Scotiabank Upgrades Comcast: Analysts Predict Increased Stock Potential

On November 1, 2024, Scotiabank raised Comcast’s (LSE:0QYF) rating from Sector Perform to Sector Outperform.

Market Analysts See Potential for Growth

As of October 22, 2024, Comcast’s average one-year price target is set at 64.85 GBX/share. Forecasts for the shares vary, with a low estimate of 48.48 GBX and a high of 82.07 GBX. This average price target indicates a potential increase of 12.78% from the latest closing price of 57.50 GBX/share.

Revenue Projections and Performance Metrics

Comcast is projected to generate an annual revenue of 127,528MM, marking an increase of 3.62%. The expected annual non-GAAP EPS is 4.23.

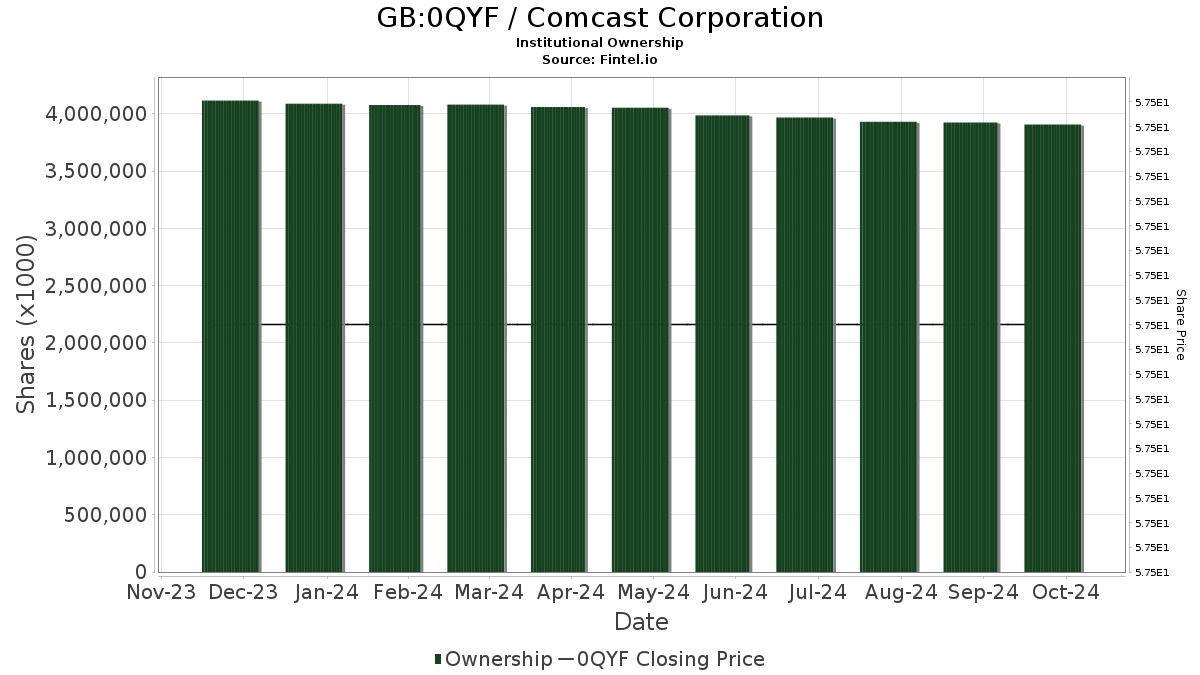

Fund Sentiment: Tracking Institutional Investments

Currently, 3,710 funds report holding positions in Comcast. This number reflects a decrease of 90 funds, or 2.37%, over the past quarter. The average weight of Comcast in these funds is 0.57%, which has increased by 2.95%. Total shares owned by institutions have fallen by 0.96% in the last three months to 3,892,306K shares.

Institutional Shareholder Activity

Capital World Investors owns 128,148K shares, which accounts for 3.32% of the company. This represents an increase of 9.71% from their previous count of 115,703K shares. However, their portfolio allocation in Comcast has decreased by 1.43% in the last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 123,606K shares, translating to a 3.20% ownership. This is a decrease of 0.74% from 124,518K shares previously owned. Their allocation in Comcast fell by 12.80% this quarter.

VFINX – Vanguard 500 Index Fund Investor Shares holds 100,460K shares, representing 2.60% of the company. They saw a slight increase of 0.61% from 99,846K shares last reported, but their portfolio allocation decreased by 13.96% over the quarter.

JPMorgan Chase owns 86,410K shares, a 2.24% stake, showing a decrease of 12.71% from their previous holding of 97,397K shares. Their portfolio allocation in Comcast has notably declined by 22.17% over the past quarter.

Geode Capital Management holds 85,791K shares, which is 2.22% of the company, reflecting an increase from 83,684K shares earlier. However, their portfolio allocation in Comcast decreased by 12.13% this quarter.

Fintel is a leading research platform that provides valuable data on investment opportunities, including fundamentals, analyst reports, and ownership trends.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.