Wolfe Research Upgrades Danaher: Analysts See Strong Growth Ahead

Fintel reports that on October 31, 2024, Wolfe Research improved their outlook for Danaher (XTRA:DAP), moving from Peer Perform to Outperform.

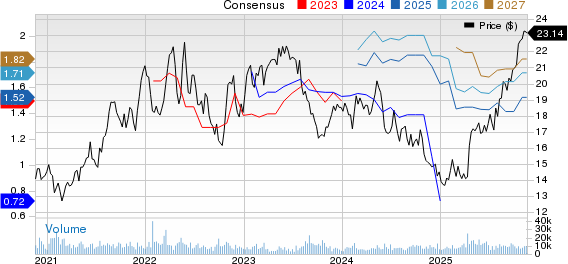

Analysts Expect Significant Price Increase

As of October 22, 2024, the average one-year price target for Danaher stands at 271.70 €/share. The forecasts indicate a low of 219.00 € and a high of 321.26 €. This average target suggests a potential increase of 20.76% from its last reported closing price of 225.00 € / share.

Projected Revenue and Earnings Growth

Danaher is expected to achieve an annual revenue of 32,699 million €, reflecting a growth of 37.73%. The annual projected non-GAAP EPS is estimated at 11.16.

Investors Show Increased Confidence

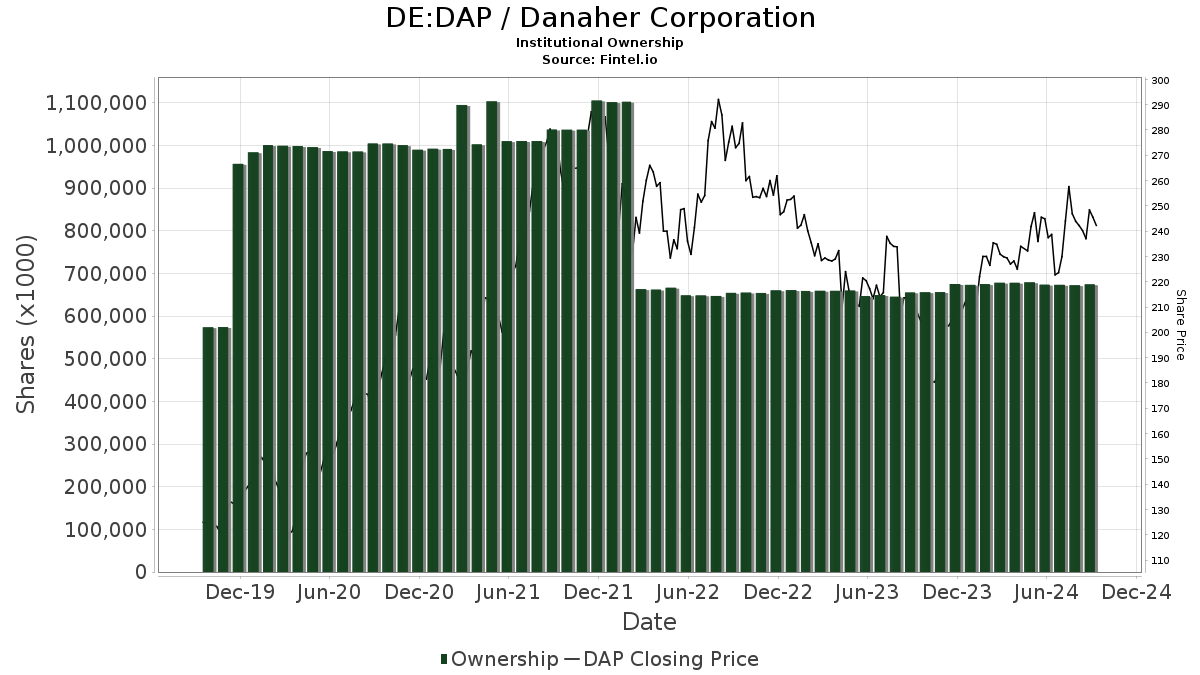

Currently, 3,506 funds or institutions hold positions in Danaher, which is a rise of 16 owners (0.46%) over the last quarter. The average portfolio weight assigned to DAP by all funds is 0.64%, up by 1.38%. Institutional ownership of Danaher shares increased by 3.18% in the past three months, totaling 675,139K shares.

Shareholder Activities Highlight Changes

Wellington Management Group LLP owns 24,478K shares, indicating 3.39% ownership. They previously held 26,725K shares, marking a decrease of 9.18%. Their allocation to DAP decreased by 7.66% over the last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares currently holds 21,066K shares, accounting for 2.92% ownership. The firm’s previous holding was 20,931K shares, showing a gain of 0.64%. However, their allocation in DAP went down by 2.08% recently.

Price T Rowe Associates increased their stake to 19,387K shares, representing 2.68% ownership, up from 16,150K shares, a notable increase of 16.69%. They have shifted their portfolio allocation upwards by 17.26% last quarter.

Capital International Investors now has 17,533K shares, or 2.43% ownership, rising from 15,084K shares for a gain of 13.97%. This institution also raised their allocation by 18.26% compared to the previous quarter.

VFINX – Vanguard 500 Index Fund Investor Shares owns 16,919K shares, representing 2.34% ownership. They owned 16,573K shares before, marking a rise of 2.05%. However, their allocation to DAP saw a decrease of 3.31% over the last quarter.

Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

Our data covers the world and includes fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, our exclusive stock picks are powered by advanced, backtested quantitative models for improved profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.