Investing in AI and Value: Key Opportunities for 2025

As November begins, it’s time for investors to focus on positioning their portfolios for 2025. A major trend that is here to stay is artificial intelligence (AI). Allocating a part of your portfolio to this transformative technology is essential.

Prominent players in this field include Taiwan Semiconductor (NYSE: TSM) and Meta Platforms (NASDAQ: META). However, it’s important to also consider other market segments.

Spotlight on AI Investments

Taiwan Semiconductor is the largest chip manufacturer globally, supplying crucial components to tech giants like Nvidia and AMD. Their AI chip business has exceeded expectations, indicating robust demand.

In Q3, Taiwan Semiconductor forecasted that revenue from AI-related chips would triple this year, making up a mid-teens percentage of total revenue. Only a year ago, these chips accounted for just 6% of sales, with a projection to reach a low-teen percentage over five years.

This rapid growth reflects the surging demand for AI chips, and the company is well-positioned to capitalize on this expansion. At present, the stock appears to be a solid investment opportunity.

Looking ahead to 2025, Taiwan Semiconductor trades at 22.1 times its projected earnings, a reasonable valuation for such a leading firm.

Meanwhile, Meta Platforms, the parent company of social media platforms like Instagram and Facebook, is a significant player in the ongoing AI revolution. A large portion of its revenue comes from advertising, a lucrative business that supports Meta’s diverse investments.

Although some investors have raised concerns about Meta’s substantial spending on future projects—such as AI—recent performance suggests the core business remains strong. In Q3, Meta reported a 19% increase in revenue year over year, alongside a 37% rise in earnings per share.

While trading at 24 times 2025 earnings may not be viewed as cheap, it could still be justified for one of the world’s tech leaders.

PayPal: A Smart Value Investment

PayPal may not be cutting-edge, but it remains a strong contender in the competitive landscape of digital payments. CEO Alex Chriss has effectively focused on new technology applications and efficiency gains, which have driven transaction margin growth.

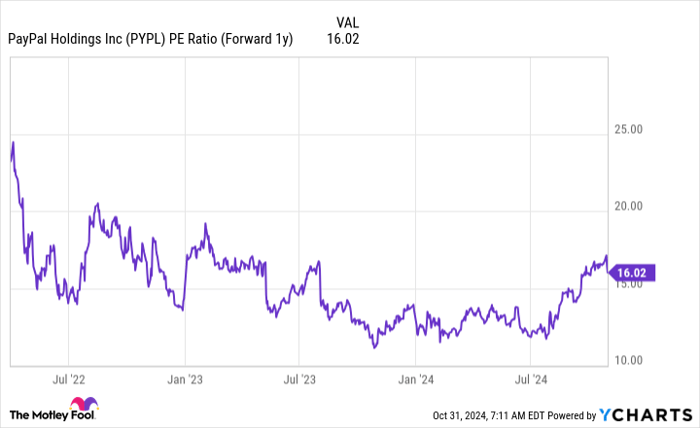

Projected earnings growth for PayPal is in the low to mid-teens for 2024, presenting a compelling case for value-focused investors. Currently, the stock trades at just 16 times 2025 earnings, making it attractive compared to the broader market average of 24 times.

The company’s management has recognized this valuation disparity, using nearly all free cash flow to repurchase shares, decreasing the total number of shares by 7% over the last year.

Although PayPal’s growth may not rival that of Taiwan Semiconductor or Meta, its solid fundamentals paired with a low valuation offer an opportunity for savvy investors.

A Second Chance for Investors

Do you sometimes feel like you missed out on investing in top stocks? Now could be your opportunity.

Our team occasionally issues a “Double Down” stock recommendation, highlighting companies that are poised for significant growth. If you’re worried about having missed your chance, now could be the perfect time to invest. The evidence backs us up:

- Amazon: An invested $1,000 in 2010 could now be worth $22,292!*

- Apple: An invested $1,000 in 2008 could now be worth $42,169!*

- Netflix: An invested $1,000 in 2004 could now be worth $407,758!*

We are currently issuing “Double Down” alerts for three exceptional companies, and this moment may not come again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 28, 2024

Disclosure: Randi Zuckerberg, a former Facebook executive and sister of Meta Platforms CEO Mark Zuckerberg, is on The Motley Fool’s board of directors. Keithen Drury has positions in Meta Platforms, PayPal, and Taiwan Semiconductor Manufacturing. The Motley Fool holds positions in and recommends Advanced Micro Devices, Meta Platforms, Nvidia, PayPal, and Taiwan Semiconductor Manufacturing.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.