Nvidia’s Remarkable Journey: A Decade of Investment Potential

Nvidia(NASDAQ: NVDA) has delivered an impressive trajectory, captivating investors for years. Its cutting-edge GPUs (graphics processing units) have created significant wealth for those who believed in the company’s potential. If you invested a decent amount in Nvidia a decade ago and held onto it, the chances are you’ve seen your investment grow exponentially.

Investors can learn valuable lessons from Nvidia’s journey, as its success isn’t entirely one-of-a-kind.

History of Ups and Downs in Nvidia’s Journey

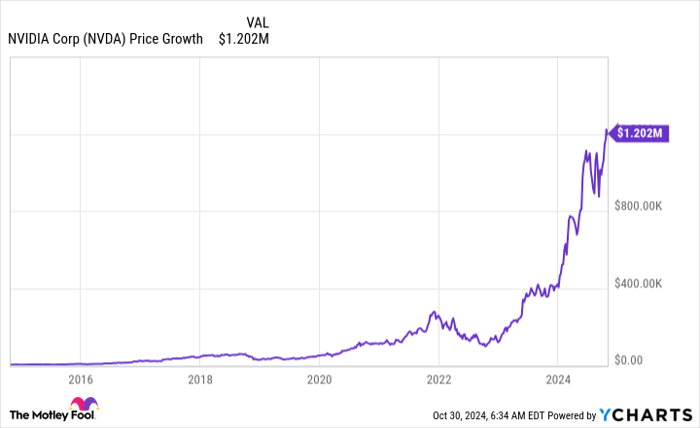

Imagine investing just $4,000 in Nvidia stock ten years ago. Here’s how that initial investment stands today:

NVDA data by YCharts

This growth is astonishing, and it’s understandable to feel regret for not investing earlier. However, it’s essential to realize that while Nvidia stands out, truly remarkable stocks are actually few and far between. Each decade, a select number of companies emerge as significant winners, but identifying them and staying invested through fluctuations poses a challenge.

Over the last decade, Nvidia experienced notable declines. It faced two periods where it lost more than half of its value, as illustrated by the chart below:

NVDA data by YCharts

Most recently, in late 2022, Nvidia saw a staggering 66% drop, wiping out returns accrued since 2020.

Investors must remember that long-term winners often undergo substantial drawdowns that might tempt them to sell. It is vital to assess whether current issues will affect the stock’s performance in five years. If the answer is yes, consider selling. If not, remain patient and ignore outside pressures.

Though buying and holding may seem straightforward, pinpointing companies with such significant potential is the real challenge.

Key to Success: Identifying Companies with Wide Appeal

When seeking companies with massive potential, the primary consideration should be their mass market appeal. Does the product or service stand to impact a large number of people worldwide?

This perspective could have uncovered winners like Amazon and Alphabet, whose offerings have transformed how individuals engage with everyday life.

Interestingly, Nvidia might have gone unnoticed due to its initial focus on GPUs, primarily designed for gaming graphics. Investors might have missed the broader implications of these processors, which excel in handling multiple calculations simultaneously. Today, they are invaluable in data centers for applications like engineering simulations and training AI models. The demand for AI capabilities significantly contributed to Nvidia’s recent success, a trend not lost on attentive investors.

Nvidia’s potential for mass market impact existed long before its current recognition. While it may not have seemed obvious a decade ago, there were indicators pointing toward its future success.

By identifying firms likely to revolutionize human behavior or business practices, investors can find opportunities. If you do find such a company, the key is to hold through the inevitable ups and downs, as short-term issues may fade in significance over five years.

Should You Invest $1,000 in Nvidia Today? A Quick Caution

Before making a purchase, it’s essential to consider the following:

The Motley Fool Stock Advisor analyst team has recently highlighted the 10 best stocks to buy now – and Nvidia isn’t among them. The selected stocks may yield substantial returns in the years ahead.

Reflect on how Nvidia was featured on April 15, 2005. An investment of $1,000 then would now be worth $829,746!*

Stock Advisor offers a straightforward pathway for investors, complete with portfolio strategies, analyst updates, and two new stock recommendations monthly. Since its launch in 2002, Stock Advisor has achieved returns more than four times that of the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of October 28, 2024

John Mackey, the former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board. Suzanne Frey, an executive at Alphabet, is also a board member. Keithen Drury holds positions in Alphabet and Amazon. The Motley Fool has stakes in, and recommends, Alphabet, Amazon, and Nvidia. They maintain a rigorous disclosure policy.

The views expressed in this article represent the author’s opinions and do not necessarily reflect those of Nasdaq, Inc.