“`html

Explore Calm Amid Market Chaos: 6 Low-Beta Dividend Stocks

Election uncertainties, economic recessions, and social unrest are rampant. But amidst this turmoil, there’s a safer path.

Looking for low-volatility investments? Here’s what you need to know.

In today’s discussion, we will highlight six reliable dividend stocks offering returns of up to 8.9%. But how do we identify these stable options? The answer lies in their beta values.

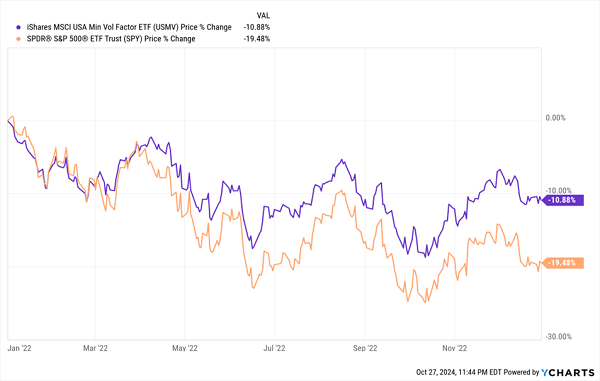

Stocks with a beta over 1 show more volatility compared to “the market,” while those with a beta below 1 are seen as less volatile. For example, a stock with a beta of 0.5 would only lose 15% in a 30% market drop—half of the market’s loss. While not perfect, beta indicates that low-beta stocks often provide some cushion during downturns. Let’s take a closer look at a popular minimum-volatility ETF’s performance during the 2022 bear market.

USMV: Only Half as Bad

We can enhance low-beta investing by selecting companies with strong business foundations that provide attractive dividends while we weather economic challenges.

Let’s examine six low-beta stocks that boast yields of 5.3% to 8.9%.

Some Old Friends

Several familiar low-beta stocks consistently show up on my radar, indicating their reliable nature. Here’s a closer look at some:

Northwest Bancshares (NWBI, 5.9% yield): This company operates Northwest Bank, which runs 131 community branches throughout Ohio, Pennsylvania, Indiana, and New York. Despite the volatility other regional banks might face, NWBI remains stable, with one- and five-year betas at 0.28 and 0.61, respectively. This stability comes from a strong balance sheet and a focus on low-risk loans. Although profit growth has been sluggish, its nearly 6% yield could keep investors satisfied.

Getty Realty (GTY, 5.8% yield): Getty just increased its dividend by 4.4%, continuing a remarkable history of growth over the past ten years. This REIT owns over 1,100 retail properties nationwide, with primary income sources being convenience stores and car washes. A high occupancy rate of 99.7% and consistent collections reflect robust stability, while its low one- and five-year betas of 0.25 and 0.94 further confirm its reliability.

Low Volatility and Great Returns? That’s Convenient.

Omega Healthcare Investors (OHI, 6.3% yield): Omega specializes in financing for skilled nursing and assisted living facilities. Its five-year beta stands at 0.99, while its one-year beta is a surprising negative 0.17. This suggests the stock behaves differently than the overall market, which can be an advantage in uncertain times. Recent interest rate cuts have boosted investor enthusiasm, as they lower OHI’s cost of debt, helping growth prospects.

Dividends on “The House”

Gaming and Leisure Properties (GLPI, 6.0% yield): Unlike typical casino operations, GLPI is a REIT focused on collecting rent from gaming properties. This triple-net lease structure leads to stable and predictable revenue, backing the higher dividend payouts. With a five-year beta of around 1, it mirrors the market, but its one-year beta of 0.32 shows it’s been less volatile recently.

VICI Properties (VICI, 5.3% yield): Similar to GLPI, VICI Properties collects rent from its portfolio of 54 gaming facilities, including notable venues like Caesars Palace and MGM Grand. With one- and five-year betas of 0.35 and 0.96 respectively, VICI also shows a trend towards lower volatility, making it a solid choice for stable income seekers.

Hasn’t Felt Like a Gamble: A Much Smoother REIT Ride for Years

“`

Exploring Low-Beta Dividends with Chord Energy

Chord Energy (CHRD, 8.9% yield): It’s uncommon to find traditional energy companies listed among high-yield, low-beta options. However, Chord Energy stands out as an exception. This independent oil and gas producer operates in the Williston Basin and has reported a 5-year average beta of 0.83 and a one-year beta of 0.71.

Earlier this year, Chord expanded significantly by merging with Canadian E&P Enerplus. This merger added valuable Bakken Shale assets and raised expectations for cash flow, not just in the present year but also moving forward. This bodes well for potential buybacks, as CHRD has a $750 million buyback program underway, and for improved dividends.

The impact on dividends is straightforward. Chord Energy has a fixed-plus-variable payout structure. The company commits to distributing $1.25 per share quarterly, which amounts to a solid 4% yield on its own. Additionally, the variable payouts over the past four quarters have contributed nearly 5% in extra yield!

A Unique 12% Dividend Opportunity

Reliable dividends serve as an essential financial cushion, providing immediate cash regardless of market fluctuations. The aforementioned dividend stocks offer considerable protection, even at single-digit yields.

Now, imagine the level of market stability a 12% dividend could provide. My One 12% Dividend to Own Now is an exceptional opportunity generating an impressive income stream. Here’s how a 12% yield translates into real money:

- $1,000 each month from a $100,000 investment

- $60,000 annually from a $500,000 investment—equivalent to a typical salary in many U.S. areas

- $120,000 a year from a $1 million investment.

These earnings are achieved while simply waiting. This kind of income doesn’t just cover expenses; it offers comfort, peace of mind, and a good night’s sleep without the constant worry of market volatility. In fact, it could allow you to live solely off dividends without tapping into your principal amount.

However, timing is crucial. There’s a limited window to secure this opportunity. Missing the deadline could mean losing out on the chance to lock in this 12% yield before the next distribution cycle.

Click here for details about this appealing 12% yield, its increasing payout, and its special dividends!

Also see:

- Warren Buffett Dividend Stocks

- Dividend Growth Stocks: 25 Aristocrats

- Future Dividend Aristocrats: Close Contenders

The opinions expressed in this article are those of the author and do not necessarily reflect the views of Nasdaq, Inc.