Rivian Automotive (NASDAQ: RIVN) has lost nearly its entire market value since going public in late 2021, with shares plummeting 92%. Despite this drastic drop, Rivian still aims to attract investors looking for opportunities in the electric vehicle (EV) sector. In this analysis, we will explore Rivian’s prospects to determine if it can still live up to its growth potential.

The Decline of Rivian’s Investment Appeal

The EV landscape has significantly changed since Rivian’s public debut three years ago. Back then, the market was thriving, largely driven by Tesla, which had shown that electric vehicle manufacturers could be profitable. Traditional automakers such as Ford, General Motors, and Stellantis seemed slow to adapt, positioning Rivian to capitalize on the gap in the market focused on pickups and SUVs.

Currently, the reasons for Rivian’s peak valuation of over $153 billion (now roughly $10 billion) have diminished significantly. Growth for pure EV manufacturers has stalled. Additionally, traditional carmakers are now introducing a multitude of options that directly compete in Rivian’s core SUV and truck market.

Worryingly, legacy automakers appear to be gaining ground, using their established brand recognition and dealer networks to attract more customers. For instance, Ford’s electric F-150 pickup truck sales doubled compared to last year, reaching 7,162 units in the third quarter. GM also reported impressive sales for several models, including the Cadillac Lyriq, a luxury SUV that increased 139% to over 7,000 units, both of which rival Rivian’s upscale offerings.

Rivian’s Strategy Going Forward

Rivian’s earnings report from the second quarter illustrates the depth of its challenges: sales increased just 3% year over year to $1.12 billion, while operating losses expanded 7% to $1.38 billion. The upcoming Q3 earnings report, set for release on November 7, is likely to reveal similar trends. Notably, vehicle deliveries dropped 36% year over year, totaling 10,018 vehicles compared to an analyst expectation of 13,000.

Nevertheless, Rivian is taking steps to address these setbacks. CEO R.J. Scaringe is optimistic about steering the company toward a modest gross profit by the fourth quarter of 2024. He aims to achieve this through lower material costs and enhanced factory efficiency. Success in these areas could set the stage for long-term profitability.

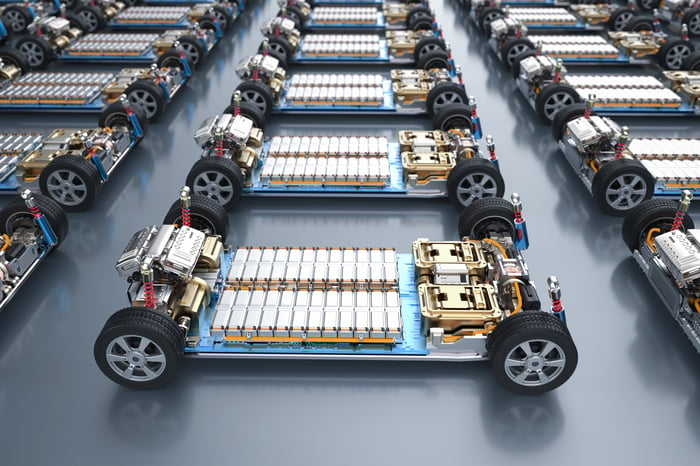

Image source: Getty Images.

Additionally, Rivian is set to boost its growth with a new SUV, the R2, utilizing a new mid-sized vehicle platform. At a starting price of $45,000, it will be much more affordable than the current flagship R1S, which starts at $77,000. Although lower-priced vehicles might not greatly enhance profit margins, they could allow Rivian to transition towards a more high-volume business strategy.

Is Rivian Still a Promising Investment?

Unfortunately, Rivian appears to be in a survival mode for now. Management’s primary focus for the upcoming years is likely to ensure the company’s sustainability rather than generating large returns for shareholders.

Currently holding $7.87 billion in cash and short-term investments, Rivian can sustain its cash flow for a few more quarters. However, the company may eventually need to seek additional funding sources, such as equity dilution, which could diminish existing investors’ stakes in future earnings. Investors should consider refraining from purchasing Rivian stock until the company presents a clear and convincing road to profitability.

Spotting Another Investment Opportunity

Ever feel like you missed the chance to invest in the hottest stocks? Here’s a chance to reconsider.

Our team of analysts occasionally releases a “Double Down” stock recommendation for companies poised for significant growth. If you think you missed exceptional investment opportunities, now could be the right time to invest again, as numbers reveal substantial potential:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $22,292!

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,169!

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $407,758!

We’re currently issuing “Double Down” alerts for three promising companies, and this may not be an opportunity you want to overlook.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 28, 2024

Will Ebiefung has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool recommends General Motors and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the author’s and do not necessarily reflect those of Nasdaq, Inc.