PayPal’s Rating Shift: From ‘Buy’ to ‘Accumulate’

Fintel reports that on November 1, 2024, Phillip Securities downgraded their outlook for PayPal Holdings (WBAG:PYPL) from Buy to Accumulate.

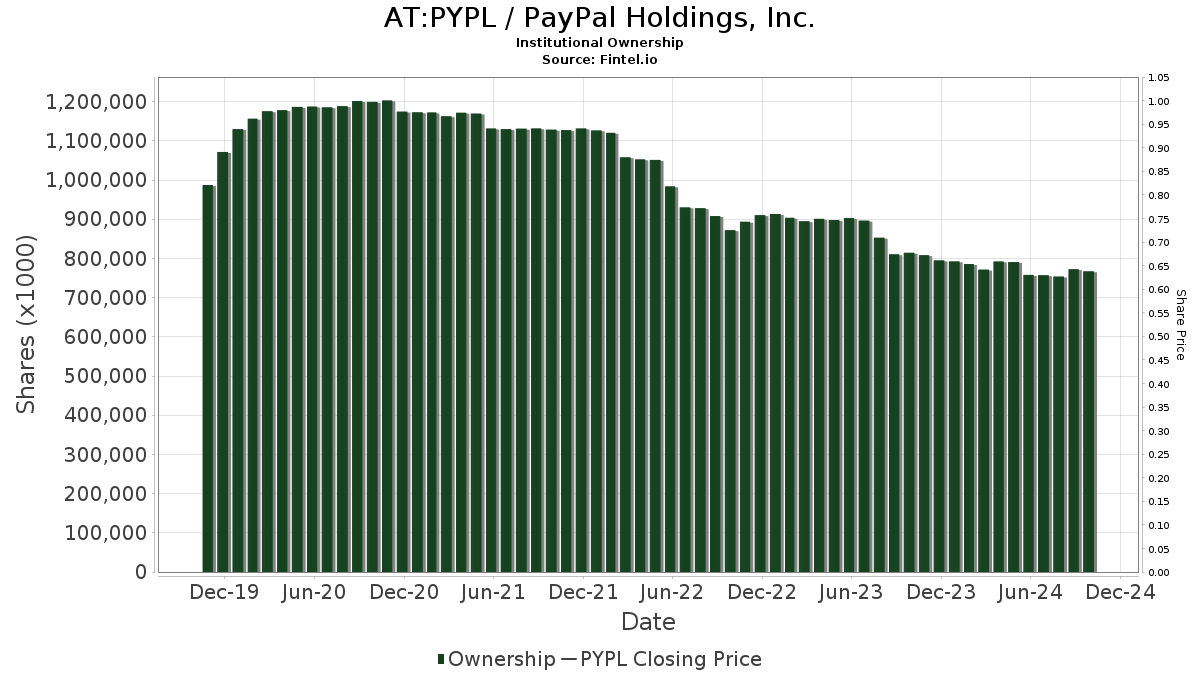

Fund Sentiment on PayPal Holdings

There are 2,726 funds or institutions reporting positions in PayPal Holdings. This reflects a slight increase of 6 owners, or 0.22%, from the previous quarter. The average portfolio weight of all funds dedicated to PYPL now stands at 0.39%, showing an increase of 1.23%. Additionally, total shares owned by institutions rose by 2.37% over the last three months, totaling 771,282K shares.

Actions of Other Major Shareholders

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares owns 33,070K shares, representing 3.30% of the company. This is a decrease from their previous ownership of 33,735K shares, marking an approximate drop of 2.01%. Their portfolio allocation in PYPL has decreased by 17.42% over the last quarter.

Comprehensive Financial Management maintains 28,164K shares, accounting for 2.81% of ownership in the company, with no changes in the last quarter.

VFINX – Vanguard 500 Index Fund Investor Shares holds 26,847K shares, representing 2.68% ownership. This is a slight reduction from their earlier report of 27,008K shares, indicating a 0.60% decrease. The portfolio allocation in PYPL was decreased by 18.49% in the last quarter.

Geode Capital Management owns 21,714K shares, or 2.17% of the company. Their prior report indicated ownership of 21,731K shares, showing a minimal 0.08% decrease. They significantly reduced their allocation to PYPL by 57.11% over the last quarter.

Invesco QQQ Trust, Series 1 holds 20,147K shares, representing 2.01% ownership. This shows a slight increase from the previous report of 20,089K shares, which is a 0.29% rise. However, their portfolio allocation decreased by 21.80% over the last quarter.

Fintel is a leading investment research platform for individual investors, traders, financial advisors, and small hedge funds.

Our data spans global markets, featuring fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and more. Our exclusive stock picks utilize advanced, backtested quantitative models aimed at enhancing profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.