portfolio allocation in PRO by 72.70% in the last quarter.

Conestoga Small Cap Fund Investors Class maintains 2,285,000 shares (4.84% ownership) with no changes in the last quarter.

The Alger Small Cap Focus Fund owns 1,972,000 shares (4.18% ownership), down from 2,208,000 shares, marking an 11.98% decrease, with a 29.87% cut in its portfolio allocation in PRO over the past three months.

Background on PROS Holdings

(Provided by the company)

PROS Holdings, Inc. specializes in AI-driven solutions that enhance selling strategies in the digital marketplace. Their offerings empower companies to effectively price, configure, and sell their products and services across various channels with speed and accuracy, drawing on decades of experience in data science.

Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

Our data encompasses global fundamentals, analyst reports, ownership insights, fund sentiment, options activity, insider trading, and much more. Additionally, our unique stock picks utilize advanced, backtested quantitative models for better investment outcomes.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.